Advantages of Venture Capital Fund Management (VCFM) in Singapore: Why Invest in VC Funds?

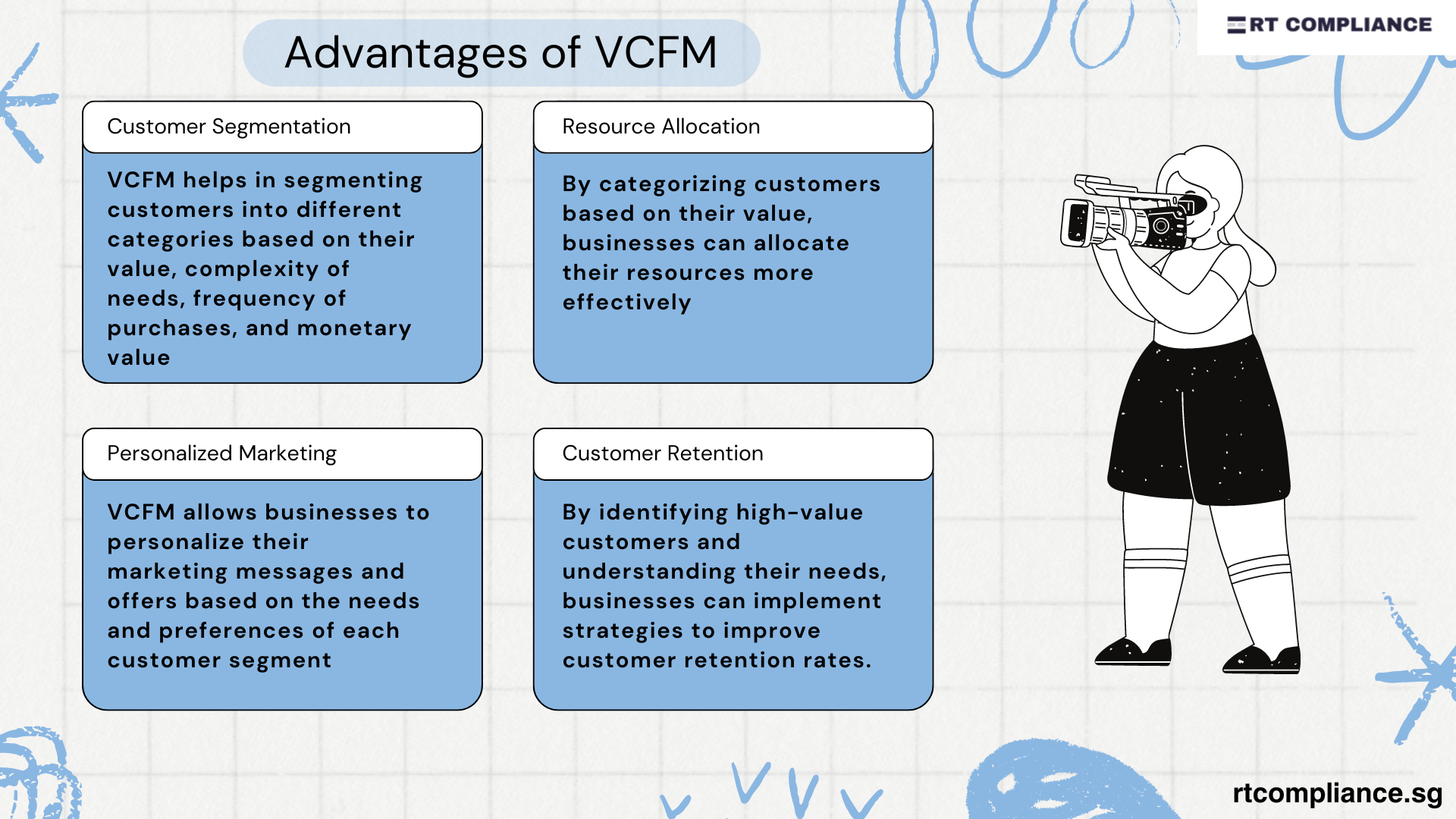

A Venture Capital Fund Management (VCFM) company in Singapore is an authorized or registered fund manager that oversees the capital of large corporations, high-net-worth individuals, and accredited investors. These firms play a key role in enabling investors to access high-growth potential startups in Singapore through structured and regulated investment vehicles. These managers are in charge of devising an investing plan that would increase the returns on their clients’ portfolios/funds. Since these investment management firms mainly cater to accredited investors (AI), there are also institutional fund management firms that provide similar services to the general public (Retail investors). This is typically accomplished by the use of a fund vehicle that pools proceed from the retail sector. The combined funds are then invested in securities, shares, and other investments in compliance with the mandate. Here are some of the advantages of the VCFM License:

Key Benefits of VCFM for Investors in Singapore

Consolidating investments through a venture capital fund in Singapore increases the buying power of a portfolio. This enables reduced risk through diversified VC portfolios and allows funds to benefit from volume rebates and lower trading costs — a key advantage of venture capital fund management. Retail investors can access deals typically only available to institutional investors, streamlining the investment process.

Funds often rebalance periodically (e.g., weekly, monthly, quarterly), resulting in substantial transaction costs for individual shareholders attempting to recreate the fund’s asset allocation — not to mention the fact that it would be incredibly time-consuming, basically full-time work!

Liquidity and Exit Strategy Expertise from VC Funds

Limited liquidity can entail realizing an investment at a discount or not at all, which is a crucial factor in financial planning. However, VCFM firms in Singapore typically offer exit strategy expertise and secondary market access, making it easier for investors to withdraw under planned conditions. These managers also help minimize market fluctuations by ensuring systematic redemptions.

This is because spreads expand at periods of uncertainty, making it more difficult for an investor to exit a place at their price determined. On the other hand, funds may increase liquidity for investors precisely by diversifying their investments since a diversified portfolio is less vulnerable to large market fluctuations. Most funds have liquidity via systematic subscriptions and redemptions and secondary market selling in some situations.

Professional Fund Management and Strategic Guidance

Most individuals lack the time or expertise to manage startup investments themselves. Through professional management of venture capital investments in Singapore, investors benefit from strategic guidance from VC fund managers, including expert due diligence, deal sourcing, and ongoing risk management.

Portfolio Diversification Through Venture Capital Funds

Portfolio diversification through VC funds in Singapore is a key reason why investors choose this model. A VC fund allows participation in hundreds of startups, which would be nearly impossible for individuals to replicate. This reduces single-asset risk and supports growth capital deployment across multiple sectors.

Access to Deal Flow and Specialised Expertise in Singapore

When investors choose to invest to through a Venture Capital Fund Management firm in Singapore they will be provided with exclusive deal flow that is typically only available to insiders and institutions. Such firms have specialized domain knowledge that gives the firms competitive advantage to be able to find and invest in worthwhile startups. Moreover, the investors get the advantage of strong corporate governance review and networking capabilities that would otherwise be difficult to access individually.

Value Added, Operational Support from VC Funds

In addition to the funding, the venture capital funds in Singapore tend to support the portfolio companies in terms of mentorship, operation support, and strategic partnerships. Such a keen interest promotes the success rate of startups, as the possibilities of higher returns are improved. The VCFMs also help in scaling startups with venture capital funds increasing business development and investor value.

Conclusion

As the fund grows and gets increasingly sophisticated, several Venture Capitalists want to outsource the day-to-day operating activities to a service firm to reap any extra benefits. The Venture Capital Fund Management Company would enable funds to consolidate activities into a single organization with a single office lease, as well as manage staff and benefits. Furthermore, the investment firm allows management aggregation and a venue for all funds to share their excess management costs, thereby insulating liabilities from just a particular fund.