Introduction to Asset Management in Singapore

Asset management is the strategic process of developing, operating, maintaining, and improving physical assets such as buildings, roads, and bridges. In Singapore, asset management is a crucial economic growth and development driver. Singapore asset management companies play a vital role in maintaining a world-class built environment that many cities envy.

Asset management in Singapore is guided by the Government’s Asset Management Framework (AMF), launched in 2003. The AMF sets out the government’s philosophy on asset management and provides a roadmap for government agencies to implement effective asset management practices. Under the AMF, all government agencies are required to develop an Asset Management Plan (AMP) that sets out their plans and strategies for managing their assets effectively.

The goal of asset management in Singapore is to ensure that physical assets are well-maintained and operated optimally to support the country’s socioeconomic development. To achieve this, agencies must clearly understand their assets and adopt best practices in asset management.

The MAS and Asset Management: A Comprehensive Overview

The Monetary Authority of Singapore (MAS) is the central regulatory body overseeing the asset management industry in Singapore. MAS is responsible for ensuring that asset managers and financial institutions operate in a safe, sound, and transparent manner, aligning with both local and international standards. MAS is known for its proactive approach to regulation, focusing on maintaining market integrity, promoting financial innovation, and safeguarding investor protection.

Key functions of MAS in asset management include:

- ✔️ Licensing and Supervision

MAS issues licenses to asset management companies, ensuring that only qualified and capable firms operate within the industry. The regulatory body also conducts ongoing supervision to monitor compliance with regulatory requirements, including fund governance and management. - ✔️ Investor Protection

MAS enforces regulations to protect investors, ensuring that funds are managed transparently and that investors are provided with adequate disclosures. The regulatory authority also sets guidelines for managing risks such as conflicts of interest, fraud, and market manipulation. - ✔️ Financial Stability

MAS plays a critical role in maintaining the stability of Singapore’s financial system by monitoring systemic risks, enforcing capital adequacy requirements, and overseeing operational risks in asset management firms. - ✔️ Regulatory Updates and Innovations

MAS is actively involved in developing new regulations that align with global standards and financial market innovations. This includes introducing measures for sustainable investment, digital assets, and fintech integration in the asset management space.

Regulations for Asset Management Companies and Funds in Singapore

Asset management companies (AMCs) and funds in Singapore are subject to a range of regulations to maintain integrity, transparency, and accountability. The key regulations for asset management companies include:

1. Licensing Requirements

To operate as a fund manager in Singapore, companies must hold an appropriate Capital Markets Services (CMS)license issued by MAS. This license covers a wide range of activities, including managing collective investment schemes, securities dealing, and investment advisory services. Other licenses such as Exempt Fund Manager (EFM) and Registered Fund Management Company (RFMC) are available for smaller or specialized operations.

2. Fund Governance

AMCs must adhere to governance standards that ensure proper oversight of fund activities. This includes the appointment of qualified directors, the implementation of risk management frameworks, and the appointment of external auditors for transparency and accountability.

3. Disclosure and Reporting

AMCs are required to provide regular disclosures to investors, including financial statements, performance reports, and updates on risks associated with the investment strategy. Compliance with MAS reporting requirementsensures that investors are fully informed and that regulatory bodies can monitor fund activities.

4. Compliance with AML/CFT

Asset management companies must adhere to stringent Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations. This includes establishing KYC (Know Your Customer) processes, monitoring transactions for suspicious activity, and reporting to MAS if necessary.

5. Taxation and Exemptions

The regulatory framework provides several tax incentives for asset managers and investment funds, such as tax exemptions on certain fund types and tax treaties that benefit foreign investors. However, firms must ensure compliance with Singapore’s Income Tax Act and other relevant regulations to qualify for these exemptions.

6. Investor Protection Laws

Investor protection is a critical component of the regulatory landscape in Singapore. Fund managers must ensure that investments are made in accordance with the client’s risk tolerance and objectives. Clear, concise, and transparent communication with investors is mandated, especially when disclosing risks, costs, and performance.

By adhering to these regulations, asset management companies can ensure that they remain compliant, operate transparently, and build trust with both local and international investors. These regulatory measures have positioned Singapore as a leading asset management hub in Asia, known for its stability, reliability, and investor protection.

MAS’s comprehensive oversight has established Singapore as a trusted jurisdiction for asset managers and investors worldwide, ensuring that the country remains a hub for responsible and transparent financial services.

Fundamentals of Asset Management Singapore: Principles to Follow

1) Adopting a life-cycle approach to asset management: This means considering all aspects of an asset’s life, from acquisition or construction to operation, maintenance, improvement, and eventual disposal or demolition.

2) Managing assets as investment portfolios: This approach recognizes that different types of assets have different risk

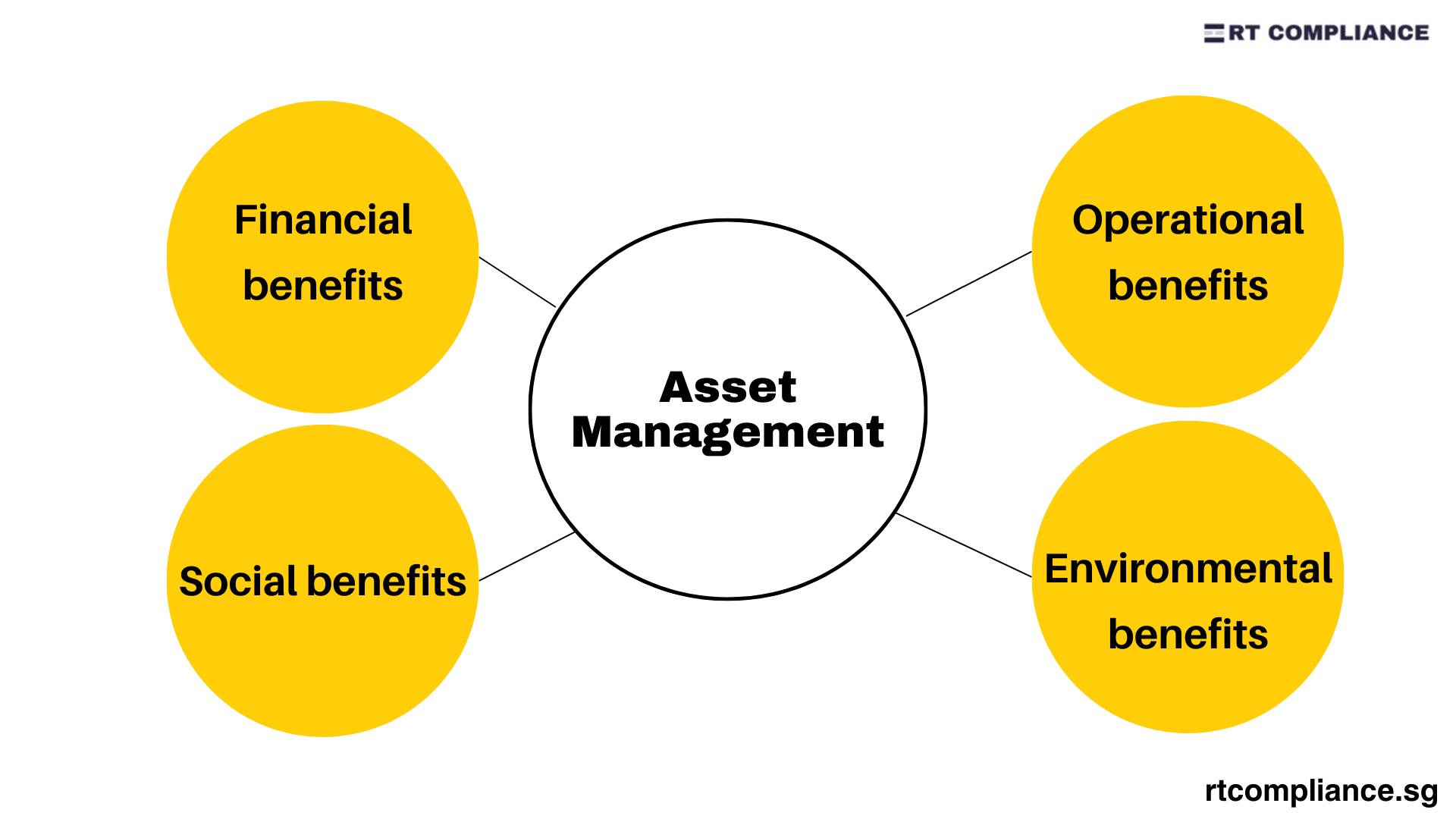

The Benefits of Asset Management for Singapore Asset Management Companies

The benefits of asset management in Singapore are many and varied, but they can be broadly categorized into four main categories: financial, operational, social, and environmental. These benefits support institutional asset management and private wealth management Singapore asset managers in achieving long-term sustainability:

- Financial benefits: One of the most apparent benefits of asset management is the financial gains that can be made from managing assets effectively. By reducing costs and increasing efficiency, businesses can save money which can be reinvested into other areas or used to improve profitability. In addition, effective asset management can help to minimize risk and maximize return on investment.

- Operational benefits: Good asset management practices can lead to improved operational performance in a number of ways. For example, businesses can reduce downtime and increase productivity by ensuring that assets are adequately maintained. In addition, effective asset management can help organizations better manage their resources and improve their competitiveness.

- Social benefits: Asset management also has the potential to deliver social benefits, such as reduced congestion and improved safety. When transport infrastructure is managed effectively, it can lead to fewer traffic jams and accidents. Similarly, when buildings are well-maintained, this can create a safer and more pleasant environment for occupants and visitors.

- Environmental benefits: Finally, good asset management can also have positive environmental impacts by helping to reduce wastage and emissions. For instance, properly maintaining buildings and machinery can help prolong their lifespan, reducing the need for replacement materials and energy consumption. In addition, by reducing resource consumption overall

Different Types of Asset Management Services in Singapore

There are a variety of asset management services available in Singapore. These services can be broadly categorized into three main types: financial planning, investment management, and estate planning.

Financial planning is setting long-term financial goals and developing a strategy to achieve them. It includes creating a budget, saving for retirement, and investing in assets such as property or shares.

Investment management is selecting and managing investments to meet specific financial goals. This can involve buying and selling stocks, bonds, and other securities. It also includes monitoring the performance of investments and making changes to the portfolio as needed.

Estate planning to ensures and guarantee that your assets are distributed according to your wishes when you die. This includes creating a will, setting up trusts, and choosing beneficiaries for your life insurance policy.

Setting Up an Asset Management Plan in Singapore

Assuming you have already decided to implement an asset management system in your organization, the first step is to develop an asset management plan. This is especially important when starting an asset management company in Singapore or seeking an asset management license Singapore requirements.

Your Asset Management Plan: Key Steps for Singapore Asset Managers

– An overview of your organization’s assets and their condition

– The objectives of your asset management system

– The scope of your asset management system

– The responsibility for managing each type of asset

– The methods and tools you will use to manage your assets

– The timeframe for implementing your asset management system

Implementing an Asset Management Strategy

The process in asset management Singapore is planning, acquiring, and maintaining physical and intangible assets in a manner that maximizes their value to the organization. This also involves compliance for asset managers in Singapore and leveraging fintech in Singapore asset management for more efficient operations. In Singapore, asset management is governed by the Public Utilities Board (PUB).

The PUB has developed an Integrated Asset Management System (IAMS) to guide organizations in managing their assets. The IAMS comprises four main components:

- A strategic asset management plan that provides a long-term vision for the development and use of assets;

- An asset information system that captures data on all assets;

- An asset performance monitoring system that monitors the condition and performance of assets; and

- An asset maintenance system that plans and schedules maintenance activities.

Conclusion

In conclusion, asset management in Singapore has become an increasingly important part of the financial sector. As the country grow and develop, asset managers will play a vital role in helping to ensure that the economy remains solid and stable. If you are thinking about starting a career in asset management or already working in this field, you must stay up-to-date with the latest industry news and developments.