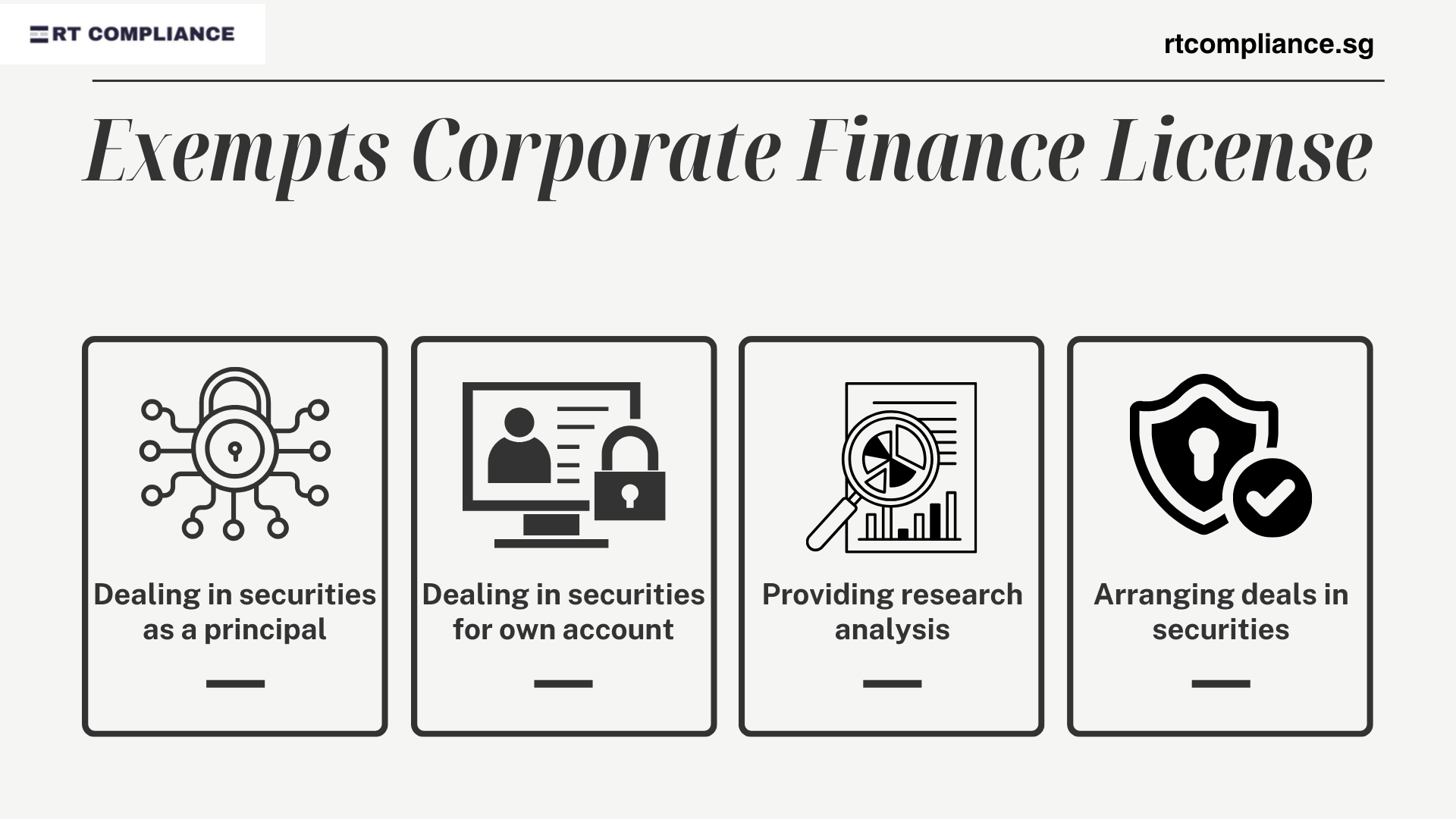

Exempts Corporate Finance License

If you are familiar with the Singapore finance licensing, you know that there are some exemptions during license application. Like the name, Exempt Corporate Finance License suggests, it means a corporate finance firm that is free to operate without a license. The Monetary Authority of Singapore uses some standards to define if a corporation is viable for exemptions. This feature demonstrates MAS stable regulatory framework that ensures that it creates a friendly ecosystem that promotes innovation and efficient services. Are you wondering about the corporate finance licenses and the exemptions? If yes, this piece is the best place to find reliable information about the exempt corporate finance license. Check it out!

What is an exempt corporate finance firm in Singapore?

Singapore is no secret among the top countries with a world-class regulatory framework giving guidelines on how businesses operate. And the finance sector needs the right licensing except for the exemptions. This detail means that corporate finance runs smoothly without the CMS licensing that corporate finance firms apply for to become legit. Note that despite being exempted, these corporations must follow the basic market practices demanded by the MAS.

Who can apply for the Exempt Corporate Finance License?

All corporate finance firms are governed by the MAS and follow specific regulations and require the CMS license. However, some firms can apply to become an exemption to the permit depending on the entities they operate. Some of these entities include:

- Financial institutions, including banks, finance companies, and insurance companies, already operate under other MAS legislation. The MAS is among the most stable regulatory bodies globally because it creates the best environments for all the companies; hence, since all these financial institutions already governed by other legislation, they are exempt from corporate finance licenses.

- Individuals who are working for people who are exempts from the licenses. Since these people are working for an exempt party, it is only fair that they don’t require the permit for their operations

- Individuals working for CMS license holders: For instance, a custodian working for a corporate finance firm with a license doesn’t require to get a permit; after all, they are working under the permit of their employer.

- People working under exempt financial institutions: Since these FIs are exempt from the licenses, all their staff don’t need them. However, these individuals must apply for the Singapore Exchange Derivatives Association membership.

The Corporate Finance licensing is under the Securities and Futures’ act, whose primary goal is to create standard rules among all participants of the finance sector. As a result, even the exempt corporate finance firms need to follow some guidelines, including the requirements of the market practices.

Conclusion

Recent reports claim that Singapore is among the best places to set up a corporate finance firm since it is among the most prominent finance markets in the world. However, the country demands the utmost respects to the set rules by the Monetary Authority of Singapore. There may be exemptions in applying for corporate finance licenses, but every business person must keep the primary market rules in mind.

I love your post, and without fail, I faithfully implement each of its recommendations every time there’s a new one. Not only that, but I excitedly share it on all my social media platforms, and my dedicated followers never hesitate to give a resounding liking and engaging with it. Continue the outstanding work and informative posts coming! By the way, I read an article from https://bit.ly/3HeGV8C on how to earn income through the internet after being made laidoff, and I would like to share my own experience how I have succeeded to solve my financial woes in just a fortnight with this 3 pronged effective strategy and guidance that didn’t cost me single cent!

Wow! Your blog post blew me away! Your ability to dissect complex topics and present them in a relatable, no-nonsense way is simply genius. Allow me to share with you and your audience about my first-hand experience of this ultimate Giant Killer! =>> (https://bit.ly/ai-biz-builder). With only One Keyword, One Description and One Click, this game-changing AI-powered wizardry Business Builder and Marketing Assistant obliterates any competitors to achieving the Superior Lead Conversion by way of performing seamlessly all-in-one tasks similar to the likes of Wix, Hubspot, Chatgpt to Jasper, Canva, Invideo to Adode Photoshop, Midjourney, Speechelo to Convertkit, Pushit and countless others. No other AI tools can match its power. Experience the unmatched power of this Giant Killer and unlock your business’s limitless potential. And here’s the cherry on top! During this exclusive launch, you can access all these incredible benefits for a limited one-time fee. Plus, a generous list of bonuses to fuel your business growth and add immense value to your establishment. I am so confident that you’ll fall head over heels for this product as it comes with a 30-Day Money-Back Guarantee. It’s a risk-free opportunity you simply can’t miss! Trust me, I’m not just blowing smoke. I’ve personally experienced the sheer awesomeness of this product, and I’m not alone. Over 15,000 users have already joined the revolution, and the numbers keep growing. Don’t wait, click here =>> (https://bit.ly/ai-biz-builder) to rule the market today! For Indepth Video Guide and Reviews, Visit =>> https://bit.ly/biz-builder-bot

Exempts Corporate Finance License | RT Compliance

adgeenwnybw

[url=http://www.g78311nyxzlo9us6hc6248t80959qgfts.org/]udgeenwnybw[/url]

dgeenwnybw http://www.g78311nyxzlo9us6hc6248t80959qgfts.org/

Road Freight Service

トリーバーチ靴コピーブランドコピー品年最新作送料無料

Carbon Fiber Flag Pole

Paperback notebook

韓国ロレックススーパーコピーチュードル時計韓国

Kawaii Gaming Chair

Composite Solid Wall Panel Machine

Car Adapter Connector

コピーブランド携帯ケースケースブランド通販老舗

Ferrule For 4SH Hose

Flat Bottom Brown Kraft Paper Coffee Packaging Bag with Valve

iphone8ケースブランドコピー

Automatic Feeder

13mm Wafer Head Screws

ブルガリ時計スーパーコピー

Combi Boilers

12V 24V Terminal Block Relay Push In Type

スーパーコピー級品ブランドコピー海外通販優良店

Colorful Sequins And Glue Beads Wedding Dress Fabric

Natural Hair Removal

クロムハーツスーパーコピー通販専門店

Ocean Shipping Services to Cotonou Benin

Downhole Mud Motor

ウブロコピー時計ぼってが

Explosive Ordnance Disposal

078 903 133 Q

ポスターコピー印刷大判出力ビジネスサービス株式

スーパーコピー級品ブランドコピー販売

Kids Lunch Box Stainless Steel

Conakry Guinea

Low-voltage power cable for ships

Harness Terminal Connector

素晴らしいスーパーコピーブランド通販サイト

ブランドコピースーパーコピーブランド販売店

Tungsten Carbide Tooling

Monel 400 V-образная лента для намотки спирально-навитой прокладки

最高級ウブロコピーウブロスーパーコピー時計激安通販

Amber Glass Dropper Bottles

Lome Togo

Mutli Function Station

701615301G

ブランドコピー販売店

Прокладки с металлической оболочкой

Vintage Clear Glass Marbles

スーパーコピー時計ダイヤ

ファッションドットコムブランドコピー

Набивка из ПТФЭ с сердечником из силиконовой резины

Portable Voc Gas Detector

Cpe Isolation Gown

021145299C

ブランド財布コピー専門ショップです

High Tenacity Low Shrinkage Anti UV Polyester Filament Yarn

Large Solar Lights

ブランドコピー日本店舗コピーブランド

スーパーコピー時計ガラス

Industrial Humidifier Factory

In-House Environmental 320TPH Asphalt Mixing Plant

Military Drone Cost

Stainless Steel CNC Machining Thru Bolt

スーパーコピー時計大阪

Carbon Steel One-Piece Shaft Collar

18g Stainless Steel Brad Nails

スーパーブランドコピー服

8ft Fence Posts

スーパーコピーブランド店舗スーパーコピーブランド人気

191721335D

セイコースーパーコピーのブランド時計偽物通販級品専門店

Common Rail Injector Valve F00VC01379

1-Methylcyclopropene Cas:3100-04-7

Diesel Common Rail Fuel Injector 1110010015

zaraブランドコピー

Power Mesh

Common Rail Injector Valve F00RJ01278

ダミエ財布スーパーコピーエルメス韓国偽物財布値段平均

Freeze Dried Pitaya

SFP28 Direct Attach Copper Cable

ブランドコピー激安通販口コミスーパーコピー代引き販売店

Diesel Fuel Injector 095000-1211

Coiled Tubing Motors

浜松ブランドコピー

Fuel Nozzle DLLA145SND313

ブランドスーパーコピー通販スーパーコピーブランド専門店

Fuel Nozzle DLLA155P180

Filament Nonwoven Geotextiles

Log Grapple Trailer

Diesel Fuel Injector 0445120006

ブランドコピーフリマ

業界最高品質ブランド靴のスーパーコピー激安販売

Листы ПТФЭ

Smt Label Feeder

New Design Three Layers Four Stretch Fabric Two Colors

スーパーコピー時計韓国

Electric Melting

Glue Spray Equipment

ブランドコピー転売

Medical Endoscope Control Board

Cutting Ribbon Cable

スーパーコピーブランド専門通販店大人気ブランド

Fuel Injector Nozzle DLLA148P513

Threaded Forged Steel Gate Valve

グッチコピー靴メンズキャンバススニーカーブランドコピー

Common Rail Fuel Injector 0954200260

xperiaxz1ケースブランドコピー

Paper back notebook

Reciprocating Linear Actuator

Peel Stick Hdpe Sheet

285-635 Red Copper Two Conductor Spring Clamp Terminal Block Installation Side And Center Marking

イヴサンローラン靴コピーブランドコピー代引き専門店

クアラルンプールブランドコピー

Golf Umbrella

Shoulder Bag

日本エルメススーパーコピー長財布専用生地スーパーコピー

Affordable Hearing Aids

RPET Fabric Umbrella

スーパーコピーブランドシャネル

Lvt Bathroom Floor

Гибкая графитовая набивка, усиленная углеродными уголками

Large Led Display

NH1 XL 1500VDC gPV Fuse

ロレックス時計スーパーコピー激安偽物

Spd

ブランド時計レプリカグッチコピー

Patriotic Supplies

3 Way Ball Valve T Port

大阪ブランドコピー店

Mardi Gras Party Supplies

ブランドコピー税関没収法人

RC Plane

Iqf Frozen Green Beans

Small Boat Anchor Winch

Super Duplex Steel Weld Neck Flanges

スーパーコピーブランドリュック

Convertible Backpack Duffle

スーパーコピー時計店舗

Reinforced Suction Plus Endotracheal Tube

Empty Lip Gloss Pen

Ash Filter Paper

素晴らしいスーパーコピーブランド通販サイト

韓国ブランドコピー相場

Empty Automatic Eyebrow Pencil With Brush Head

Dairy IML Labels

Vibration Isolation System

韓国ブランドコピー靴下通販

2 Phase I/O Control Stepper Driver Precise And Reliable Control

メンズ腕時計スーパーコピーブランドバッグ

Pvb Interlayer

Impact Resistant Injection Molded Hockey Visor

cokazaブランドコピー

Chronic Relapsing Pancreatitis

Portable Hair Straightener Brush

Dc Voltmeter And Ac Voltmeter

redditブランドコピー

Welded Galvanized Steel Tube for IBC Tanks Bottom Pallet

日本人気スーパーコピーブランドの通販買取専門店

IBC TANK Finished Barrel Thickened Version

Caster For Icu Bed

Integrated Nema23 closed loop stepper motor

Absolute Position Encoder

スーパーコピーブランドウブロ

Solar Powered Fan

フェンディメンズスーパーコピー靴激安販売専門店

Hydraulic Wheel Motor

Indoor outdoor boots suppliers

Carbon Steel Solar Carport Mounting System

シュプリームブランドスーパーコピー通販専門店

Silica Ceramic Fiber Packing Reinforced with Inconel Wire

口コミで高評価スーパーコピーブランド時計コピー

Automatic Folding Mobility Scooter

スーパーコピー時計違い

Benefits of using a water bottling plant machine

Automatic Candy Making Machine

How many miles do engine mounts last

Heavy Duty Garage Springs

ロレックススーパーコピータイクロエパラティ財布時計

Thick Tyre Gear Cycle

激安スーパーコピーブランド通販専門店

Kids Table And Chairs Set

What is an Artificial Lawn Cutter

ブランドコピー代引き対応バッグブランドコピー

Sideboard

高品質財布エルメススーパーコピーブランド優良店

stickers and activity pads

Secure Package Delivery

Pastry Bag

ブランドコピーマーケット口コミ

The use of Galvanized Steel Coil

Golf Electric Car

iphone8ケースブランドコピー激安

Sports Bottle

Dk111 Opc Drum

Anti UV Black Nylon Industrial Yarn

ブランドコピースーパーコピー通販市場

最新スーパーコピーブランド級品販売通販

Women’S Shoulder Bags Sale

Dye

Stainless Steel Pulley

高品質ブランドスーパーコピー時計財布バッグ通販

Reflective PVC Warning Tape

What are the advantages of Assembly Machine

China Decking and WPC

ブランドコピー服代引き

iphone11ケースブランドコピー激安

18 layer 3step HDI PCB

Acrylic Fireproof Cloth

Dental Lab Furnace

韓国ブランドコピー韓国スーパーコピー

N9923A FieldFox Handheld Microwave Spectrum Analyzer

The Origin of Artificial Flowers

ブランドコピーiphone11pro

Salt Water Desalination Plant

Plastic Vest Carryout Bag

Low Carbon Steels Weld Fabrication Makings

ブランドコピーおすすめサイト

スーパーコピーブランド専門店ブランドコピー販売

Car Diffuser Rotating

Cnc Machining Center

シャネルスーパーコピーブランドコピー専門店

DC51D+AZ Color Coated Galvanized Steel Coil

Beryllium Copper Foil Manufacturer

スーパーコピーブランド優良店

Natural Meat Chicken Flavor Canned Wet Cat Food

Cat Ball Sisal Toys

大阪時計スーパーコピー

Air Source Heat Pump Installation Cost

BUFDE+Z Color Coated Galvanized Steel Coil

セブ島スーパーコピー時計

Wholesale Bagasse Tableware

Tire Pump for Car

スーパーコピーブランドアイフォンケース

Land Rover Fuel Pump C2S20035

Jumbo Paper Roll Price

Wood Coffee Table

Barge Tile

ブランド財布コピー品

ブランドコピーカタログ

Insert Milling

Octavia Fuel Pump 2018-2021

ブランド品の偽物コピーの種類と見分け方

Air Cargo

Rivet Nuts

ブランドコピーランキング

Incoloy 825 Capillary Tube

Audi A3/S3/Sportb./Lim./qu. Fuel Pump 2004-2008

leather laser cutter

エルメス財布コピースーパーコピーブランド偽物販売店

Yellow Cloth Warning Tape

Extrusion Line for Solid Wall Pipe

Pipe Socket

時計スーパーコピークォーツ

Tracker System For Solar Using Dual Axis

Crystal Clear Soft Vinyl Film

韓国スーパーコピーバッグ

Pilot Margarine Making Machine

ブランドコピーiphone8ケース

Stainless Steel Lunch Box

Wire Rope Clips

Leds Membrane Switch

スーパーコピー時計専門店カード払い

ブランドコピー販売代引き

Ss304 Round Head Bolt

Lithium Iron Phosphate Battery

Cnc Milling Part

スーパーコピーブランド財布代引き通販専門店

Assembly and Testing Machine

Brass 2 Way Garden Hose Connector

What is the relaxation principle of the Vibration Massage Gun

jazzmouth.org

LCD Digital Infrared Thermometer

Chloride Process

Ilmenite Uses

Titanium Dioxide Tla100

Small Swivel Chairs For Living Room

Paper Flat Pocket Bags

Paper Bag with Handle

Wide Office Chairs

ctcglobal.org

Paper Bags

Cable Lugs

Amber Reading Light

Importance of Sewage Pumps in Wastewater Management

7 Inch Rear View AHD Monitor

Wooden Led Lamp

Essential Oils Their Benefits and How To Use Them

reminders.chegal.org.ua

Wireless Bedside Lamp

Mini Spot Welder

Scope of application of Pillow Packaging Machine

LCD Display construction and its working

orden.coulot.info

Battery Insulation Paper

Pan Framing Head Self Tapping Screw

Spot Welding Electronics

Classification of computerized flat knitting machines

What is Steering Rack

Pedicure Dust Collector

What is an Gusset Bag

thrang.kr

Nail Dust Collector Machine

Nail Color Card

Knockout Cell Lines

Animal Cell Lines

Stainless Steel Eye Bolts

Stone Cladding Support System Fixing Marble Angle / Curtain Wall Bracket

Liver Cell Lines

Stainless Steel A2 A4 Stone Curtain Wall Mounting Bracket Fixings

http://www.opylashy.website

Galvanised Steel Coil

Cold Rolled Galvanized Steel Coil

Wedge Anchor

Anchor

Sleeve Anchor

Dx51d Galvanized Steel Coil

roody.jp

Granular Pe Wax

Fischer Tropsch Synthetic Wax Composition

sceaindia.org

Positioners And Actuators

Ceramic PCB

High-power LED ceramic PCB

Thin Film Circuit Board

24V/36V High Speed Spur Gearbox Motor For Car

37mm 12V Small Gear Reduction Motor For Serving Robots

Car Charger

32mm High Torque Electric Planetary Gear Reduction Motor

12v Battery Charger

rosexport.su

Balance Charger

Car Window Hammer

Auto Phone Holder

ODM 2.2 Inch Lcd Display

ODM 10 Tft Monitor

Car Tool

Lcd Touch Module

http://www.userv.su

Wooden Fut Ceiling T Grid

T Bar Suspended Ceiling T Grid

Wooden Flat Ceiling T Grid

Quick Drying/Fast Drying Bath Mat

Pvc Bathtub Mat

http://www.titanium.tours

Quick Drying/Fast Drying Bathtub Mat

automol.by

What are the applications of Laser Range Finder Module in the military field

biodegradable food containers

Saxifraga stolonifera Extract

shiitake extract powder

Introduction of Hydroxy Propyl Methyl Cellulose

Zeaxanthin powder

Custom Food Bags

Biodegradable Food Bags

Makeup Sponge

Makeup Puff

Single Makeup Brush

Loose Leaf Tea Bags

http://www.treatec.myjino.ru

easter picture crossword puzzle

gbwhatsapp.apkue.com

Computer Chair

professional watercolor set paint

hydraulic portable sawmill

Swivel Gaming Chair

Gaming Desk Height Adjustable

Knife Bristle Block

Belt Encoder

Biomass Boiler Igniter

Function structure and working principle of wheel loader

Nbu 15 Grease

ISO7379 Hexagon Socket Head Shoulder Screw

http://www.ruoungo.vn

Paper Packaging Products

Brown custom kraft paper bag

Food Take Away Boxes

kinnikubaka.xsrv.jp

Research direction of industrial endoscopy

stainless electrical cabinet

roll out 1 compartment chicken nesting box

Marketing Promotional Items

http://www.sportedzoitanfolyam.hu

CNC Aluminum Parts Multi-faceted complex part

Sand Play Toy

CNC Aluminum Parts Motor Housing

Promotional Merchandise Toy

CNC Machining Aluminum Motorcycle Parts

Relief Valve

Plush Dog Toy

Chew Dog Toy

winsta.jp

Spigot Joint

Pressure Release Valve

Vacuum Cleaner for Home and Car

What accessories does the Aluminum Door consist of

dial brass padlock

Drone Jammer

Smartphone Control Lock

Magnetic Mortice Locks

Drone Detector

t-formafitness.hu

Barbell Factory

Why are more and more businesses using LCD square displays

qa.singarea.org

40kg 100kg Dumbbells Gym

What are the main types of testing machines

Hex Dumbbells Weights

What are the models of Mercedes Benz engines?

Easter Puzzle Game for Children

Auto parts Power steering pump Professional producer For Fiat OEM 504046460

Hrc Hardness Tester

Irrigation Hose Pipe

Watercolor Pan Sets

Double Line Drip Tape Machine

olfrontals.com

Custom Usb Cable Assemblies

Aluminum Foil Kitchen Sticker

Patterned Kitchen Sticker

Kitchen Sticker

Board to Board Connector

Usb Mini B Cable

ruoungo.vn

400A Cable Accessories

Small Paper Box for Skin Care Product

professional manufacturer auto parts 0k60a 33 28z front axle d1199 8319 car brake pad kits gdb737

Heat Shrinkable Sleeves

Watercolor Paint Reveiws

Other Spare Parts For Transformer

http://www.kids.ubcstudio.jp

Functional Home Decorative Metal Brackets Stamping Parts

Boom Lift Battery

Lifepo4 Forklift Battery

36v Lithium Battery For Golf Cart

http://www.jakubdolezal.savana-hosting.cz

Angle Brackets

Triangle Brackets

Ce Ivd

Water Vacuum for Car

Gynecological Tumor Detection Reagent

Small Vacuum for Car

http://www.sp-plus1.com

Automated Molecular Diagnostics

Wet Vacuum Cleaner for Car

Aoc Ethernet Cable

Asbestos Packing with PTFE Impregnation

Asbestos Packing with Graphite Impregnation

Ramie Fiber Yarn Packing with PTFE Suspensoid Impregnated

Dac Aoc Cable

http://www.xinpian.net

Sfp+ Optical Cable

dasanms.com

Expanded Ptfe Gasket

Expanded Ptfe Sheet Gasket

Branch Shredder

Big Wood Chipper

Expanded Teflon Gasket

Giant Wood Chipper

60% Bronze Powder Filled PTFE TEFLON Sheet

Neoprene Rubber Bonded Cork Sheet

http://www.okinogu.or.jp

Nitrile Rubber Bonded Cork Sheet for Transformer

Hair Growth Products In Uganda

Invisible Aligner

Hair Treatment

Color-marking Co-extrude Equipment

Electric Two Wheeler

Fast Electric Scooter For Adults

Good Mountain Bikes

keyservice.by

Single-screw Extruder

Conical Type Twin-Screw Plastic Extruder

Stainless Steel S Type Load Cell

Press Brake Bending Machine

Multiple uses of Wireless vacuum cleaner

tdzyme.com

Bypass Built-In Motor Soft Starter

What is the type and scope of garment bag

Press Brake Bending Machine

Watercolor Set with Paint Tin

Active Network Tap

Passive Optic Tap

Benefits of Pet Dog Bed With Removable Canopy

Vlan Tag

lioasaigon.vn

Automatic Disposable Coffee Cup Machine

SPARK Nickel Chrome Alloys

Smart Electric Air Fryer

Aluminium Alloy Wire

Built-In Cooker

hunin-diary.com

Nichrome Wire Heating Element

Stainless Steel Electric Air Fryer

Water Purifier Model

Water Purifier Tablets

garden-green.pl

Brushless Gear Reduction Motor

Water Filter Ro Price

Brushless Motor

Motor Hub

Microduct Connectors

Npk Fertilizer Machine

Food Waste Fertilizer Machine

Compound fertilizer granules making equipment

Straight Microduct Connector

Pneumatic Air Hose

soonjung.net

Animal 3D Wooden Puzzle

Weighers China

Online Checkweigher Factory

Conveyor Belt Metal Detector Manufacturers

okinogu.or.jp

3D Mini Corsair Jig Puzzle

3D Wooden Farm Puzzle

Small Rock Crusher

Mobile Crusher On Rent

Jaw Crusher Price

How to choose an LED panel light

Capacity growth of China s aluminum alloy die casting industry

Solar Inverters Help Solve Electricity Challenges in South Africa

pmb.peradaban.ac.id

Lithium Metaborate

http://www.jofu.tw

What are common food additives

Chelating Agent

adhesive waterproof breathable membrane

What are the use methods and precautions of the Pressure Cooker

Non Ionic Detergents

sinoahcabinets com Qingdao Sinoah Co Ltd

luckymurphyboat com Qingdao Lucky Murphy Boat Co Ltd

Sink Single Bowl

Antique Wooden Furniture

Stainless Steel Washing Sink

allsoft.com.do

jingkon com Ningbo Jingkon Fiber Communication Apparatus Co ltd

Carbon Steel 4.8/8.8 Grade Zinc Plated Hot DIP Galvanized HDG U Bolt with Nut for Electric Power

http://www.beackgol.co.kr

China Shipping Agent

Air Shipping

DIN3570 Stainless Steel A4-80 U Bolt or Square U Bolt

DIN 3570 hot-dip galvanized square U-bolt

Railway Freight

Living Room Furniture Chairs

6000 Series Anodized Aluminum Extrusion Profile

Solar Panel Aluminium Feet Bracket Mounting Structure Frame T-Slot Aluminum Profile

Budget-friendly dining chairs

Aluminium Profile for Building And Industrial

Versatile dining chairs

http://www.pstz.org.pl

http://www.sailingteam43.it

Flange Bolt

Stacker Parking

Bolt

Hex Bolt

Mechanical Car Park System

Underground Car Parking System

Wireless Wifi Camera

http://www.sp-plus1.com

ST01Z Color Coated Galvanized Steel Coil

DX51D+Z Color Coated Galvanized Steel Coil

Home House Energy Storage Batteries

Mini Cctv Camera

DX53D+Z Color Coated Galvanized Steel Coil

Galvanized Corrugated Metal Roofing

Chewy Rope Toy

Steel Truss

naimono.co.jp

Puppy Rope Rubber Body Toys

Tough Tug of War Rope Toys

Crngo

M10 Stainless Steel 18-8 Keps Nut K-Lock Nut

Meat Pie Making Machine

Meat Cutting Machine Price

Stainless steel 304 direct sale metric hex domed cap nuts

Stainless Steel 304 K Nut

Patty Former

appsapk.net

[url=http://bactrim.cyou/]bactrim 800 mg 160 mg[/url]

Molded Motorcycle Ear Plugs Uk

Dog Paw Print Ice Cube Tray

Magotan Fuel Pump 2016-2024

Motorcycle Soap Mold

sudexspertpro.ru

Touan Fuel Pump 2018-2023

Passat Fuel Pump 2018-2024

Main features of Wheel Bearing

Why is the computerized flat knitting machine so popular

7kw Ev Charging Stations

Type2 Ev Charging Stations 220vac

white porcelain

Charging Station For Electric Scooter

domser.es

Spiral Notebook

Laser Welder For Mold Repair

Notebook

Leather Notebook

Maquina De Soldar Laser

Laser Fiber

warszawa.misiniec.pl

30cm Wall Clock

Steel Doors for Purification Room

Countdown Clock App

Medical Purification Steel Door

userv.su

20 Inch Wall Clock

Diaper Packaging Bags

Mechanism Panel

Wifi Valve Controller

Clean Sampling Car

Flow Meter Controller

http://www.czarna4.pl

Ultrasonic Sensor Khz

Motorized Ball Valve Actuator

Ozone Generator

Air Filter

Purification Equipment

Pipeline Valve Controller

Mesh Dish Scrubber

Car Seat Belt Webbing

http://www.sudexspertpro.ru

Tow Strap Racing Strong

Mesh Scourers

Plastic Mesh Scrubber

Black Work Gloves

Leather Welding Gloves

Kitchen Scouring Pad

Green Polyester Strapping

Scourer Plastic Scourer Mesh

8.2mhz Eas Rf Alarming Label

Handmade Diamond Painting

Eas Rf Soft Sticker Label

Diamond Painting Christmas Cards

Eas Rf Label

Morden Diamond Painting

Christmas Cards

bigstar.co.jp

Rf Eas Label

Halloween Diy Diamond Painting

8.2mhz Eas Label

[url=http://retina.cfd/]retin a 05 mexico[/url]

[url=http://zoloft.cfd/]zoloft best price[/url]

[url=https://doxycycline.guru/]doxycycline 100mg australia[/url]

Blind Rivet

Magnetic Ore Separator

Hex Bolt

Solid Rivet

jisnas.com

Laboratory Magnetic Separator Machine

Permanent Suspension Magnet

U Bolt

Non Ferrous Metal Separator

Laboratory Magnetic Separator Machine

Bolt

Diesel Trailer

Stainless Steel Clamp on Rod Holder

Mobile Light Tower

Stainless Steel Vertical Fishing Rod Holder

warszawa.misiniec.pl

Boat Stainless Steel Fishing Rod Holder Clamp On Rail Mount

Stainless Steel 360 Degree Adjustable Fishing Rod Holder

Mobile Power

Stainless Steel Heavy Duty Fish Rod Holder With Drain

Led Eco Lighting

Towable Generator

Privacy Protection Garden Fence Balcony Cover

UV Protection Outdoor Sun Shade Net Balcony Privacy Screen

Privacy Screen Panels for Chain Link Fence

http://www.den100.co.jp

Container For Explosive Device

Eod Bomb Suit Statue

Protection Ballistic Blanket

Vhf Uhf Jammer

Hw- 24 Non-Linear Junction Detector

Fence Cover and Privacy Screen for Chain Link Fence

Privacy Screen For Chain Link Fence

Horizontal High Speed V Cutting Machine For Metal Plates

Horizontal High Speed V Slotting Machine

Aln Wafer

Aln

V-Shaped Grooving Machine

CNC Horizontal High Speed V Grooving Machine For Stainless Steel Plates

CNC Horizontal High Speed V Grooving Machine For Metal Plates

Chip

Substrate In Semiconductor

http://www.dinhvisg.com

Wafer Crystal Orientation

Mayonnaise Machine

Cosmetic Anti-dandruff Agent Climbazole

Fire Retardant Paint For Steel Structures

Automatic Cartoning Machine

Fire Retardant Paint For Wood

rotary pump price

Non-Intumescent Fireproof Paint

Intumescent Fireproof Paint

Vacuum Toothpaste Mixer

modan1.app

Tubes Filling Machine

Cylinder Metal Zipper Pencil Case

Brown Bear Embroidered Pencil Case

Exit Sign Lights

Exit Sign With Emergency Lights

sakushinsc.com

Crosswalk Light

Black Oxford Cloth Printed Pencil Case

Emergency Lighting Exit Signs

Large Capacity Pencil Case

Traffic Signals Lights

Printed Monster Face Leather Pencil Case

Toyota Yaris Vitz Vios Radiator

EVA Slide Sandals For Men

digitallove.in

Custom Slide Sandals For Men

Radiator for

Toyota Yaris

Auto Radiator

Mens Slides Shoes

Waterproof Slide Sandals For Men

Black Slide Slippers For Man

Radiator for Toyota Vitz Vios

Tracking Bl

OBD GPS Tracker

LSR Medical Silicone Components

LSR Medical Grade Silicone Tubing

Cargo Tracker

LSR Medical Grade Face Mask

LSR Medical Silicone Tube Drainage Tube

Wireless Tracker

Echtzeit-GPS-Tracking-System

thinkplus.tv

LSR Automobile Parts Miscellaneous Parts

Butterfly Valve With Gear

EVE 3.2V 280Ah Battery Cell

beackgol.co.kr

Hand Gear

Glass Cooking Pot

Worm Wheel Gearbox

Valve Gear Actuator

Glass Cups

Bevel Gear

EVE 3.2V 304Ah Battery Cell

Glass Tea Set

Lace Guipure

Nylon Lace

Frozen Squid Tentacle

http://www.mix.com.az

Black Guipure Lace

Frozen Squid Ring Skin Off

Frozen Squid Flower

Frozen Squid Ring

Frozen Squid Tube

Beaded Lace Fabric

Grey Guipure Lace Fabric

Chinese video lessons HSK level 3

Chinese course HSK 4 A

Warm Slipper Video For Ladies

Warm Indoor Slippers Exporters

Chinese course HSK 2

Chinese course HSK 4 B

Lightning Arrester In Substation

Warm Slippers Factory

Chinese online 1-to-1 course

Surge Arrester

http://www.gataquenha.com

Modified Truss Head Self Tapping Screw

White Enamel Brush Set

Double Flat Head Pozi Drive Chipboard Screw

Angled Paint Roller

Torx Double Flat Head Chipboard Screws Full Thread Yellow Zinc Plated

Pan Framing Head Self Tapping Screw

High Quality Air Removing Roller

DIN 7981 Pan Head Phillips Self Tapping Screw

Caulking Gun For Silicone

4 12mm Yellow Stripe Mini Paint Roller Cover

shidai5d.com

Air Cooler RC Control

2 Inch Ratchet Tie Down

Air Cooler Manual Control

Tower Heater

samogon82.ru

Towing Belt

Polyester Strapping

Polyester Composite Strap

Fan Heater

Tower Fan with Humidifier Manual Control

Polyester Ratchet Tie Down Straps

Tensioner and Belts

Drive Shaft

Solar Related Products

Lifepo4 280ah

Inverter

Inverter Hybrid

Auto Lighting Systems

http://www.sukhumbank.myjino.ru

Wheel Hub Bearing

Lifepo4 Battery Pack

Head Light

[url=https://retina.cfd/]cost retin a[/url]

Automotive Cable Assebmlies

Rear Shock Absorber

Steering Wheel

Suspension Air Spring

Micro Usb Cable

4k Hdmi Cable

Shock Strut Mount

Hdmi Arc Cable

osuszaniegdansk.com

Front Shock Absorber

Mini Usb Cable

[url=http://fluoxetine.cyou/]fluoxetine brand name uk[/url]

Road Bollards

Industrial Door Access Control Keypad

Static Bollards

Remote Rising Bollards

Bollards For Sale

IP65 Industrial Keypad

http://www.mix.com.az

Traffic Bollard

Industrial Metal Keypad

Industrial Machine Keypad

Industrial Code Lock Keypad

Air Line Filters

portal.knf.kz

Non Woven Insulated Tote Cooler Bag

Rpet Cooler Bag

Air Compressor Filter

Cooler Bag

Hydraulic Air Compressor

Hydraulic Oil

Thermal Cooler Bag

Pump Air Compressor

Reusable Thermal Insulated Cooler Bag

PTFE Color Sewing Thread

PTFE Colored Sewing Thread

http://www.tdzyme.com

Needle Punched Felts and Fabric

Cylinder cover

PTFE Thread Sewing

Purifier complete

Wire Rope

Fire Blankets

Fa-2lsym1 Factory

PTFE Accessories and Rope

Linear Actuator Controller

Wood Pellet Ceramic Igniter

Ceramic Wood pellet igniter for pellet boiler

24v 150mm Stroke Linear Actuator

Telescopic Linear Actuator

Alumina Ceramic Pellet Stove Igniter

Electromagnet Linear Actuator

High Speed Linear Actuator

wood pellet furnace ignitor

http://www.softdsp.com

replacement hot rod for pellet grill

Stylish Carry-on Luggage For The Modern Traveler

Carry-on Luggage Reviews

Ansible Vault File

Lightweight Carry-on Luggage Options

Affordable Carry-on Luggage Deals

http://www.hunin-diary.com

Password Protect File Windows 10

Lightweight Suitcase With Wheels

Video Animation Online

Online Classes For Students

Encrypt File Online

Developer Roller

Wood Pellet Ceramic Igniter

Coper Chip

Alumina Ceramic Pellet Stove Igniter

Ceramic Wood pellet igniter for pellet boiler

Unit Of Charge

radioklub.blansko.net

replacement hot rod for pellet grill

Cleaning Blade

wood pellet furnace ignitor

Logic Board

Bias OTR Tire

Diamond Tread Plate

Bias Tire

Square Metal Tubing With Holes

Thread Steel

techbase.co.kr

Radial AGR Tire

Agriculture Tire

Bias AGR Tire

Hot Rolled Steel Sheets

Square Tubes

iPhone 6sp Incell Lcd Assembly Replacement

iPhone 7 Display Assembly Replacement

Car Dustproof Rubber Cover

http://www.oldgroup.ge

Automotive Wiring Harness in Black Rubber EPDM Gromment

Speaker Funnel Sheath

Touch Screen iPhone Xr

Screen Tak Boleh Touch

Automobile Dust Proof EPDM Wire Harness

iPhone Screen

Black Rubber EPDM Automotive Wiring Harness Gromment

Anti Slip Conveyor Belt

zsmf11 explosion proof type without white stips poly fender

Manure Belt Poultry

Conveyor Belt Pvc

Egg Belt

zsmf09 heavy duty truck rear fender cover

Fabric Nylon Flat Belts

naimono.co.jp

zsmf12a with ear type poly fender

zsmf10 2 heavy duty tractor body parts rear fender

zsmf10 1 heavy duty tractor body parts rear fender

Titanium Golf Heads

Transparent Sink

Cast Titanium Bicycle Parts

soonjung.net

Marble Stone Counter Top

Ti Gr.2 Casting Parts

Vanities

Easy To Clean Bathtub

Mirrors

Cast Titanium Impellers

Cast Titanium Parts Of Medical Apparatus

yumemiya.xsrv.jp

Wide Torque Range Smart Electric Screwdriver

Fixed Smart Screwdriver With Torque Control

High Torque Fixed Smart Screwdriver

DC 120W Fixed Smart Screwdriver

Vintage Gold Velvet Sofa

Public Furniture

High Precision Fixed Smart Screwdriver

Bar chairs

Leather L Shape Sofa Set

L Shaped Bar Table

Flat D-Cut Plastic Cold Cutting Machine

200W Foldable Solar Panel

Cloth Bag Making Machine

Garbage Trash Bin Plastic Bag Production Machine

Pv Panel

Carry D-Cut Bottom Sealing Carrier Plastic Poly Bag Making Machine

325W Solar Modules

350wp Solar Panel

http://www.yoomp.atari.pl

Slitting Machine

Solar Panel Flexible

Heat Shrink Bag

EVA Bag

PEVA Bag

http://www.dinhvisg.com

Stationery Bag

Plant Cultivation Bag

Plant Culvation Seedings Bag

Childrens Messenger Bag

Running Backpack

Neoprene School Bag

Backpack For Kids

[url=https://robaxin.cyou/]robaxin otc usa[/url]

Other Truck Parts

Polyethylene Netting

skarbek.fr.pl

Spring latch

Anti-Uv Plastic Agricultural Net

Plastic Netting Mesh

Cargo Track

Cargo Track Fittings

Truck Foot Steps

Hardware Netting

Plastic Net

cedmilano.com

4g Poc Mobile Radio

Protolabs Injection Molding

Micro Injection Molding

Earphone Case

Injection Mold Making

Medical Injection Moulding

Car Intercom

Laptop Case

Polypropylene Molding

Classic Laptop Case

Diaphragm Repair Kit for 2.5 Inch Right Angle Valve

eibiz.co.th

Waterproof Electrical Junction Boxes

Wire Ties

2 Inch Diaphragm Repair Kit

Plastic Anchors

Screwed Cable Gland

Diaphragm Replacement Kit for 1.5 Inch Pulse Jet Valve

Water Biological Filtration Filter Cloth

Luggage Cord For Cycle

Diaphragm Repair Kit for 3 Inch Right Angle Solenoid Valve

[url=http://phenergan.cyou/]phenergan online pharmacy[/url]

[url=https://ivermectin.guru/]stromectol 3 mg[/url]

Hpmc Inci

Black Leather Shoulder Bag

White Canvas Shoulder Bag

Hpmc Side Effects

Apa Itu Hpmc

Simple Small Crossbody Bag

Hpmc Phthalate Solubility

Hpmc Molecular Weight

Printed Bird Canvas Shoulder Bag

http://www.treatec.myjino.ru

Cationic Washing Bag

Water Dispenser

Commercial Water Filter

Probes In Usg

Ultrasound Vet

Pipeline Water Dispenser

http://www.saidii.co.kr

RO Water Dispenser

Endoscope Components

UF Water Dispenser

Refurbished Ultrasound

Convex Transducer Ultrasound

oby.be

9Y1955329 Wiper Blade

95B998001 Wiper Blade

Automotive Harness Connectors

Connector Car

Auto Connectors For Wire Harness

974955427A Rear Wiper Blade

971955427A Rear Wiper Blade

Car Ecu Connector

Wire Board Connector

97051157100 Front Hood Support

Benzocaine 200 Mesh

DIN 7504P Pan Head Phillips Self Drilling Screw

Benzocaine Powder

Benzocaine 80mesh

1009-14-9 Supplier

http://www.firma.js.com.pl

Bugled Head Self Drilling Screw

Modified Truss Head Self Drilling Screw Head Paint

Purity Benzocaine

Flat Head Phillips Self Drilling Screw With Wings

DIN 7504N Flat Head Phillips Self Drilling Screw

Ride On Sweeper Parts

Floor Cleaning Machine Ride On

Stretch Knitted Elastic Band for Apparel

jffa.my

Stretch Knitted Elastic Band for Accessories

Versatile Stretch Knitted Elastic Band for Sewing

Magic Tape

800 Industrial Ride-On Sweeper

Stretch Knitted Elastic Band for Clothing

Hand Push Sweeper Video

Hand Push Sweeper Video

http://www.grain-seeder.ru

250 Insulated Terminal TO Y-type Terminal Wiring Harness

Charger

Hand Warmer Heating Pad

Metal Button Switch Industrial Equipment Connection Harness

Recharge Hand Warmers

Industrial Equipment Aerial Docking Connection Harness

DB25 Industrial Equipment Signal Transmission Harness

USB 2.0 TYPE C F TO PH2.0 Industrial Wiring Harness

Qi Fast Charger

Old Hand Warmers

Miniature Rod Ends

Agricultural Bearing

Conveyor Roller Bands

Deep Groove Ball Bearing

LED Aluminum Hot Channel Profile

http://www.tupelo.pl

Extruded Aluminum Hot Pot Shell

6203 Bearing

Industrial Extruded Aluminum Profile Radiator

Special Shaped Aluminum Radiator

Aluminum Heatsink

Vertical High Speed V Grooving Machine For Stainless Steel Plates

Unleached Pcd Cutting Tool High Quality 1613

Vertical High Speed V Groove Cutting Machine

Vertical High Speed V Cutting Machine

DTH Bit Diamond Tipped Cutting Tools

Conical PDC Cutter 1919

shidai5d.com

Coal Diamond Cutting Inserts 1613

Conical PDC Cutter 1313

Vertical High Speed V Groove Slotting Machine

Vertical High Speed V Grooving Machine For Metal Plates

Italian Pump Capsule Coffee Machine Espresso

Double Head Capsule Coffee Machine with Steam Function

http://www.faarte.com.br

Home Use Commercial Small Coffee Machine

Electric Cooling Pump Mercedes

Mercedes Cooling Pump

Fully Automatic Commercial Coffee Machine

Mercedes Coolant Pump

Water Pump For Cooling System

Smart Automatic Commercial Coffee Machine

Coolant Pump For Car

Solar Cable 1500v

Solar Cable 1000v

Professional Pizza Oven

Solar Cable PV Wire 6mm2

Solar Cable PV Wire

Portable 14 Inch Oven

Big Size Pizza Oven

Tabletop Pizza Oven

Solar Cable

Pizza Oven Restaurant

http://www.tbgfrisbee.no

OEM Toy Manufacture

Vending Toy

Blind Bag Toys

Mini Figures

Sodium O,O-diisobutyl Dithiophosphate

Isobutyl Sodium Phosphorodithioate Cas No. 53378-51-1

lioasaigon.vn

2 Inch Capsule Toys

Sodium Diisobutyl Monothiophosphate Cas No. 53378-51-1

Sodium Diisobutyldithiophosphate

Sodium Isobutyl Dithiophosphate

Commercial Gym Equipment

Cement Bloc Brique Machine

Water Rower

Block Forming Machine

Magnetic Rower

http://www.suplimedics.com

Automatic Block Making Machine

Brick Machine Making Automatic

Fitness Equipment For Home

Exercise Equipment For Home

Concrete Block Machine

[url=http://rybelsus.best/]wegovy online order[/url]

Ball Valve Refrigeration System

Condensing Pressure Regulator

Titanium Dioxide R2219

szklarski.pl

Chloride Process

Anatase Titanium Dioxide

Sulfate Process

Hot Gas Bypass Regulator

Titanium Dioxide R895

Refrigerant Ball Valve

Crankcase Pressure Regulator

[url=https://ozempictabs.online/]where to buy ozempic online[/url]

Ball Valve Refrigeration System

korchambiz.blueweb.co.kr

Brass Terminal Spot Welding Machine

Capacitive Discharge Spot Welder

Smart Spot Welder

Heavy Duty Spot Welding Machine

Condensing Pressure Regulator

Refrigerant Ball Valve

Crankcase Pressure Regulator

Hot Gas Bypass Regulator

Spot Welder Voltage

At present, remote control software is mainly used in the office field, with basic functions such as remote file transfer and document modification.

Cement Mortar Line

Tile Glue Mixer

Cement Mortar Plant

Solar Cable 1000v 16mm2

Sand Mortar Mixing Machine

Dry Mix Mortar Mixing Machine

Solar Cable 1000v 6mm2

odnowica.milaparila.pl

MC4 Connector T Branch 3 In 1

Solar Cable 1000v 10mm2

Solar Cable 1000v 4mm2

1000Vdc NH1 PV Fuse Base

10x38mm Fuse Clips For PCB

Travel System Prams

10x85mm GPV 1500VDC Fuse Link

Travel System Stroller

Double Travel System

10x38mm 1000VDC PV Fuse Holder

1000Vdc NH0 PV Fuse Base

http://www.grain-seeder.ru

Pink Travel System

Lightweight Umbrella Stroller

Isobutyl Methyl Carbinol

MIBC

Ore Processing Agent

Methyl Isobutyl Carbinol Cas No. 108-11-2

Methyl Amyl Alcohol

http://www.entlaak.work

Tinted Jalousie Glass

4mm Float Glass

Rose Gold Tinted Glass

Soda Lime Float Glass

Float Glass Mirror

Precision Ball Lock Punches

Precision Molding

Abs Plastic Molding

Precision H40S Carbide Punches

Plastic Molded Parts

Plastic Molding Development

Special Dies

lavidamata.xyz

Special CNC Parts

Low Pressure Moulding

Coating Punches

2,2-Bis(hydroxymethyl) propionic acid Cas No. 4767-03-7

Pannelli solari 7kw prezzo

Solare fuori dalla rete di distribuzione

HEC

Hydroxyethyl Cellulose Cas No. 9004-62-0

Generatore energia elettrica solare

Batteria gel per veicoli elettrici

Hydroxy Ethyl Cellulose

Kit solare per la casa

Hydroxyethyl Cellulose Ether

http://www.jion.co.jp

Aluminum Profile Aluminum Alloy

Anodized Aluminium Alloy Black Picture Frame Poster Snap Frame

Aluminum Extruded Tubes And Aluminum Profiles

Hydraulic bending equipment

Aluminum Poster Frame Corner

Outdoor Aluminum Double-Sided Frame Sidewalk Signage

http://www.misiniec.pl

Industrial pipe bending machine

“Industrial metal bending tool”

NC metal bending machine

K series press brake with Schneider Electric control

[url=http://ozempic.best/]wegovy 14[/url]

xn--h1aaasnle.su

Edlc Dry Electrode

Smart Motion Sensor

Three Systems Collar Flat Knitting Machine

Cixing Collar Flat Knitting Machine

Sensor Mats For Dementia

Corded/Cordless

Two Needle Bed Knit To Shape Flat Knitting Machine

Motion Detector Lights

Four Needle Bed Knit To Shape Flat Knitting Machine

Yarn Storage Knit To Shape Flat Knitting Machine

Rock Wool Fiber For Brake Pads

Fiberglass Filter Felt

Needle Felt with PTFE Membrane

Fiberglass Fiber

Concrete With Fiber Reinforcement

PTFE Woven Fabric

PTFE Needle Felt

http://www.skarbek.fr.pl

Paper Bags Cheap

Chopped Strand Fiberglass

Aramid Needle Felt

SUR Series Resistor

Cbn Making Machine

http://www.mhcclinic.jp

Sliding Rheostat

Pulse Resistor

Pcbn Pdc/Diamond Enchantment/Hydraulic Cubic Press

SUR Pulse Resistor

Complex Organic Acid (Special For Pig)

Plate Rheostat

Complex Vitamin B2

Hpht Cubic Hydraulic Press

Best Car Mechanic Gloves

Heavy Duty Sliding Door

thinkplus.tv

Gloves Household

Extremely Narrow Aluminum Swing Door

Off-Axis Heavy Duty Door

Vinyl Household Gloves

Double-Hinged French Patio Doors

Welding Gloves For Sale

Industrial Oven Gloves Suppliers

Single-Hung Narrow French Door

Array Resistor

All Terrain Electric Scooter

http://www.agnoli-giuggioli.it

CSR Precision Current Sensing Shunt

Solar Scooter

Off Road Electric Scooter

FL-2 Fixed Type Shunt Resistors Shunt

CSR Precision Current Sensing Resistors Shunt

Emove Scooter

Blue Electric Scooter

MELF Resistor Network

[url=http://ozempic.pics/]semaglutide diabetes[/url]

Broken Bridge Sliding Windows with Outward Gauze Mesh

Two Track Aluminium Sliding Windows With Mosquito Net

Broken Bridge Medium Narrow Sliding Windows

5mm Swimming Wetsuit

Broken Bridge Sliding Windows

Short Arm Steamer Wetsuit

5mm Chest Zip Wetsuit

kinnikubaka.com

Womens Wetsuit Short Sleeve

9mm Spearfishing Wetsuit

Triple Track Sliding Windows

[url=https://semaglutide.trade/]wegovy tab 14mg[/url]

Coil Slitting Machine

Vibrating Solid Concrete Brick Block Machine

oby.be

Brick Construction Machinery

Diaper Bag Making Machine

Fabric Roll Slitting Machine

Multifunctional Concrete Brick Making Machine

Surface Center Rolling Slitting Machine

Film Slitting Machine

Hollow Concrete Block

Clay Brick Machine

Ceramic Vase Flowers

AC Electrical Contactor

Outdoor Portable Misty Fan

skylets.xsrv.jp

Ceramic Supply Store

Ceramic Vase Blue

AC Magnetic Contactor

AC Operated Contactor

Contemporary Ceramic Vase

Industrial Power AC Contactor

Ceramic Vase Big

Paper Bag Making Machine

http://www.valor.plus

Small Laser Marking Machine

Laser Marking Machine Working

Sheet Metal Fiber Laser Cutting Machine

ABC Film Blowing Machine

Laser Marker Machine For Sale

ABA Film Blowing Machine

AB Strip Machine

Metal Pipe Laser

Film Blowing Machine

Inconel Part Oil Stamping

Metal Stamping Fuse Boxes

Metal Stamping Fuse Clips

Big Lunch Bags

rt-patriot.ru

Transmission Lead-Frames

Steel Lunch Box

Brown Lunch Bag

Steel Tiffin Box

Metal Lunchbox

Inconel Part Aerospace Stamping

Makeup Mixing Jar

Solar Panel Black Rapid End Clamp

Solar Panel Black Rapid Mid Clamp

Skincare Vacuum Bottle

http://www.jion.co.jp

Cosmetic Diffuser Bottle

Aluminum Solar Agriculture Mounting

Beauty Light-Proof Jar

Solar Agricultural Aluminum tripod Mounting

Cosmetic Uv Blocking Jar

Solar Farm Ground Mounting

Laser Welding Machine Fiber

KP28123SGA

Fiber Laser Marking fiber laser marking machine fiber laser marking fiber laser marking machine 50w fiber laser marking machine 20w fiber laser marking machine 100w fiber laser marking machine 30w fib

High PFC Non-isolated Constant Voltage

http://www.poweringon.com

KP28162SGA

100w Fiber Laser Engraving Machine

KP28122SGA

Laser Rust Remover

Single-Stage PFC Built-in MOS Constant Voltage Chip

Laser Marking Machines

Recirculating Steam Generator

Solar Rail Mount

Aluminum Railless Racking Mounting

Solar Carport Solar Mounting Rail

Steam Heat Generator

Solar Panel Mounting Rails

On Demand Steam Generator

Steam Generator For Food

Steam Energy Generator

http://www.ecopanel.com.vn

Solar Aluminum Mounting Rail

Extruded Polyether-Based Tpu Pellets

Five Layer PA Blown Film Machine

Five Layer EVOH Blown Film Machine

Injected Polyether Tpu

Five Layer High Speed Blown Film Machine

Five Layer EVA Blown Film Machine

Tpu For Oil-Seals Injection

Polyester Based Tpu

Recycled Tpu Resin

Five Layer PE Blown Film Machine

Heavy Duty Copper Terminal Crimping Pliers

C Channel Rail

Painted Parts

DuPont Connector Crimping Pliers

Crimping Pliers For Bare Terminals

Welding Parts

Studs

Brass Products

Non Insulated Terminal Crimping Pliers

Anderson Plug Terminal Crimping Pliers

Plain White Poster Board

5 inch lcd

Oak Veneer Window Board

Lined Poster Board

Color Tft display

10.1 inch lcd display

PVC Shower Panels

10.1 inch lcm

White Foam Board

1280×800 display

Multifunctional Cigarette Converter

Auto Inverter 12 220

4 inch tft display module

tft 3.97 inch mipi display 480×800 ips

tft lcd 2.8 inch

Converter 220v Fast Charge

12V To 220V Power Converter

12V To 220V Integrated Machine Power Supply

tft lcd touch modul

tft display 3.5 inch

IPS TFT Module

OEM Small Bath Mat

Kitchen Mat Sets

Custom TFT Display

7.0 Inch RGB TFT LCD

Logo Door Mats Commercial

Outdoor Doormat For Wet Areas

Touch Screen Display

Sunlight Readable TFT Display

Pedestal Mat

[url=https://oprednisone.com/]prednisone 20mg no prescription[/url]

4.3 inch tft lcd display

wqvga tft lcd

Cheap Pcb Prototype

Best Chinese Pcb Manufacturer

Prototype Pcb Assembly

4.3 tft lcd display

lcd touch screen display

Pcb Production And Assembly

480*272 matrix lcd module

Custom Pcb

Electrical Lockout Station

Loto Lockout

custom size capacitive touch screen

4.3 and quot; tft display

Lockout Cable Device

high-quality LCD modules

Electrical Lockout Station

Lockout Tagout Station

lcd displays

4.3 inch touch lcd

[url=https://prednisonekx.online/]generic prednisone 20mg[/url]

7.0 Inch TN TFT 800*480 RGB 40 Pin with RTP

1.44 Inch Square TFT Display 128*128 8bit-MCU ST7735S 20 Pin

Picnic Reusable Lunch Bags For Women

Pencil Bag For School Stationery

Marvel Schoolbag

Kids Primary School Backpack

7.0 Inch TN TFT 800*480 RGB 50 Pin with CTP GT911

Picnic Reusable Lunch Bags For Women

1.54 Inch Square IPS TFT 320*320 SPI ST7796S 24 Pin with CTP

3.95 Inch Square TFT Display 480*480 All Viewing Direction

Laser Fiber Cutting

Laser Plasma Cutting Machine

24 Bit Parallel RGB 4.3 Inch TN TFT Module

Mini Portable Fiber Laser Marking Machine

Protection Cover Fiber Laser Cutting Machine

7.0 Inch USART HMI Touch Screen Display

Free Viewing Angle 4.5 Inch IPS TFT Display

Desktype plasma cnc cutting machine

24 Bit Parallel RGB 4.3 Inch Touch Screen Display

1024*600 Pixels 7.0 Inch IPS TFT Display

3.5 inch tft lcd module

Hawk Bag Color

lcd 3.5 module

3 Pocket Pencil Case

3.5 inch small lcd module

3.5 tft lcd

Hand Made Pencil Case

Pop It Pencil Case

3 Ring Binder Pencil Case

640×480 dot matrix lcd module

semi electric stacker

ABB 07DC92

ABB 07KR51

ABB 07KP90

Wire Rope Puller

Zenith Crane Scale

ABB GJR5251400R0202 07DC91

Zero Gravity Spring Balancer

Tire Changer

ABB 07DC92 GJR5252200R0101

KRF Series Single-phase Voltage Regulator Module

KMS Series Three Phase Motor Reversing Module

KRE Series Three Phase Voltage Regulator Module

Pink Goblets

Teapot Kettle

Bracket Shelf

Gift Card Box

KYR Series Single Phase AC Voltage Regulator Module

KWR Series AC Output Voltage Regulator Module

Bended Straw

[url=http://metforminbi.online/]metformin 200[/url]

Kraft Paper Spiral Notebook

Pp Spiral Notebook

Frp Roof

Fabric Hardcover Notebook

Frp Trench Cover

Silk Cover Notebook

Frp Chemical Storage Tanks

Frp Dustbin

Frp Bathtub

Linen Notebook with Pen Port

Custom Street Signs

Walking Signal Light

2 Way Traffic Sign

Traffic Light Sign

Minavans

Minavan

Pure electric minivans

Pure electric minivan

New energy minivans

Yellow Traffic Light

Vinyl Coated Solid Color Mesh Tarpaulin

Kitchen garbage electric vehicles

Mesh Debris Tarp

Mesh Tarp For Dump Truck Trailers

Special vehicles

Kitchen electric garbage truck

Truck Tarps

Replacement Tarp For Dump Truck Roll Tarp Kit

Kitchen garbage new energy vehicles

Kitchen electric garbage trucks

TN Seven Segment LCD Display

Automatic Hospital Bed

Hospital Equipment

Graphic Monochrome LCD Display

Electric Hospital Bed Mattress

Graphic LCD Display 320×240

Hospital Patient On Bed

HTN Seven Segment LCD Display

Medical Bedding

Monochrome Segment LCD Display

orden.coulot.info

heated hunting vest

car Power Batteries

auto lithium battery

Women's Cropped Hoodie Top – Soft Cotton Sweatshirt Modern Streetwear Customizable Oversize Fit Women Full Zip Hoodie

Flame Retardant Workwear

rain coat men

german soldier uniform

Unisex Streetwear Hoodie: Comfortable Cotton Pullover Solid Color Oversized Fit Y2k Fashion Staple Casual Loungewear

Casual Cotton Hoodie For Women – Customizable Sweatshirt Unisex Streetwear Essential Loungewear

car parts

purple fleece jacket

New energy vehicle batteries

Chic Women's Hoodie And Sweatpants Set – Comfortable Loungewear Trendy Streetwear Cotton Blend

Unisex Cotton Hoodies Casual Oversize Pullover Comfort Streetwear Solid Color Fashion For Women And Men In Multiple Colors

Automotive parts

Sleds

Slim Fit Mens Bodybuilding Muscle Training Workout Curved Hem Round Neck Muscle Fitness Mens Gym T-shirts

Adjustbale Kettlebell And Barbell

48V 5000W-70A MPPT Solar Inverter

Barbell Wall Storage

48V 3000W-70A MPPT Solar Inverter

48V 2000W-70A MPPT Solar Inverter

Anti-Slip Metal Handle Dumbbell

Weight Vest Fitness

48V 6000W-70A MPPT Solar Inverter

Custom Summer Good Quality Custom Oversized Cotton Round Neck Vintage Washed Bleached Women T Shirt

http://www.gaucbc.org

48V 4000W-70A MPPT Solar Inverter

Wholesale Women Dear-lover Western Clothing Lets Go Girls Western Boots Graphic Tee Vintage Cotton T Shirt

Custom China High Quality 95% Cotton 5% Spandex Soft Sports Round Neck Curve Bottom Gym Tee Mens T Shirts

Summer Baby Tee Crop Tops Tee Shirt Sexy Shirt Woman Cotton High Quality T-shirt With Logo Printed

False Ceiling T Grid Channel Roll Forming Machine

Custom Logo Good Quality Multi Color Basic Cotton Breathable Women's T-shirts For Printing Daily Tshirt For Women

Flat Ceiling T24 Grid Roll Forming Making Machinery

Green Yellow Solar Earthing Cable

Customization Women's Organic Cotton T Shirts Designer Multi Color Basic Printing Women's T-shirt

Halogen Free Al Alloy Solar Cable

Ceiling T Grid T Runner T-Bar Roll Forming Machine

Customized Print On Demand T-shirt Custom Printing Blank Slim-fit T Shirt For Women Oem Logo T-shirt

Tinned Alloy Solar Earthing Cable

Wholesale Custom Short Sleeve Plus Size Anime T Shirts Unisex Hip Pop Acid Wash Heavyweight Streetwear T Shirt For Women

Bare Copper Solar Earthing Cable

Solar Panel Extension Cable

Hot Sale Custom Breathable Women's T-shirts Vintage Washed Cotton Blank Dark Green Crop Top T Shirt

Racking Shelf Upright Roll Forming Machine

Cable Tray Bridge Roll Forming Equipment Machine

thanhnhat.vn

Double Bus

automol.by

Disposable Atomizer E Cigarettes

High-quality Cotton Hoodies Assorted Colors Men's Oversized Sweatshirts Streetwear Custom Unisex Essentials Wholesale

Men's Camouflage Print Hoodie High-quality Cotton Anti-shrink Streetwear Essential Custom Unisex Hoodies Oversized Fit

100 Nic Vape

City new energy delivery vehicle

Disposable Electronic Cigarettes

Disposable Pods Nicotine 5000 Puffs

Double-decker buses

Double buses

City new energy delivery vehicles

Bold Red Oversized Hoodie Men's High-quality Cotton Streetwear Sweatshirt Unisex Custom Plain Hoodies 2024 Fashion

Tri-color Hoodie Men's High-quality Cotton Streetwear Sweatshirt Custom Hoodies Unisex Anti-shrink Essentials

Men's Dark Green Hoodie Set High-quality Cotton Anti-shrink Streetwear Custom Unisex Hoodies Oversized Tracksuit

3mg Nicotine

Hardcover Spiral Notebook

Small Windmill

Vertical Axis Wind Mill

Kraft Paper Spiral Notebook

Pp Spiral Notebook

Soft Cover Spiral Notebook

Magnetic Leather Journal

Unisex Hoodies Set In Black And Mint Green Soft Cotton Oversized Streetwear

20kw Wind Turbine

Cropped Hoodie Men With Graphic Design Modern Streetwear Zip-up Sweatshirt

China New Design Women Short Sleeve Dragon Print T-shirt Summer Fashion Crop Top Daily Wear Women Tshirt

Oversized Hoodie With Large Blue Graphic Unisex Streetwear Top

http://www.jacr.info

Vertical Axis Wind Turbine

Wind Fan

Men's Black Hoodie With Dragon Print Oversized Streetwear Sweatshirt

Women's Multicolor Hoodie Collection With Custom Logo Options High-quality Fleece For Branding

Vacuum X Ray Tube

William Coolidge X Ray Tube

alphacam.jp

X-ray shielding Lead glass

Self-driving bus

Factory Direct Supply Wholesale Custom Logo Women's Crop Top T-shirt Crop Tops Tank Top Women's T-shirts

Enterprise Shuttle Bus

Auto driving bus

Sustainable V-neck Tshirts Women Soft Breathable Eco-friendly Fashion Wholesale Packs In Assorted Color Comfort Fit Tees

Acid Washed T Shirt Women Vintage Cotton T-shirts Streetwear Soft Mineral Tees Girl Loose Luxury Brand Tops

Light Bus

Self-driving buses

High-quality Cotton Oversized Hoodies Unisex Solid Color Streetwear Essentials Sweatshirts Clothing Men Wholesale Custom

China X Ray Housing

China Tube Head X Ray Suppliers

Steel Barbell

Stylish Tank Top Women's Sleeveless Shirt High-quality Cotton Blend Comfortable Fit Fashion Essentials Solid Color Streetwear

Cardboard Magnetic Makeup Eyeshadow Palette Box

Vinyl Coated

Rigid Paperboard Magnetic Eyeshadow Palette Box

Men's Vintage Blue Distressed Hoodie Acid Washed Casual Cotton Pullover For Street Style Clothing

Camel Brown Cotton Hoodie Men's Casual Soft-touch Pullover Heavyweight Warm Comfortable Classic Streetwear

Perfume Cylinder Box

Core Home Fitness Dumbbell

Empty Magnetic Eyeshadow Box

Olive Green Full Zip-up Hoodie For Men Premium Cotton-rich Streetwear Comfortable & Tailored Fit Eco-friendly Men's Fashion

http://www.ecopanel.com.vn

10kg 15kg 20kg 30kg 40kg Dumbells

Kettlebell Handle

Empty Magnetic Eyeshadow Palette Box

Navy Blue Men's Zip-up Hoodie Soft Cotton Blend Comfortable Casual Street Style Jacket High-quality Classic Modern Tailored Fit

Men's Contemporary Two-tone Hoodie Full Zip Casual Streetwear Sweatshirt With Hood

OLED Display

Bathroom Tall Taps

Toilet Basin Tap

Mustard Yellow Men's Hoodie Oversized Cotton Sweatshirt High-quality Streetwear Essentials Unisex Custom Plain Hoodies

Tall Basin Faucet

8.0 Inch Custom TFT Display

Stylish Men's Color Block Hoodie Zip-up Design With Contrast Panels Cozy Cotton Fabric For Casual Or Sportswear

Designer Cotton Hoodie For Women Custom Logo Pullover Oversize Streetwear Sweatshirt Available In Elegant Neutral Colors

3.5 Inch Custom TFT Display with Capacitive Touch Panel

10.1 Inch Custom TFT Display

Farmhouse Faucet

Men's Hoodies & Sweatshirts 2024 Collection Customizable Vintage Street Style

Free Standing Bathtub Mixer

Monochrome LCD Module

http://www.mdebby.co.il

[url=https://oprednisone.com/]prednisone otc uk[/url]

Streetwear Tees T Shirt Women Bow Drawstring Short Sleeves Orange Green Fashion Sexy Top Women T-shirt

thin lcd screen

http://www.soonjung.net

small OLED Display

Customizable Logo Color Block Hoodies For Women Soft Fleece Winter Sweatshirt Available In Assorted Colors For Print On Demand

Light Grey Men's Zip-up Hoodie Soft Cotton Blend Casual Streetwear Comfortable Classic Style High-quality Modern Tailored Fit

Cartoon Frog Graphic Pullover Hoodie In Purple And White Women's Fashion Sweatshirt Cozy Casual Streetwear With Animal Print

tft module

Apple Iphone Package

Iphone 8 Box

0.91 inch OLED

Iphone 11 Pro Packing

0.91 inch OLED display

Iphone Xr Packaging Box

Iphone Se Shipping Box

Women's Fleece Crop Hoodie Fashion Streetwear Comfort Cotton Pullover Custom Logo Warm Loungewear Available In Soft

[url=https://prednisoneo.com/]buying predesone on line[/url]

Lift Recliners For Elderly

Good Price High Quality Custom Mens Muscle Slim Fit Organic Cotton Blank Gym T Shirt Mens Workout Fitness Tshirt

New Design High Quality Acid Washed Women Sportswear Irregular Decoration Fashion Short Women Tshirt

Small Recliner Chairs For Elderly

Customization Vintage Washed Band Chic Hot Sexy T Shirts Streetwear Summer Baby Tee Crop Tops Tee Shirt

bigstar.co.jp

Hot Sale Plus Size First Class Quality 100% Cotton Digital Printing Drop-shoulder Tee Shirt For Women

Medical Recliner

New Design High Quality Sexy Casual Acid Wash Retro Embroidery Print Short Navel Women Vintage T Shirt

Rotary Tiller Cultivator Blade Power Tiller

Multi Row Farm Tractor Ridging Machine

Tilting-In-Space Rise Recliner

LED Tri-proof Light

LED Tri-proof Light

Blade Powered Rotary Tiller Cultivator

Quattro Lift Chair

Sunways 25KW Three Phase Hybrid Inverter

Chitosan Agriculture

Best Fish Hydrolysate

Sunways 8KW Single Phase Hybrid Inverter

Npk Raw Amino Acids

Men's Purple Hoodie With Athletic Stripes Comfortable & Durable Streetwear Cotton-rich Urban Style Pullover

Men's Distressed Grey Hoodie Urban Streetwear Casual Comfort Edgy Cotton Pullover Relaxed Athleisure Wear

Men's Custom Logo Blank Hoodies Drop Shoulder Hooded Oversize Pullover Sweatshirt 100% Cotton Heavyweight Hoodie For Men

DEYE 50KW Three Phase Hybrid Inverter

Edgy Distressed Grey Hoodie For Men Soft Cotton Casual Pullover Durable Urban Streetwear Cozy Heavyweight Design

Fertilizer With Trace Minerals

licom.xsrv.jp

Men's Dark Zip-up Hoodie With Front Pockets Casual Street Style Cotton Blend Comfort Fit Versatile Layering Piece

DEYE 10KW Three Phase Hybrid Inverter

Sunways 12KW Three Phase Hybrid Inverter

Citrus Fertilizer With Trace Elements

http://www.fullsho.com

Custom Logo Heavyweight Vintage Streetwear Crewneck 100%cotton Acid Washed Oversized Mens Hoodies

3 Taps Pipeline Water Dispenser

Heavyweight Fabric

Small Pipeline Water Dispenser

Classic Double Gate

Decorative Metal Hook

Men's Grey Hoodie – Heavyweight Cotton Oversized Sweatshirt

In Bulk Sloth Graphic Oversized T-shirt For Men Casual Cotton Short Sleeve Tee High Quality Custom Logo With Men

Custom Layered Construction Men Sweatshirt Cotton Blank Heavy Weight Pullover Acid Wash Oversize Nipped Waists Men Hoodies

ISO 7380 Socket Button Head Screw

Stainless Steel ISO 7380 Socket Button Head Screw

Top Wood Burning Stoves

Diamond Dowel

ISO 7380 Socket Button Screw Grade 10.9 Zinc

Round Needle

Cemented Carbide Dies

Paper Calendars

Classic Women's Polo T-shirt Set In Assorted Colors Custom Logo Golf Tennis Casual Wear Short Sleeve Pullovers.

antheminfotech.com

Paper Bags

Slotted Second Punch

Kraft Bags

Women's White Loungewear Set High Quality Cotton Comfortable Oversized Hoodie With Wide-leg Joggers Casual Streetwear

Women's Green Sweatshirt And Shorts Set Casual Cotton Loungewear Oversized Summer Athleisure Comfortable Soft Set

Gift Bags

Luxury Bags

Bugle Screws Header Punch

Women's Fashion Hoodie With Rhinestone Embossed Text Design Streetwear Loungewear

Self Screw Header Punch

Bathroom Shower Faucet Set

Women's Striped Casual Hoodie Comfortable Winter Fleece Top Fashionable Multicolor Streetwear Outerwear With Skirt

3inch Waterproof General Cloth Duct Tape

Rubber Impact Panels

Women's Golf Tennis Polo Shirt Custom Logo Available In Soft Pink Breathable Fabric Short Sleeve Top.

Women's Pink Casual Pullover Hoodie Oversized Sweatshirt Fleece Winter Clothes High Quality Fashion Loungewear

Rubber Embedded Ceramic Wear Tile Panels

High Quality Custom Logo Design Classic Men's Polo Shirt Durable Knit Construction Comfortable & Breathable

3inch Waterproof Furniture Cloth Duct Tape

Aggression Rubber Liner

provino.com.kz

Heavy duty Furniture Cloth Duct Tape

Men's Cotton Polo Shirt Collection Variety Of Solid Colors Soft And Breathable Fabric Ideal For Golf High Quality Polos For Men

Multicolor Furniture Cloth Duct Tape

White Furniture Cloth Duct Tape

Ceramic Wear Plates

Men's Modern Basic Grey Oversized T-shirt Lightweight Cotton Comfortable Wear Easy Fit

Mill Liners

Big Size Lamination Machine

Women's Designer Red Hoodie With Stylish Typography Premium Fleece For Cool Weather Comfort

sportedzoitanfolyam.hu

Stylish Tshirt Women Short Sleeve Slim Fit Cotton Streetwear Tee For Women Tshirt Women Fashion Bulk Wholesale Options Available

Black Kraft Bags With Handles

High Speed Sheet to Sheet Litho Laminator

Women's Hoodie Casual Top Pullover High-quality Fleece Streetwear Embossed Satisfy Desires Text Warm Fashion Sweatshirt

Tft Lcd Display Module

Shopping Bag Craft

SHANHE MACHINE printing and packaging

High-quality Neutral Toned Oversized T-shirts For Women With Logo Detail Comfort Fit Cotton Streetwear Style Soft

Corrugation Board Laminating Machine

Printed Brown Paper Bags With Handles

Die Cutting Machine

Eco Friendly Kraft Bags

Trendy Assorted Cropped Cotton T-shirts For Women Soft Comfortable Fit High-quality Material Streetwear Style

[url=https://oprednisone.com/]where to get prednisone[/url]

[url=http://predniso.online/]can you buy prednisone over the counter in canada[/url]

Outdoor Garden Balcony Privacy Screen

copeland digital compressor

HDPE Triangle Sun Protection UV Shade Sail for Balcony

Tecumseh Refrigerator Compressor

Tecumseh Equivalent Compressor

Privacy Fence Screen Heavy Duty Windscreen Fencing Mesh

Wholesale New Brand Custom Customizable Red Polo Shirt For Women Ideal For Logos Personalized Fittings Durable

Custom Short Sleeve Women Polo Shirt Sports Logo Grey Polo T-shirt Comfortable Fit For Active Women Sporty Design With Logo

Trendy Striped Zippered Boys Hoodie With Layered Collar For Street Fashion Trendy Boys' Striped Zip Hoodie Urban Kids

Dc Inverter Compressor Voltage

Balcony Privacy Screen Cover Balcony Shield Screens Net

HDPE Garden Windscreen Netting Privacy Screen Net

http://www.transhol.pl

Emerson Copeland Compressor

Rustic Orange Boys' Hoodie With Plaid Hem Detail For Autumn Adventures Holiday Reindeer Boys

Custom Logo Women Ladies Polo T Shirts Classic Blue Soft Cotton Polo T-shirt For Women Everyday Comfort

Artistic Illustration Graphic T-shirt In Black – Contemporary Urban Style

Black Self-Fusing Rubber Tape

Vitamin C Cas No. 50-81-7

Cable Box

http://www.soonjung.net

Abs Plastic Junction Box

Men's Black Cotton Tee With Multicolor Letter Print Regular Fit Casual Shirt

Men's Camouflage T-shirt Outdoor Casual Cotton Blend Short-sleeve Military Top

Waterproof Self-Fusing Rubber Tape

Lv Withdrawal Switchgears

Distribution Switch Box

Light Blue Men's Jersey Style T-shirt With '10' Print Casual Sporty Tee

Electrical Connector Terminal

L-Ascorbic Acid Cas No. 50-81-7

Classic Solid Green T-shirt For Men Soft Cotton Crewneck Casual Everyday Wear

Waterproof Self-fusing Silicone Tape

[url=http://bestmetformin.online/]metformin 25 mg[/url]

Black Oversized Zip-up Hoodie For Men Premium Cotton Soft-touch Comfort Street Style Casualwear Modern Tailored Fit

Hydroelectric Power

t-formafitness.hu

Display Boxes

High Back Executive Chair

Box Dividers

Men's Fashion Hoodie In Muted Taupe Premium Cotton Streetwear Oversized With Kangaroo Pocket Casual Essentials

Cardboard Tubes

Streetwear Tees T Shirt Women Bow Drawstring Short Sleeves Orange Green Fashion Sexy Top Women T-shirt

Container House Roofing Design

Packaging Sleeves

Wholesale 2023 Streetwear Tees T Shirt Women Bow Drawstring Short Sleeves Fashion Sexy Top T-shirt

PCE

China Wholesale Extra Long Loose Oversized T Shirts Soft 100% Cotton Multi Color Printed Letter Women Tshirt

Desk With Hutch

Packaging Stickers

Empty Copy Paper Boxes

Plastic Couplings DN15 to DN50

Compact Wheel Loader

Solid Coffee Brown Cropped Women's T-shirt Casual Street Style Cotton Top

Small Paper Box

Brass Couplings DN15 to DN50

Tractor

Printing Paper Box

Paper Bag Goodies

http://www.ssummit.vozin.st

Best Design Female T-shirt Wholesale T Shirt For Women Casual 100% Cotton Blank T-shirt Women

Classic Red V-neck Short Sleeve Top For Women Casual Cotton Comfort Fit

Soft Pink Tie-dye Crop Top Trendy Cotton Summer Tee For Women

Soft Cotton V-neck T-shirt With Pocket Detail For Everyday Women's Fashion

Wheel Loader

Hand Tissue Paper Box

Carbide Saw Blades

Light Blue Women's Long Sleeve Polo Shirt Cotton Soft Classic Fit Elegant Design Customized Sports Long Sleeve Polo

Aluminum Sheet Stamping

CNC Turning Parts

Stainless Steel Stamping

Custom Oem & Odm Classic Black Knit Sweater For Kids Elegant Casual Wear Cozy Warm Top

http://www.st.rokko.ed.jp

Zinc Galvanized Concrete Coated Nails

Custom Oem & Odm Navy Blue Children's Polar Fleece Sweatshirt Warm Kids' Winter Apparel

15° Plastic Collated Decking Coil Nails

Ring Shank Finish Nails

Metal Stamping Part

Plastic Collated Strip Framing Nails

Minimalist Black Hoodie With Cap Embroidery For Boys' Casual Streetwear Minimalist Boys' Black Hoodie Casual Cap

Sophisticated Off-white Long Sleeve Women's Polo Shirt Comfortable Cotton Blend Versatile Work To Weekend Wear

CNC Machining

medical mattress fabrics

Custom Women Cropped Winter Hoodies Clothes Jumper Breathable Oversized Streetwear Jacket Coat Hoodies

Ibelink

http://www.setsatian.ac.th

PVC Waterproof Medical Mattress

swimming pool fabrics

Antminer S19j Pro

S19 Pro Hashboard

Custom Plain Heavyweight Blank Hoodies Unisex Oversized Hoodie Print Sweatshirt Women Printing Hoodie

Sporty Purple Grid-patterned Polo Shirt With Logo Athletic Fit Moisture-wicking Fabric Sporty Purple Polo Shirt

Antminer

Laminated Frontlit Banner

Jasminer

Blockout Flex Banner

Customized High Quality Unique Design Hoodies Oversized Cut Crop Top Urban Sustainable Hoodie For Woman

Interesting Printed 2023 New O-neck Long Sleeve Women's Autumn And Winter Fashion Women's Clothing Y2k Casual Hoodie

Ladies T Shirt Clothing Women Polo T-shirts High Quality Rich Maroon Women's Polo Shirt Timeless Desig Versatile Wardrobe Staple

Solar Garden Waterproof Spike Light

Fiberglass Mesh Clothing

Solar Road Stud Light

Chopped Strand Mat

Solar Path Light

High Quality Polo Shirt Summer Slim Short Sleeve Classic Fit White Women's Polo Shirt With Vibrant Orange Trim & Sleeve Detail

Sporty Grey Hoodie For Active Boys With Bold California Print Top Durable Everyday Wear Stylish Streetwise Pullover

Women Clothes White Ladies Sport T-shirts Custom Polo Golf Shirts Chic White Polo T-shirt For Women Sleek Black Accents Sporty

Custom Logo Oem & Odm Kids Sleeveless Hoodie Black Cotton Vest For All-season Layering

Solar Pathway Lights With Edison Bulb

Fiberglass Cloth Roll And Resin

Original Classic Pop Solar Spotlight

fujispo.xsrv.jp

Fiberglass Woven Fabric

Carbon Plain Weave

Sport Gloves

Minimalist Black Hoodie With Cap Embroidery For Boys' Casual Streetwear Minimalist Boys' Black Hoodie Casual Cap

Light Blue Women's Long Sleeve Polo Shirt Cotton Soft Classic Fit Elegant Design Customized Sports Long Sleeve Polo

What is an Artificial Lawn Cutter

The introduction of actuator

Sophisticated Off-white Long Sleeve Women's Polo Shirt Comfortable Cotton Blend Versatile Work To Weekend Wear

Custom Oem & Odm Classic Black Knit Sweater For Kids Elegant Casual Wear Cozy Warm Top

Introduction to brake system

What are the types of new energy batteries

Usb C To Hdmi Cable

Custom Oem & Odm Navy Blue Children's Polar Fleece Sweatshirt Warm Kids' Winter Apparel

Earc Hdmi Cable

Audio Optical Cable

Usb C To Hdmi Cable

retrolike.net

d1544 rear brake pad

Titanium Forged

BIMINI Fitting

Casting

Marine Hardware

Bright Blue Toddler Hoodie And Sweatpants Set With Adjustable Drawstrings For Playful Comfort

Forging Bus Crank

Multi-color Block Hoodies With Logo Space – Durable Unisex Pullover For Custom Design Custom Design Ready Durable Fabric

Refrigeration Parts

Pipe Stanchion

Engine Parts

Children's Maroon Hoodie Black Pants Set – Soft Fabric Casual Outfit For Girls

Youth Color Block Pullover Hoodie And Sweatpants – Sporty Casual Wear For Kids

Cream Ribbed Two-piece Set For Toddlers With Cozy Texture For All-day Comfort

Chain Stopper

Hinge

gpsmarker.ru

Boys Earth Tone Color Block Tee Stylish Daily Wear Shirt With Trendy Print Soft Cotton Top

Monodicalcium Phosphate

Taurine Ethyl Ester HCL

edzokepzo.hu

Organic Goji powder

Vibrant White Short Sleeve Cotton T-shirt With A Comfortable Fit For Girls Soft And Comfortable

Girls' Blue Sequin Cropped T-shirt – Sparkly Party Wear Tee

Girls' Vibrant Pink Unicorn Graphic T-shirt – Colorful Magical Casual Tee

Hydrogenated tallow amine

Coffee Paper Cups

Telescoping Flag Pole

L-Glutamic acid monosodium salt hydrate

Guide Flagpole Kit

Paper Cups

Boys Striped Sleeve Polo T-shirts In Navy And Grey – Trendy Sporty Look

Paper Bucket

110 To 240 Converter

Chic Blue Hoodie For Women Casual Streetwear Pullover With Minimalist Text Soft Cotton Loungewear Comfortable

Bright Turquoise Polo T-shirt For Women Custom Logo Pullover Design Soft Fabric Golf Tennis Yoga Clothing Comfort Wear.

Women's Mint Green Printed Pullover Hoodie Casual Oversized Sweatshirt High Quality Fleece Fashion Streetwear 2024

Isolation Transformer 120v

Pad Mounted Transformer

Outdoor Telescoping Flagpole

Telescopic Flag Pole for Tour Guides

Telescopic Guide Flagpole Camping

Multipurpose Flag Pole

Golden Head Camping Pole

Women's Casual Tracksuits For 2024 Zip-up Hoodie And Track Pants Set Slim Fit Sweat Suits With Custom Embroidery

1000kva 1250kva Compact Power Substation

thinkplus.tv

Navy Blue Hoodie For Women Oversized Streetwear With Bold Back Lettering Casual Pullover For Loungewear With A Message

45 Kva Transformer

Awning Window

Artificial Wedding Flowers

Silk Bougainvillea

Green Nylon Cricket Practice Nets

cricket practice nets Made For Sports Enthusiasts

Cricket Practice Football Sports Ground Net

China Factory Streetwear Summer Men Fashion Cotton T-shirt Casual New Fashion Multi Color Men T Shirt

New Style High Quality Soft Cotton Oversize Custom Monogram And Printed T Shirts For Men Slim Fit With Collar

Knitted Mono Anti-Bird Netting Black

keyservice.by