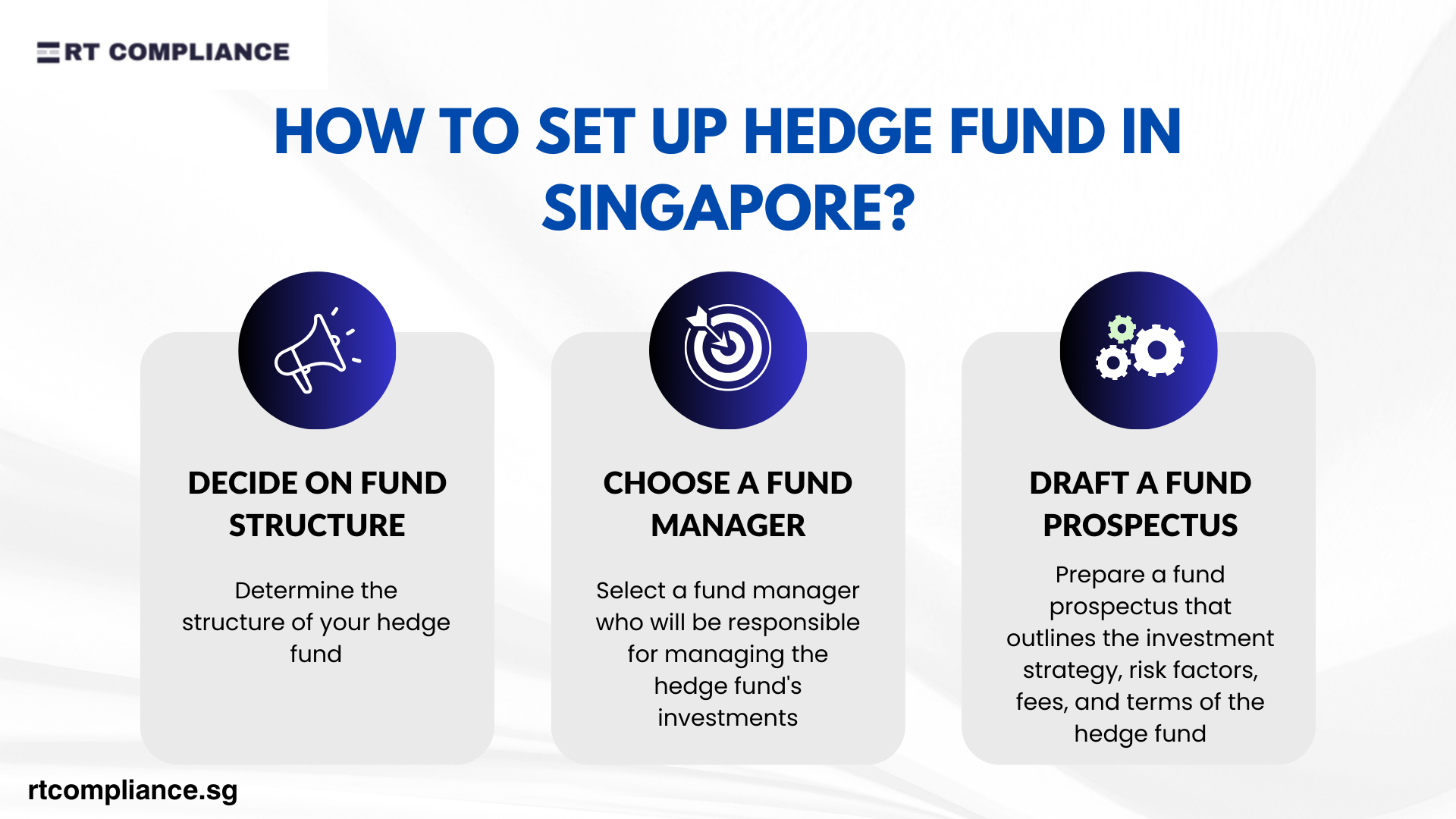

How to set up Hedge Fund in Singapore?

One outstanding thing about Singapore is how well it balances both the locals and the foreigners interested in doing business in the country. The investment framework favors both parties making it easy to set up fund in Singapore. However, just like any other state, there are guidelines. You don’t want to go against them lest you face the music or miss an opportunity. That’s probably why you want to find out how to set fund in Singapore within their rules.

It is as simple as setting it up according to the country’s investment regulations. The governing body is the Monetary Authority of Singapore (MAS). It regulates and approves rules and licenses. The body is guided by the country’s Code on Collective Investments Schemes. It is an outline of the characteristics that every hedge fund should have. Let’s take a look at the rules and regulations and much more.

What is a Hedge Fund and How to Set Up One in Singapore?

Under the regulation of the Monetary Authority of Singapore (MAS), hedge funds in Singapore are defined under the Securities and Futures Act 2001 and the Singapore Code on Collective Investment Schemes. A hedge fund in Singapore typically uses advanced investment strategies across cash, fixed income, or equity markets. Understanding what a hedge fund is forms the basis for anyone looking to set up a hedge fund in Singapore.

It is the responsibility of MAS to determine whether the fund complies with the regulations. To do so, it uses such factors

- Derivatives, arbitrage, short-selling and leverage-based strategies

- Non-mainstream assets investment. These classes include all the other investments except listed bonds, equities and cash.

Types of Hedge Funds in Singapore: Domestic vs Foreign Structures

The main classifying factor of hedge funds is domicile. Going by that, there are to types of hedge funds namely domestic funds and foreign funds. Their other names are onshore funds and offshore funds.

- Domestic/onshore funds: Domestic or onshore hedge funds are established in Singapore and are regulated by the Hedge Fund Guidelines under the Code on Collective Investment Schemes. They can be structured as a company, trust, or limited partnership and fall under the purview of MAS hedge fund regulations.. Their markets are usually domestic investors.

- Foreign/offshore funds: As for these funds, their establishments are outside Singapore. Their market can be domestic investors but only under certain circumstances.

Key Laws and Regulatory Requirements to Set Up a Hedge Fund in Singapore

- Securities and Futures Act, Chapter 289: It guides anyone planning to set up fund in Singapore on the various types. It also goes ahead to define the types and the characteristics they need to possess.

- Securities and Futures (Offers of Investments) Regulations 2005

- Financial Advisers Act, Chapter 110

- Financial Advisers Regulations

- Collective Investment Schemes Code

- Third Schedule of the Securities and Futures (Offers of Investments) Regulations 2005: It is important to note that it is mandatory that each hedge fund have a prospectus. Equally important, the prospectus of that fund has to comply with this regulation.

Final Thoughts on Setting Up a Hedge Fund in Singapore

Therefore, if you intend to set up fund in Singapore, there is a number of things to keep in mind. First of all, it needs to have the characteristics as defined by the Singapore Code on Collective Investment Schemes. There are two types of funds to consider. Last but not least, the main laws and regulations are also at your disposal.