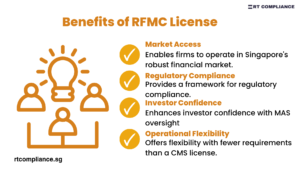

Singapore has emerged as an best and safest financial hub due to its robust administrative framework, government support, and business-friendly ecosystem. Fund and Asset managements is a lucrative sector for fund managers looking to establish a presence in Singapore. According to the regulatory framework, FMCs can be divided into Registered Fund Management Companies (RFMCs) and Capital Market Services Licenses (CMSLs). RFMC is subject to fewer compliance requirements and oversight. CMSL, on the other hand, is considered a full license and has strict requirements granted to applicants.

Important requirements of RFMC

To qualify as an RMFC, an RMC’s assets under management (AUM) must be no more than S$250 million and must cater to no more than 30 accredited investors. Once the MAS approves the license, the FMC can begin operations.

The minimum proficiency requirements for RFMC registration are:

- FMC needs at least he has two directors.

- Director must have at least five years of relevant experience.

- Of the directors, at least one of the executive officers employed full-time for the company’s day-to-day operations must be a resident of Singapore.

- The RFMC Chief Executive Officer (CEO) must have at least five years of relevant experience.

- FMCs must have at least two relevant professionals, directors, CEO, and representatives.

- His FMC professional involved must have at least five years of relevant experience.

- At least two of the FMC’s representatives must be residents of Singapore.

With the relaxation of MAS compliance requirements, fund management has become one of the regulated activities in Singapore, and there are many fund management companies (FMCs) in the country.

Processing Time Required

MAS expects the review and processing of an application to take no more than four months, provided the business model is simple, the applicant fully meets the relevant eligibility criteria, and the application is complete and precise. MAS will need more time to review your application for more complex cases or where information is determined to be incomplete or inaccurate.

Physical office

An RFMC or A/I LFMC must operate from a physical office in Singapore. Suppose a company wishes to use a service bureau in its early stages. In that case, the bureau must be separate from the offices of other users of the service bureau, and RFMC or A/I LFMC information and documents must be stored securely.

Crisis management

RFMCs and A/I LFMCs also require detailed compliance, risk management, and KYC manuals to correctly document all policies and procedures. These documents should be customized based on the risks associated with each FMC’s business and operations, specific trading strategies, etc.

Audit functions, custodian banks, and administrators

RFMC or A/I LFMC must appoint an external auditor with sufficient experience auditing FMCs. An internal audit function will also be implemented to ensure appropriate controls are in place. Managers and managers appointed by FMC must be reputable entities.

Professional Liability Insurance

RFMCs or A/I LFMCs don’t need professional liability insurance, but many do so because of good practice and investor convenience. Any professional liability insurance arrangement, or lack thereof, must be disclosed to investors.

| compliance singapore | rfmc | cms license |

| rfmc license | vcfm | exempt financial advisor |

| vcc bizfile | lfmc | registered fund management company |

| Risk Management | Capital Market Service License | Asset Management Singapore |

RFMC IN SINGAPORE

aehebcpscm

ehebcpscm http://www.g2t4m6z8hyxj947813qz4m0w91cwl55es.org/

[url=http://www.g2t4m6z8hyxj947813qz4m0w91cwl55es.org/]uehebcpscm[/url]

The working principle Anti Drone System

Teflon Seal

東京ブランドコピー

Self Aligning Roller

50D White Hot Melt Nylon Yarn

ゼニス時計スーパーコピー

Lamp Harp 6

スーパーコピーシャネル時計

UK Version EmeTerm Fashion Anti nausea Wristband

マツダブランドコピー

Plastic Pump

Perfume Packaging Box

スーパーコピー時計オーデマピゲクレジットカード決済

Fire Pump Package

Standard Shopping Trolleys

iphone5sケースブランドコピー

Trimless Linear Light

N5231B PNA-L Network Analyzers

Eva Squeegee

How the solar power system works

ブランドコピーおすすめサイト

ルイヴィトン靴コピーの超人気激安スーパーコピー靴専門店

Thermostatic Kettle

Flexible Graphite Sheet

TU-768 PCB

上海スーパーコピー時計

Gold Shower Trap

Xpon Onu Huawei

ブランドコピー時計ルイヴィトンブランドコピー

Double Layer Shopping Basket Trolley

Stand Up Pouch Packaging

Plates for Cars Phone Number

スーパーコピー時計ガラス

Health/Wellness&Fitness

High Protein Low Fat Duck Strips Natural Dog Treat

財布コピーブランド

Pneumatic Torque Gun

Cup Holder Ashtray with Lid

ブランドコピーqmd

B170P1E+Z Galvalume Coil

ブランドコピー店舗大阪

Foldable Bed Frame King

glass bottle with cork

スーパーコピーロレックスロレックスコピー腕時計老舗

HC260YD+Z Galvalume Coil

White Mosaic Tile

ブランドサングラスコピースーパーコピーブランド

Students Large Leather Notebook

ブランドコピーリング

3D Puzzle Animal In Bulk Factory

Top Load Capacity Fully Automatic Laundry Machine

Capacitive Water Level Sensor

PS Blister Packaging Sheet Extrusion Machine

韓国ブランドコピー旅行

Hippo Crinkling Plush Dog Toy

100kvar 690v Static Var Generator Price

スーパーコピー届くヴェルサーチ財布スーパーコピー

Led Planted Aquarium Light

Rubber Dog Chew Toy for Aggressive Chewers

ブランド時計コピー大好評ブランド時計コピー届く

amazonブランドコピー

Vintage A5 Leather Notebook

Automatic Alluminum Pool Covers

Portable Infrared Gas Stove

カルティエ時計カリブルスーパーコピー

Passat Fuel Pump 1999-2005

Taigo Fuel Pum 2022-2023

Water Meter Installation

スーパーコピーブランド通販

Battery Powered Hydraulic Tools

モンクレールメンズジャケット韓国スーパーコピー

TRUMPCHI

Drill Bit Metal Hss

スーパーコピーブランドモンクレール

Application Scenarios of Interactive Whiteboard

Pump Supports

ブランドスーパーコピー通販楽天

R&S FPL1026 Spectrum Analyzer

Disposable Blue Nitrile Glove

ブルガリ時計スーパーコピー

Juicer Knife Holder

Duplex Hex Nut Flange Nut

Microcentrifuge

ロレックススーパーコピー代引き

Octavia Fuel Pump 2014-2017

Cnc Boring Mill

ブランドコピーbrand-menu

クロエスーパーコピー韓国場所スーパーコピーランキング

Handheld Drone Detector 2.4G 5.2G 5.8G

Layer 3 Managed POE Switch

スーパーコピー時計販売

Trawling Dee Shackle with Round Pin

X Series Casing with Coupling

スーパーコピーブランド激安n級通販専門店topkopi.net

Carbon Steel Hex Bented U-bolt HDG

Pet Pad

iphonex手帳型ケースブランドコピー

Glass olive oil bottle

Fastener Stainless Steel 304 316 T Bolt Square Head T Bolt

Cashmere Sweater With Sequin

Mattress Moving

ブランドコピー洋服

Cute Pattern Diaper

トートバッグブランドコピー

Self Tapping Screw

エルメスコピーバーキンエルメススーパーコピー財布通販

Butyl Tin Stabilizer

Classification of steering pump

Superb Fuel Pump 2008-2015

Golf/Variant/4Motion Fuel Pump 2009-2014

Rouge Mocap Motion Capture Studio

Smart Motion Gloves

Andy Serkis Mocap

Yeti Fuel Pump 2010-2013

grain-seeder.ru

99 Alcohol

Ethylene Glycol Monobutyl

Nuts

99.9 Alcohol

saidii.co.kr

Special Forged Parts

Plastic and Rubber Parts

Compact Hydraulic Crimping Tool

Black Candle Jars

Custom Chocolate Bar Boxes

cebg.guarico.gob.ve

I Love You Flower Box

Split Hydraulic Crimping Tool

Heavy Duty Hydraulic Cable Cutting Tool

Camping Fan with LED Lantern

Pcb Layout Printing

Bicycle parts maintenance tips

Frame Conveyor Oven

kotki.eu

Digital Hot Air Oven

15kw Frequenc Inverter

PCB Assembly

Confined Space Blower

PCBA

Mobile Crusher

v3.sd5dhd.com

Centrifugal Inline Duct Fan

Communication PCBA

Squeaky Chew Ball Dog Toys

Engaging Rubber Chew Toy

Exterior Wall Lights

pgusa.tmweb.ru

Emergency power supply

Outdoor Pergola Lights

Beef-flavored Chew Toy

Push Gate Snap Hook Clasp

http://www.deshengst.cnv.vn

Reflective Double Dog Leash

PE Warning Tape

PVC Warning Tape

Self-fusing Tape

Bulk Satin Ribbon

Towing Wire Mesh Grip

Conduit Rod

thaibeer.com

H220BD+Z Galvalume Coil

BUSDE+ZN Galvalume Coil

DX52D+ZF Galvalume Coil

Pulling Rod

Different Inch Double Sided PVC Tape

Telescopic Boom Lift

Wrecker

Sany Parts

Wide Double Sided Opp Tape

tinosolar.be

Wide Double Sided PVC Tape

Biodegradable Poly Mailer

http://www.firesafety.ro

Compostable Envelope Bag

Steel plate curtain wall

Stick Built Curtain Wall

Holographic Padded Envelopes

Alucobond

Marble Effect Wallpaper

3D Marble Wallpaper

Knitted Gloves With Fingers

school33.beluo.ru

Marble Wallpaper for Home

Nice Bucket Hats

Warmest Liner Gloves

Hex Flange Head Yellow Zinc Plated Cement Concrete Screw Bolt

Zinc Plated Carbon Steel Concrete Screw Bolt with Flange Head

Hex Head Galvanized Zinc Plated Concrete Screw Anchor Bolt

Vacuum Sealer

Biodegradable&Compostable Dog Poop Bags

odnowica.milaparila.pl

HDPE Shopping Bags With Logo

Buy Silicone Wristbands

Adjuatable Bracket Tin Roof PV Mounting Structure Aluminum Solar Panel Mount Clamp

Badge Dog

Solar Panel Mounting Mid Aluminum Clamp with Hex Socket Head Cap Screw

Stand Seam PV/ Solar Roof/ Solar Panel/ Solar Module Bracket Aluminium Clamps with M8 Screw

http://www.licom.co.jp

Other Key Chains

Oval Container Boxes For Snacks Storage Dishwasher Safe

High Quality Brotdose Edelstahl,

unibjjaluno.tempsite.ws

M3 M20 Stainless Steel SS304 SS316 DIN 929 Hex Weld Nuts

Stainless Steel Din 929 Hex Projection Weld Nut M6 M20

Bento Lunch Box Stainless Steel

Size M6 DIN929 Stainless Steel Hexagon Weld Nut

http://www.biosweet.eco

Furniture Design

Furniture Style

Folding Flat L Shaped Stainless Steel 304 Support Microwave Shelf Angle Corner Bracket for Glass

Large L Shaped Stainless Steel 304 316 Brackets for Mounting

Corner Brace Stainless Steel SS304 Stamping L Shaped Heavy Duty Angle Brackets

Decoration Show

Carbon Steel Self Drilling Hanger Bolt for Solar Metal Double Head Roof Mounting

Stainless Steel 304 410 Dowel Screw Thread Solar Panel Hanger Bolt for Metal

SUS304 SUS 410 Stainless Steel Double Threaded Hanger Bolts for Self Drilling

5 Parameter Monitor

Central Monitoring System In Hospitals

Remote Monitoring Healthcare

http://www.robutex.pl

ASTM A194 Grade 2H Teflon PTFE Blue Hex Heavy Nut

Deluxe Stirring Popcorn Maker

http://www.idearico.com

Grade 8 Zinc Plated Carbon Steel Hex Nut DIN 934

Teflon PTFE Coated Xylan 1070 Green DIN934 Stainless Steel Hex Nut

Egg Cooker For Hard Boiled Eggs

Rapid Egg Cooker

Anti Crime Fence

3d Wire Mesh Fence

SS 304 316 DIN7504N Cross Recessed Countersunk Head Self Drilling Screw

A2-70 A4-80 Stainless Steel 304 316 A2 A4 Countersunk Square Head Self Drilling Screws

clearwaterrv.net

Stainless Steel 304 DIN7504p Flat Countersunk Head Bugle Head Self Drilling Screw

Perforated Panel Screen

Stainless Steel Wooded Thread Double End Hanger Bolt

Solar Mounting Threaded M8 M12 M10 Double End Screws Wood Thread Hanger Bolt

Used Xcmg Crawler Excavator

SS304 SS316 Self Tapping Double End Threaded Hanger Bolt for Solar Bracket

inovstart.pt

Liugong Used Road Loader

Used Boom Pump Putzmeister

http://www.medworld.cz

Nutrition Bar Energy

What are the advantages of using Acrylic Aquarium Tank

Product Features of the Paper Straw Machine

Jokaroom Casino App

Pop Slots Mod Apk

Cashman App Download

M14 Stainless Steel SS304 SS316 DIN976 Thread Rod

Aluminum Welding Rods

Aluminum Electrodes

Aluminum Filler Rod

http://www.t-formafitness.hu

M6 M18 Stainless Steel SS304 SS316L A4-80 A2-70 Thread Bar DIN975 DIN976

304 316 Stainless Steel DIN 975 DIN976 Stud Bolts Thread Rod

Golf Fuel Pump 2018-2021

Santana Fuel Pump 2012-2024

backoff.bidyaan.com

Angle Body Piston Valve

Vento Fuel Pump 2019-2024

Small Electric Piston Actuator

Valve Ball

http://www.vajehrooz.ir

Gold Pendant Light

What is petroleum resins used for

What to do with air sickness bag

Brass Table Lamp

Branch Chandelier

Chipboard Screw Zinc Plated

Carbon Steel SUS304 Roof Solar Panel Installation Solar Hanger Bolts with Nut

Waterproof Relays

SUS304 Carbon Steel /Stainless Steel Double Threaded Wood Screws Hanger Bolts for Solar Panel System

http://www.raskroy.ru

Stainless Steel 304 430 Solar Hook Hanger Bolt with Hex Flange Nut And EPDM Washer

Automotive Fuse Types

Car Fuses Sizes

Single Handle Diode Laser High Speed Hair Removal Lasers

Stainless Steel Food Containers

High Strength Pe Ud Fabric

Stainless Steel Wine Tumbler

Soft Polyethylene Ud Fabric

sunflavour.co.jp

Lightweight Ballistic Fabric

Megtron4 High speed PCB

Fully Automatic Fish Type Face Mask Making

Inside Ear Loop Face Mask Making Machine

NELCO High Frequency PCB

ISOLA FR408HR PCB

Automatic Non Woven Fabric Face Mask Making

id98786332.myjino.ru

http://www.borisevo.ru

Beautiful Promise Ring Setting

Piegatrice Per Piastre In Acciaio Inox

Main raw materials and characteristics of Lace Fabric

Mini High Pressure Washer

“Utensili da cucina in acciaio inox”

Varie dimensioni

What are the specifications of wood screws

“piatti” (dishes)

oem eq1094 r w brake pads for dongfeng

Strumentazione per alimentazione di animali domestici

Charactristics of Automotive Rubber Parts

skarbek.fr.pl

“Forno rotativo automatico”

Hex Flange Head 304+410 Mechanical Zinc Plating Self Tapping Threads Bi-Metal Screws for Metal Teck

Liquid Fertilizer Factory

kinnikubaka.xsrv.jp

Stainless Steel Hex Flange Head Bi-Metal Self Drilling Screw for Solar Photovoltaic

China Magnesium Sulfate Manufacturers

Pesticide Insecticide Abamectin

Hot Rust Treasure Mechanical Zinc Plating Hex Flange Head Bi-metal Screw for Solar Bracket

DIN 934 Class8 Hex Nuts

Flying Fiber Laser

http://www.mbautospa.pl

DIN 934 Hex Nut Class 8 with HDG M30

Yellow Zinc Plated Hex Head Bolt Nut

Co2 Laser Engraving And Cutting Machine

Laser Fiber Marking Machine 50w

Ice Climber Boots

Avatrombopag maleate

Strap On Cleats

Should the car condenser leak be repaired or replaced

Traction Spikes

odnowica.milaparila.pl

Classification of bicycle derailleurs

Celda Solar Fotovoltaica

Some Maintenance Tips of Excavator Hydraulic Pump

yhxbcp000400 Front Brake Pad

Sistema de energía solar de

Half-Cut Mono Panel Solar

What is the Auto PCB Relay

http://www.licom.co.jp

Muffler Pipe

Passat Fuel Pump 2016-2024

Catalytic Exhaust

kmu.ac.th

Car Ceramic

Phaeton Fuel Pump 2002-2016

Phaeton Fuel Pump 2009-2010

Multimedia Filter

Aggressive Chewers Rope Toys

Whole House Water Filter

Extra Large Dog Rope Toy

orden.coulot.info

Chlorine Water Filter

Toughest Dog Rope Toy

Pizza Production

Automated Pizza Making Kitchen

EM-888K high-speed PCB

Large size High speed Backplane

Buried resistor PCB

Industrial Pizza Line

pclgame.online

Unbonded Post Tension Anchor

The Advantage of Metal Wine Box

What are the precautions before running the Coil Slitting Machine

Pool Skimmer Pole And Net

Telescopic Fiberglass Pole

eibiz.co.th

8mm Fibreglass Rod

R&S FPL1026 Spectrum Analyzer

R&S FPL1007 Spectrum Analyzer

House Battery Storage

Solar Pv And Battery Storage

Home Energy Storage Systems

R&S FPL1014 Spectrum Analyzer

company.fujispo.com

Hydrogen Energy Stack Cover

Trimless Spot Lights

Suspension Spot Lights

http://www.partenariat-francais-eau.fr

CNC Aluminum Parts New Energy Power Electronic Controller Housing

Custom CNC Aluminum Cover

Phase Dimming Spot Lights

How to Apply a Electric Mobility Scooter

Standoff Screws

nextplanner.jp

Microcomputer Control Steam Autoclave

Stainless Steel Anchors

T Slot Screw

200mm Screws

ontocon.sdf-eu.org

Carbon Steel Channel Nut with Taper Spring Zinc Plated Yellow

Carbon Steel Square Nut Coil Thread

Ge Terminal Block

Carbon Steel Channel Nut HDG with Zinc Plated Spring

Terminal Blocks Din Rail

Feed Through Terminal Block

Manual Curtain Eyelet Punch Machine

Curtain Grommet Machine

Square Nut

Channel Nut

Hex Nut

kopus.org

Eyelet Machine For Canvas

Welding Robot Machine

Stainless Steel 304 Hanger Bolt with Self Tapping Hanger Bolt For Wood

Solar Mounting Solar Panel Hanger Bolt

thinkplus.tv

Gantry Type Numerical Control Plasma Flame Cutting Machine

Open Fiber Laser Cutting Machine

Stainless Steel Stud Dowel Screw Europe Solar Mounting Hanger Bolt

Pt Plastic Injection

Injection Mold Making

High Power 100W 2G 3G 4G 5G GPS WIFI Phone Signal Jammer Module

Plastic Injection Mold Making

http://www.fhbr.web1106.kinghost.net

30W Phone Signal Jammer Module

12 Channel Desktop Wall Mount Phone Signal Jammer

Agricultural Fertilizer Packing Machine

Bag Palletizer

Advantages of paper bags in packaging bags

Chemical Fertilizers Granularity Machinery

What are the characteristics of corrugated boxes

http://www.lovehere.club

What is the best solar light to get

http://www.winsta.jp

Silicone Snack Cup

Wooden Paddle Hair Brush

Wooden Bristle Hair Brush

Wooden Detangling Hair Brush

Silicone Ice Cube Tray

Pumpkin Silicone Mold

Round Wood Cutting Boards

Stainless Steel Sheet Metal Stamping Parts

Puzzle Cutting Board

Steel Progressive Die Sheet Metal Stamping Part

Stamping Press Welding Sheet Metal Parts

apkue.com

Cooking Cutting Board Wood

http://www.thaibeer.com

Facial Spider Vein Removal

Ultrasonic Weight Loss Machine

Puppy Rope Tug Toy

Dog Rope Toy With Squeaker

Professional Laser Tattoo Removal Machines

Recycled Chewing Rope Toy

Breath Analyser Test

http://www.xuongsi.com

Helical Vertical Axis Wind Turbine

Micro Wind Turbine

10kw Wind Turbine

Alcohol Testing Meter

Breath Analyser Test for Alcohol

Plastic Foots

Examples Of Non Ionic Surfactants

mspace.pl

Surfactant Chemicals

Research Chemical Market

Stainless Steel Ss304 Custom weld Solar Tile Roof Hook Stamping Parts

Plastic Knob Screws & Bolts

radiolom.kyiv.ua

Rimless Eyeglasses

Eyewear Frames

eco friendly plates and bowls

What are energy storage batteries used for

Two forming processs of Stainless Steel Spring Wire

Titanium Eyeglasses Frames

http://www.softdsp.com

height increase insole

Military Cold Weather Sleeping Bag

How to choose Bamboo Fiber Flower Pots

Military Cold Weather Sleeping Bag

Precautions during the use of Water based Epoxy Varnish

Multicam Black Bdu

Thin Cutting Board Wood

waterjet spare parts pure orifice

The History and Development of Investment Casting

Large Cutting Board

microfiber pouches snap button

mbhsdarlinghurst.org

Wood Cutting Boards

Turning and Milling Combined Machine

Guarnizione freno veicoli industriali Renault

online

VW ID

1toner.it

Slant-bed CNC Lathe

Four wavelength Diode Laser Hair Removal

Led Headlamp For Car

Kammprofile Gaskets

Metal Jacketed Gaskets

Acrylic Night Light

Stand Magnifying Glass

1toner.it

Silver Gasket

Hot metal sheet folding machine

Custom Puzzle 1000 Pieces Pricelist

Press Brake Price

1000pcs Puzzle Manufacturers

http://www.hexaxis.ru

CNC bending systems

Puzzles Games 1000 Piecs Custom Free Sample

Latex Work Gloves

How should the Linear Electric Actuator be maintained

Cooper Angle Globe Valve

Leather Garden Gloves

http://www.myreceiptmybusiness.com

Gloves Work

Steel Forging

Glass Bottling Equipment

http://www.tbgfrisbee.no

How to compound the cut rubber compound

Silica Gel Powder

Precautions for using a Car Freezer

Water Filling Line

Water Bottling Machinery

PVC Solid Color Wallpaper

3D Wooden Grain Wallpaper

woodpecker.com.az

Alloy Pipe

A106 Carbon Fitting

Wood Effect Wallpaper

90 Degree Elbow

Uv Sterilization Lamp/Uvc Sterilizer Light

Uvc Lamps For Sale

http://www.mcityband.ru

Furniture Cloth Duct Tape

Cloth Duct Tape

General Cloth Duct Tape

Uv Light In Sterilization

M436 Opc Drum

http://www.deshengst.com

E120 Opc Drum

Mini Power Inverter 300W

Portable Power Station 1000W Power Peak 2000W

607 Opc Drum

1000w Portable Car Power Inverter

Christmas Shadow Box

History of LCD Displays

http://www.jazzmouth.org

19 inch open frame infrared touch monitor

Newborn Photo Frame

Wall Decor Frame Set

Understanding Different Types Of Wheelchairs

Identification Ties

A2 A4 M12 M16 M8 M64 M32 SS304 SS316 Stainless Steel Hex Nut

A563 M6 M24 Manufacturer Stainless Steel 304 Hex Nut DIN934 China Bolt And Nut

http://www.setsatian.ac.th

Metal Strap Seals

Stainless Steel Hex Nuts Din 934 Hex Nut Large Hex Nuts

Marker Ties

R4 Grade Detachable C Link

Dope Dyed Polyester Yarn

What is an acrylic pool

Polyester Poy

http://www.isotop.com.br

Polyester Ring Spun Yarn

Regular Size of Wardrobe Doors

Car Top Led Display

17 layers ultra small size coil PCB

ruoungo.vn

Advertisement Truck

EM-890 PCB

Multilayer PCB circuit board

Led Gas Price Signs

Doll Shape Cake Tin

Steel Channel

Cosmetics Tin Container

FUT Ceiling T Grid

freemracing.jp

Ceiling Steel Channel

Beautiful Tea Caddy

cedmilano.com

Desktop Server Rack

Server Rack Cost

Multi Jet Dry Type Cold Water Meter

Pc Server

Plastic Multi Jet Dry Dial Cold Water Meter

ABS Plastic Multi Jet Water Meter

Hydraulic Shell Tube Heat Exchanger

Glitter Powder Puff

Metal Stamping Parts

Makeup Powder Puff

http://www.egservice.com.ve

Hydraulic Plate Heat Exchanger

Industrial Oil Chiller

Balcony Solar Mounts

Electrofusion Coupler Hdpe

Solar Balcony Mounting System

http://www.rwopr.pl

Ppr Pipe Full Form In Hindi

Hdpe Granule

Solar Ground Mount

Omni Signal Jammer Antenna

Solar Light 3000K LED Flutlichter

Plate Signal Jammer Antenna

itsgolbal.co.kr

Decoration String Light

PCB Signal Jammer Antenna

Led Grow Lights With Uv

Differentiated LCD Display

Casting Gearbox Components

Self Adhesive Floor Tile

Pvc Vinyl Flooring Roll

http://www.thrang.kr

Casting Pulleys

Casting Seeder Housing

Double Loop Composite Insulation Crossarms

E6c2 Cwz3c

Round Frame Composite Insulation Crossarms

Wire Encoder

http://www.osuszaniegdansk.com

74147 Encoder

Single Loop Composite Insulation Crossarms

hantik.ee

Hammer for Breaking Car Window

Cabinet Drawer Slides

Window Breaker Hammer

Drawer Slides Telescopic

Teflon Drawer Slides

Emergency Car Hammer

Environmentally Friendly Sugarcane Paper

Sugarcane Paper Supplies

Mini Fan Diffuser for Car

egservice.com.ve

Car Vent Oil Diffuser

Essential Oil Diffuser Mini

Raw Material For Paper Cup

Stainless Steel Sleeve Anchor Curtain Wall Wedge Anchor for Stone Cladding Marble Angle Fixing

Rigid Boxes

Book Style Rigid Box

Zinc Plated Carbon Steel Class 4.8 Wedge Anchor M8x75

GB/T22795 color plating zinc class 8.8 Wedge Anchor M8x75

Card Board Box

borisevo.myjino.ru

Hot Rust Treasure Stainless Steel Mechanical Zinc Plating Solar System Bi-Metal Screws with EPDM Washer

worksp.sakura.ne.jp

1022A+SCM435 Hot Rust Treasure Hex Flange Head Roofing Screw /Self Tapping Screw/Composite Screws/Bi-Metal Screw

Solar Lamp Indoor Use

Garden Spring /Easter Solar Light

home depot solar house numbers

304+410 1022A+SCM435 Hex Flange Head Bi-metal Screw with EPDM Washer

Lazy Boy Recliners For Elderly

Terminal Crimping Plier Tools

http://www.klickstreet.com

Brown Leather Recliner Chair

Fastening Tools

Cold Press Plier Tools

Electric Massage Recliner Chair

Branded Watch For Men 2023

Plastic Cases

Men Watch 2023

Excavator Mats

http://www.modan1.app

Bluetooth Wrist Watch

Sealing Rings

Christmas Led Light

Pet Grooming

Weld Nut

http://www.mix.com.az

Coupling Nut

Cap Nut

Craft Materials For Kids

2 Part Epoxy Clear

Resin Coat Paint

Resin Epoxy And Hardener

Eos Fuel Pump 2011-2016

Beetle Fuel Pump 2012-2016

Beetle Cabrio Fuel Pump 2011-2016

fpmontserratroig.cat

Amarok Fuel Pump 2017-2023

Easel Stand For Painting

Decorative Art

Caddy Fuel Pump 2004-2015

mobilesales.chegal.org.ua

Diamond Painting Pen

Caddy Fuel Pump 2004-2020

Polyurethane Waterproofing Price

Plastic Ruler Sets

Flexible Polymer-Cement Waterproof Coating

Waterproof Sheet

Plastic Writing Splint

Plastic File Fasteners

chungsol.co.jp

90colors solid watercolor paint set portable metal box

Facemasks Medical

Portable Automatic Horizontal Sawmill

Gauze Bandage Tape

disney princess giant activity pad

Urine Catheter Bag

http://www.domser.es

Spring Pin

List Of Antioxidant Supplements

Pine Bark Extract Benefits

inovstart.pt

Polyphenols Food List

Rigging

Square Nut

Pvc Extruder Machine

Fancy Brushing Machine

Textile machinery

Pvc Sheet Extruder Machine

arkbaria.com

Hdpe Pipe Extrusion Process Pdf

Shearing Machine

Wool Felt

Sheet Extrusion Line

Maintenance Equipment

Solarline

Single Person Cleanroom Air Shower

Natural Gas Treating Skid

Laboratory Laminar Air Flow Clean Bench

Pig Trap Launcher And Receiver

Stainless Steel Air Showers

Light Ends Recovery Skid

CNG Compressor Skid

Vertical Flow Clean Bench For Cleanroom

Single-person Double-blowing Air Shower Room

okinogu.or.jp

Natural Gas Treating Skid

316 Stainless Steel Deck Hinge

Air Source Heat Pump Low Temperature

316 Stainless Steel Casting Hinge 76*38MM

Air Heat Pump Vs Ground Source

Air Source Heat Pump Chiller

Air Source Heat Pump Combined With Solar Panels

316 Stainless Steel Casting Hinge 50*50MM

Anchor Chain Stopper 316 Stainless Steel

http://www.radioklub.blansko.net

316 Stainless Steel Top Cap

Air Source Heat Pump

316 Stainless Steel Double Cross Bollard

nextplanner.jp

316 Stainless Steel Boat Mooring Bollard Bit For Marine

Single Cross Bollard Heavy Duty Marine Grade 316 Stainless Steel

316 Stainless Steel Horn Bollard

Metal Elbows

316 Stainless Steel Single Cross Head Bollard

Elbow 1 4

Medium Plate

Male Elbow Pvc

Compression Elbows

Rust Cleaning Tool

Leather Counter Stools

Rust-free Kitchen Cleaning Meta Scourer

Mesh Office Chair

Counter Stools With Backs

Pot Scrubber For Tough Stains

Rust Stain Removal

Wire Cleaning Ball For Efficient Cleaning

Kitchen Bar Stools

Farmhouse Bar Stools

edi.chegal.org.ua

1200 Mesh Green Silicon Abrasive Sand

klickstreet.com

Metal Detector

Hex Flange Bolt And Nut

800 Mesh Green Silicon Abrasive Sand

1000 Mesh Green Silicon Abrasive Sand

Hex Head Nut

Stainless Steel Hex Bolts

Hex Head Flange Bolt

Grindstone for Shearing Machine

Hex Flange Bolt With Nut

Step Up Transmission Transformer For Solar Power Plant

http://www.carveboad.com

Educational Robotics Arm

Scara Cobots

3 Axis Arm Robot

10 Mva 33 11kv Electric Power Transformer

35 Kv 20000 Kva Power Transformer

Robot Arm Cleaning

1 Megawatt Solar Panel Transformer

Industrial Robot Arm 6 Axis Robot Arm

35kv 20mva Industrial Power Plant Transformer

Pure Copper Kitchen Scrubber

Mesh Scourers

Kitchen Scouring Pad

Stationeers Wind Turbine

Urban Wind Turbine

Wind Turbine Installation

Wind Turbine System

adentech.com.tr

Wind Turbine System

Scourers Plastic Mesh Scourer

Solid Rivet

25v Battery

Energy House Battery

Oem Lithium Battery 200 Ah

Electronic Article Surveillance Companies

Eas Loss Prevention

Electronic Article Surveillance Eas

Electronic Article Surveillance Eas Systems

Customized 12v 50ah Lifepo4

Copper Blind Rivet

Oem 48v Lifepo Manufacturer

http://www.leilia.net

Fishing Rod Holder

http://www.pclgame.online

Nail Dust Collector

Marine Ladder

Fingernail Dryer

Boat Cleat

Boat Bollard

Nail Display Card

Bow Chock

Instant Nail Polish Dryer

Toe Nail Dryer

Brushed Carding Cloth

280 Mesh Green Silicon Abrasive Sand

Cleaning Carding Cloth

600 Mesh Green Silicon Abrasive Sand

Fireproof ABS Particles

Transparent ACR

Chlorinated Polyethylene (CPE) Manufacturer

Titanium Dioxide Uv

Rutile Titanium Dioxide

320 Mesh Green Silicon Abrasive Sand

sandbox.phpwebhosting.com

Flame Resistant Paint

Prototype Pcb Assembly

Circuit Board Design

Pcb Components

External Fire Retardant Coating

Fire And Heat Resistant Paint

alphacut.jp

Fire Resistant Paint For Metal

Fire Retardant Paint For Exterior Wood

Electronics Manufacturing Companies

Precision Sheet Metal

Marble Finish Pvc Sheet

Mild Amino-acid Based Surfactant

Mild APG Surfactant

Mild Surfactant

digitallove.in

Mild Amphoteric Surfactant

Marble Finish Pvc Sheet

Wholesale Wood Plastic Composite Floor Factories

Mild Surfactant

Wholesale Waterproof Wall Panels Manufacturers

Wholesale Waterproof Wall Panels Factory

Dimethoxydimethylsilane

Colorless Heptamethyltrisiloxane

Mechanical Dock Shelter

Silicone Oil 5 Cst

Inflatable Dock Shelter for Cold Storage

Inflatable Warehouse Loading Dock Shelter or Dock Seal

Dimethoxydimethylsilane

gaucbc.org

Dock Shelter

Adjustable Dock Seal

Silicone Fluid

Pets At Home Dog Grooming Table

Body Armor

Reinforced Protective Arm

Pet Grooming Table

Multifunctional Folding Knife Belt

portalventas.net

Nail Desk With Extractor Fan

Nail Salon Table

Folding Dog Grooming Table

Telescopic Monocular Telescope

Explosion-Proof Helmet

keyservice.by

Wireless Charge Sonic Electric Toothbrush

Rechargeable Sonic Electric Toothbrush

Emergency Oxygen Cylinder

Wireless Charge Rotating Electric Toothbrush

Smart Timer Sonic Electric Toothbrush

Argon Gas Bottle

Rechargeable Rotating Electric Toothbrush

Welding Cylinder

Mini Propane Tank

Pure Oxygen Tank

20-50L Fully Automatic Filling Machine

Aluminium Sheet

1 4 Aluminum Plate

Open Barrel Seprated Machine

1-20L Fully Automatic Filling Machine

1 4 Aluminum Plate

10mm Aluminium Plate

Close Barrel Seprated Machine

80 Ton Round Type Counterflow Water Cooling Tower

http://www.oldgroup.ge

Aluminum Plate Stock

Solar Led Floodlight

modan1.app

Aluminum Tube

Aluminum Alloy Busbar

Mining Headlamp

Aluminum Sheet

Rgb Led Downlights

Aluminum Extrusion

Halo Led Surface Mount Downlight

Black Light Led Strip

Aluminum Poster Frame

http://www.bilu.com.pl

Rotary Knife Vegetable Cutter

Fresh Pizza Provider

Fingertip Pulse Oximeter

Pulse Oximeter Handheld Digital Fingertip Pulse Oximeter

Fingertip Pulse Oximeter Bluetooth Digital

Digital Rechargeable Fingertip Pulse Oximeter

Italian Style Pizza Vending Machine

Fingertip Digital Pulse Oximeter

Intelligent Vending Machine

Food Processing Line

Real Wood Burning Stove

Single Door Dog Crate

Indoor Wood Fired Boiler

Fireplace Indoor Wood

Silicon Nitride Si3n4 Ceramic Substrate

Festive Hanging Baskets

Wooden Planters

Ceramic Insulating Heat Dissipation Substrates

Metal Ceramic Substrates

Power electronic substrate

me.mondomainegratuit.com

SHOPPING BAG

Butt Weld Fitting

Ptfe-Lined Hose

Pipe Connection Ball Valves

thaibeer.com

COOLER BAG

Ptfe Core Hose

Flange Adapter

RECYCLED BAG

PP Non Woven Bag

PLA BAG

woodpecker.com.az

Industrial Machine Keypad

IP65 Industrial Keypad

Crypto Miner Case

Industrial Code Lock Keypad

Atx Case Rackmount

Industrial Metal Keypad

Compact Pc Case

4u Case

Wall Mount Pc Case

Industrial Door Access Control Keypad

1.14 inch TFT

softdsp.com

Olympic Weight Plate Tree

Barbell Rack

Glute Ham Developer

1.3 inch TFT

1 inch TFT

1.44 inch TFT

1.77 inch TFT

Vertical Medicine Ball Rack

Medicine Ball Rack

Semiconductor Clean Room

Clean Room Led Panel

Hvac Hepa Filter

Raised Beds

Greenhouse Raised Garden Bed Flowerpot

Ffu

Outdoor Planter Boxes

Wood Planter Box Stand for Backyard

Fan Filter Unit

mspace.pl

Garden Potting Bench

2160P Front and Rear Camera Built-in 5GHz WiFi

Lathe Turning Tungsten Carbide Cutter

http://www.jdsd.co.jp

2160P Rearview Mirror Backup Camera

2160P Rearview Dash Cam Backup Camera

External Turning Cutters

TNGG160402R-F TNGG160404R-F TNGG160402L-F TNGG160404L-F NX2525

Aluminum Sheet Wood Lathe

4K Dash Cam With Voice Control Wifi GPS

DCGT11T302 DCGT11T304 DCGT11T308 DCGT32.51 AK H01

2160P Front and Rear Camera

http://www.market.hexaxis.ru

Warm White Par Light

Modern Outdoor Post Lights

Outdoor Backyard Lights

Waterproof Dupont Kraft Paper Pouch

Non Woven Cooler Lunch Bags

Fashion Cylinder Car Tissue Box

7w Battery Inside Integrated Led Emergency Power Supplyip65

Lithium Battery

Tyvek Reusable Lunch Bags

Cylinder Tissue Box For Car

http://www.vpxxi.ru

48 Port Patch Panel

Pass Through Ethernet Cat6

Lightweight Trolley Cases

Suitcase for Trolley Travel Luggage

Suitcase with Wheels

Network Kit Tools

Aluminum Hardside Trolley Luggage

Cat6 Ethernet Connector

Wall Plate

Aluminum Travel Luggage

methamphetamine

2-(2-Oxo-4-Phenylpyrrolidin-1-Yl)Acetohydrazide

http://www.alajlangroup.com

Collapsible Mobile Container Shelters For Disaster Relief

Gbl

Emergency Folding Security Houses

Foldable Container House

Flualprazola

Disaster Relief Container Homes

Earthquake Proof Container House

Bu-300

Frozen Monkfish Tail

Frozen Peru Ocean Squid Whole Round

Frozen Yellow Corvina

Frozen GIANT Squid FILLET SKIN ON

bng.opaleimpressions.com

Casting coating bentonite

Frozen Peru Ocean Squid Skinless Fillets

Sodium-based bentonite for casting

Pulverized Coal Is

Junior Bentonite Cat Litter

Pet Snacks

China Semi Trailer

Shantui Bulldozer Front Idler

Military Boots

Reinforced Protective Arm

mbautospa.pl

Shantui Bulldozer Steering Pump

Multifunctional Folding Knife Belt

Telescopic Monocular Telescope

Binocular Military Telescope

Kubota Excavator Hydraulic Pump

Xcmg Skid Loader

Bently Nevada 3500/94 145988-01

EVA Kids Sandals With Double Buckles

Kids Sports Sandals

Bently Nevada 3300/55-04-01-08-08-00-00-00-00

Kids Summer Sandals With Printing

Bently Nevada 3500/72M 140471-01

Gjr5253100r0270

Boys Summer Sports Sandals

Little Kids Summer Sandals

http://www.justmdv.it

Pm865k01

Linear Actuator High Speed Industrial

Industrial Linear Actuator

Linear Electric Motor

Mini Electric Linear Actuator

TN Segment Lcd Display TYT1621

7 Segment Lcd Display VA POSITIVE TRANSFLECTIVE

qa.singarea.org

7 Segment Lcd Display VA

HTN 7 Segment Lcd Display SG1621

12v Waterproof Electric Linear Actuator

7 Segment Lcd Display VA AIP31621E or Equivalent

Linear High-Speed Thrusting Vibrator

Realistic Ultra-long Thrusting Vibrator

Hydraulic Suction Strainer

den100.co.jp

Remote Controlled Thrusting Vibrator

Disk Clutch Friction

Oil Filter Change

Air Filter

Thrusting Shaft Vibrator

Realistic Thrusting Rabbit Vibrator

Clutch Plate Material

Double Speed Pendant Control Station

XAC Pendant Control Station

Carbide Wear Sleeve

Emergency Push Button Switch

Pdc Nozzle

Carbide Valve Seal Rings

Carbide Bearing Sleeve

Tungsten Carbide Rotary File

Crane Emergency Stop Switch

http://www.gataquenha.com

Waterproof Lifting Button Control Switch

Push Button Control Station

Waterproof Lifting Button Control Switch

Emergency Push Button Switch

Wholesale Light Stick For Kpop

ncthp.dgweb.kr

Double Speed Pendant Control Station

Kpop Light Stick Keychain

Led Bracelet Concert

Led Light Sticks For Party

Led Flashing Stick

Lifting Button Control Switch

Portable Military Telescope

Industrial Water Filter System

Temperate Military Boots

Water Desalination Plant

Ultra Clear Military Telescope

http://www.sudexspertpro.ru

Sodium Hypochlorite Generating System

Water Chlorination System

Online Chlorination System

Cold Zone Military Boots

HD Military Telescope

USB 3.1 TYPE C USB Data Cable

80 * 80 * 25MM Stage Lighting Equipment Cooling Fan

http://www.arsnova.com.ua

92 * 92 * 25MM Car Purifier Cooling Fan

USB 4 TYPE C High-speed USB Data Cable

China Anle Dental Unit and Dentist Chair

Lounge Chair For Living Room

Lamp Wool Chair

80*80*38MM Laser Equipment Cooling Fan

marble coffee table

Brown Leather Chair Living Room

Indoor Furniture

Candles and Candle Holders

Hand Baggage

Handcarry Baggage

Picture Frames

Rustic Wooden Lanterns

Small Suitcase 45x36x20

Hand Luggage Case

http://www.microbait.pl

Small Hand Luggage Suitcase

Decorative Wooden Lanterns

Full Auto CR Coil Slitter Rewinding Machine

12-16MM HR Cut To Length Line

Power Divider Vhf

Steel Coil Cutting Machine For Narrow Strip

3 Port Directional Coupler

Sheet Metal Cut To Length Machine

Duplexer Uhf Repeater

Metal Sheet Coil Perforated Production Line With Cutting

Broadband Power Divider

http://www.agnoli-giuggioli.it

Waveguide Power Combiner

zscr08 steel curtain side roller

air ventilation system

Pyridine-3-sulfonyl chloride

Benzoic Acid Preservative

catrinapuchary.pl

Zinc Calcium Stearate

Pregablin Powder

Fire Truck Roller Shutter

Fire Truck Parts

zscr07 curtain side truck roller

Zinc Calcium Stearate

Spring Nut customization

Vacuum pump oil

Clutch Plate Compression Spring

Lay

Excavator track adjuster

zssh01s refrigerated truck side door hinge with nozzle

zsdl29s truck body door locks

http://www.kazimierz.misiniec.pl

zssh03s truck side door hinge

zssh02s refrigerated truck side door hinge

zsdl30 truck rear door handles recessed cam lock

Ceramic Lamp Shade

LED floor lamps

大型家电到香港

Progressive Dimming Maternal and Filiative Floor Lamp

Ceramic Lampshade Mother Lamp

Incrementally Adjustable Mother and Child Floor Lamp

Photochromic Brown

sporry.com

1.61 High Index Lenses

Blue Light Glasses No Glare

淘宝转运仓

“Acquistare pala da miniera con caricatore a lunga portata” (Italian for “purchase mine shovel with long-range loader”)

mining machinery”)

High-Speed Sweater Textile Knitting Machine

Round Neck Argyle Cashmere Jumper

“Macchinario minerario Degong Dg

cloud.kctu.org

Fully Automatic Sweater Knitting Machine

“Caricatore a lunga portata” (Italian for “long-range loader”)

Round Neck Cosy Cashmere Jumper

Auto elettrica BYD Qin Plus EV

Round Neck Cashmere Sleeveless Jumper

Streetwear Clothing Manufacturers

Patterned Sweater Flat Knitting Machine

Cardigan Sweater Knitting Machine

Custom Clothing Design Manufacturers

Cable Sweater Flat Knitting Machine

Chinese Clothing Companies

yumemiya.co.jp

Best Sweater Flat Knitting Machine

Shirt Distributors

Swelling Sweater Flat Knitting Machine

Womens Work Clothes Sale

zssh07s refrigerated truck door hinges

Fire Retardant Coating

Bahan Kimia Chrome Semprot

Aluminum Extrusion Machine

http://www.pstz.org.pl

zssh09s truck side door hinges

zssh11s truck side door hinges

zssh06s rear refrigerated truck door hinge

zssh08s refrigerated truck side door hinges

Aluminum Brushing Machine

Extrusion Profile Aluminium

For Ryobi

24W Desktop Power Adapter

Tool Battery Inverter Charge Controller

48W Detachable Plug Power Adapter

18W Desktop Power Adapter

36W Desktop Power Adapter

Charging Head Battery Connector

Battery Charger For Milwaukee

Portable Battery Backpack

12W Desktop Power Adapter

http://www.tokina.co.kr

Chlorophyllin Copper Complex Sodium

Screwdriver Bits

pomegranate extract Polyphenols

Smart Screwdriver Spare Parts

http://www.baronleba.pl

Screwdriver Nozzle

Fixed Offset-torque Smart Screwdriver

Vacuum Adapter for Screwdriver

Saw Palmetto Extract Oil

pomegranate extract Polyphenols

Siberian Ginseng Root Extract

White Marble Kitchen Floor

File Bag Purse

Marble Veneer Sheets

Light Emperador Marble

Coach Dempsey File Bag

Ellie File Bag

China Stone

Marble Countertops Cost

Mini Rowan File Bag

Document File Bag

http://www.carveboad.com

PVC Laser Sewing Zipper Bag

Pure Beeswax Candles

6pcs Wax Candles

Candle Wax Bulk

400g Fluted Candles

http://www.sp-plus1.com

Standup PVC Zipper Waterproof Bag

Standup PVC Zipper Bag With Hand

PVC Sewing Zipper Handle Bag

Standup PVC Zipper Cosmetic Bag

Candle Perfume

Machinery Parts

Co2 Sensor

Entertainment Card Game

Infrared Sensor

Playing Card

Box Mod Enclosure

Tarot Card Deck

Jigsaw Puzzle

http://www.thrang.kr

Flash Card

Robot Parts

Cast Titanium Parts Of Medical Apparatus

Titanium Golf Heads

Shaftless Screw Conveyor

Cast Titanium Impellers

Cast Titanium Bicycle Parts

Scrap Crusher

http://www.studentlinks.es

Industrial Filter Paper

Magnetic Drum Separator

Ti Gr.2 Casting Parts

Small Milk Cooling Tank

Uplighter And Reading Light Floor Lamp Lighting

Black Dome Light Floor Lamp Lighting

http://www.skarbek.fr.pl

Drainer

Satin Nickel Single Pole Floor Lamp

Single Tube Uplighter LED Floor Lamp Lighting

Sink Kitchen Faucet

Single Pole Big Lamp Shade Floor Lamp

Single Basin Kitchen Sink

Stainless Kitchen Sinks

Knitted Wear

Abs Enclosure

Automotive Suspension Shockproof Black Rubber Parts

Automotive Dust Proof EPDM Rubber Grommets

Bungee Straps

Automotive Suspension Black Rubber Damping Sleeve

Automotive Suspension Black Rubber Bushing

Black Rubber Wiring Harness Protector

Enclosure Waterproof

Junction Box

http://www.wiryei.co.kr

Bungee Rope

Edge Cutting Tools

Classic Letter Felt Laptop Bag

Cutting Tools And Equipment

abilitytrainer.cloud

Classic Sleeve Bag

Chainsaw Mill

Minimalist Sleeve Bag

Dual-side Waterproof Portable Laptop Bag

Router Bits

Litchi Veins Sleeve Bag

Milling Machine Cutters

Pneumatic Valve for Baghouse Air Dust Collector

Fabric Filter Air Cleaning Valve

Solenoid Pulse Valve

Lathe

Cnc Machining Center

Affordable 3d Printing

Cnc Machining Materials

Custom Metal Fabricators

DC24V 4 Inch Aluminium Pulse Solenoid Valve

dinhvisg.com

Compact Pulse Valve

Silicone Food Storage Bags

T Shirt Bags

Skin Care Product Packaging Box with EVA Insert

jazzmouth.org

Cosmetic Packaging Magnetic Box with EVA Insert

Sugar Bag

French Fries Pouch

Packaging Gift Box with EVA Insert

Red Wine Bottle Packaging Box with EVA Insert

Storage Boxes For Clothes

Tool Packaging Box with EVA Insert

Pellet Boiler Igniter

Wood Pellet Stove Igniter

Countertop Dishwasher

Wall Mounted Air Conditioner

Television Set

Pellet Burner Igniter

pellet stove igniter

http://www.tbgfrisbee.no

Wood Pellet Boiler Igniter

Refrigeration Evaporator

House And Home Fridges

????? 5337-93-9 4- ?????????????????

Electric Coil

Toroidal Coil

Am Antenna Coil

????? 593-51-1 ?????????? ????????????

????? 1451-82-7 ??????????? -4

Bobbin Induction Coil

Customize The Plastic Bobbin Coil

??????? ???? 123-75-1 ???????????

st.rokko.ed.jp

????? 49851-31-2 ??-?????????????????

Ignition Coil

presskit.misiniec.pl

Elisa Reader 450 Nm Supplier

Elisa Reader 96 Holes

Salt Spray Fog Test Chamber

Elongated Toilet Seats

Infrared Thermal Imaging

Porsche Lighting Systems

Round Toilet Seat Quite

Salt Spray Chamber Test

Porsche Daily Running Lights

CBD cartridge deliver

vape cartridge clogged CBD

Vape Cartridge Packaging Cbd Oil

essential CBD cartridge

Cabinet Doors Rustic

Kitchen Cabinet Doors

PE Self-sealing Bag

CBD vaporizer cartridge

http://www.lipetskkrovlya.ru

Shower cap

Raincoat Ball

Chronic Relapsing Pancreatitis

Porcine Intestinal Mucosa

Front Bumper

Reticular Arteriovenous Thrombosis

LED Fog Light

hexaxis.ru

Halogen Xenon Tail Lights

Human Pituitary Gonadotropin(Hpg)

Front Grille

Rear Bumper

Cerebral Embolism

3 Wheel Bike For Adults

Card Holder

E Rickshaw Website

ppparagon.co.th

Adult Electric Tricycle

Lever Arch File Bag

Electric Tricycle 3 Wheel Powerful

File Bag Black

Tuk-Tuk Manufactures

Makeup Organizer Bags

Advocate File Bag

Backpacks for High Schoolers

Anthocyanin 95%

http://www.hantik.ee

Practical Backpacks for Students

Polygonum Root Extract

Backpacks for College Students

Student Backpacks

Polygonum Root Extract

School Bags for Teens

Cissus Extract

Epimedium Leaf Powder

Bellows Type Expansion Joint

http://www.linhkiennhamay.com

Multi-Rack Micro Data Center

Room Precision Cooling Air Conditioner

Room Type Modular Data Center

Rubber Flexible Joint

Rubber Bellow Catalogue

Pipe Rubber Bellows Expansion Joint

Outdoor Container Data Center Solution

Expansion Bellows Rubber

Single-Rack Micro Data Center

Cardboard Tubes

Pillow Boxes

support.xortec.de

Cake Boxes

Wire Brush Cutter Head

Grass Trimmer Head

Foldable Lid And Base Boxes

Nylon Trimmer Head

Wine Gift Box Empty

Dual Power Trimmer Line

Tray And Sleeve Boxes

Stick On Wall Tiles

Plastic Pipe Crusher

Square Kitchen Tiles

Plastic Crusher

Plastic Bottle Crusher

Ivory Porcelain Tile

24×24 Ceramic Floor Tile

renobeya.com

Waste Plastic Crusher

PET Plastic Bottle Crusher

750x1500mm Floor Tiles

Anterior Nasal Covid-19 Self Test Rapid Antigen Test

Safe Collection Covid-19 Self Test Rapid Antigen Test

Nasal Swab Covid-19 Self Test Rapid Antigen Test

Efficient Covid-19 Self Test Rapid Antigen Test

Using Tap And Die

Miniature Taps And Dies

Flat Die Thread Rolling Machine

Die And Mould Industry

http://www.knf.kz

Bead Roller Tipping Dies

Simple Operation Covid-19 Self Test Rapid Antigen Test

Cotton Carding Machine

Electric Cabinet Tributary Ammeter

Automatic Plucker

Electromechanical Cabinet Silicon Tube Rectifier Tube

Electric Cabinet Trigger Board

http://www.swenorthab.se

Vertical Ring Magnetic Separation Electromechanical Cabinet Emergency Control Panel

Long Puffer Coat With Hood

Electric Cabinet Tributary Voltmeter

Sample Carding Machine

Cashmere Carding Machine

Bright LED Batten Lighting with High Lumen Leds

P10 Smd Led Module

Novastar 4k Led Processor

LED Tri Proof Lamp with 5.8G Intelligent Sensor

http://www.jakubdolezal.savana-hosting.cz

Colorlight 5a 75b

Ts802d Sending Card

Novastar Control System

Linear LED Fixture Batten Tri-CCT with Sensor

Cold Version -40??C IP66 Emergency LED Tri Proofs

External IP65 Highbay PIR Sensor LED Tri Proof Luminaire

Touch Screen Commercial Coffee Machine

Electric Coffee Maker

Coffee Maker

Vet Ultrasound

Cardiac Monitor

Ultrasonido Portatil

Bone Densitometer

imar.com.pl

Espresso Coffee Maker

Capsule Coffee Maker

Ecografo Portatil

A Flexible Tribbed Sheet Factories

Opaque PVC curtain-PVC strip curtain finished product customization

Natriumchlorat Cas No. 7775-09-9

A Flexible Tribbed Sheet Supplier

Magnetic Plastic Curtain Factory

Sodium Chlorate Cas No. 7775-09-9

Chlorate De sodium Cas No. 7775-09-9

Natriumchlorat

vpxxi.ru

Chlorate De sodium

Wholesale Pvc Curtain

Ammonium Hydrogen Fluoride

robutex.pl

Ammonium Hydrogenocarbonate Cas No. 1066-33-7

Ammoninum Bicarbonate Cas No. 1066-33-7

Ammonium Hydrogenfluoride

Gelatin Votator

Sauce Filling Machine

Scraper Heat Exchangers

Ammonium Hydrogen Carbonate Cas No. 1066-33-7

Gelatine Votator

Butter Packaging Machine

Bovine bone collagen peptide

Hydrolyzed Collagen

Dichlorocopper Hydrate

Cupric chloride dihydrate

Aluminium Nitride Price

Bovine skin collagen peptide

Molybdenum Disulfide Powder

Bismuth (Bi) Powder

http://www.hunin-diary.com

Tungsten Carbide Welding Ropes

Spherical Boron Nitride Powder

Facial Exfoliating Wet Pads

Contour Brush

Vertical Five Axis Precision Components Rackmount

Vertical Five Axis Precision Casing Assembly

Eyeliner Brush

Plastic Nails

Aluminum Precision Stamped Keyboard Components

borisevo.ru

Private Label Makeup Brushes

The Sleeve Of A Valve

Vertical 5 Axis Six Connections

Flete Maritimo

C12-14

Spain Freight Forwarder

SLES 70%

SLES 70% Cas No. 9004-82-4

Freighter Ships

Bill Oflading

Forwarder Cargo

Sodium Lauryl Ether Sulfate Cas No. 9004-82-4

SLES Cas No. 9004-82-4

http://www.slserwis.pl

Meat And Bone Cutting Machine

Frozen Chicken For Sale

Electric Bone Saw

Lightweight Portable Metal Money Cash Box with Key Lock

Bone Separator

Frozen Squid Meant

Portable Metal Security Cash Safe Box

vnreal.net

Multiple Compartment Trays Safe Portable Metal Cash Box

Colorful Handle Children Stainless Steel Scissors

Safety Children Student Stainless Steel Cutting Scissors

ATSP

TSP

http://www.stickers.by

HPMA Cas No. 26099-09-2

Vertical Pump

Hydrolysed Polymaleic Anhydride Cas No. 26099-09-2

Side Channel Blower

HPMA

High-Voltage Motor

Vacuum Pump

Peripheral Pump

Deep Boring On A Lathe

DC portable misty fan

Cylinder Honing Machine

AC-operated contactors

Lathe Gun Drill

Cnc Deep Hole Drilling

Lathe Gun Drill

http://www.bidyaan.com

Lint Roller

Paper Punch Machine

Stapler

Mini Wheel Excavator

Demolition Excavator

Alkyl Dimethyl Benzyl Ammonium Chloride

BKC

Benzalkonium (C8-C16)

BKC 80%

http://www.yoomp.atari.pl

Articulated Wheel Loader

Bucket Wheel Loader

Compaction Wheel For Excavator

Benzalkonium Chloride Cas No. 8001-54-5

ZEEKR 009

Windows Pda Devices

http://www.sakushinsc.com

650nm Laser Hair Growth

ZEEKR 001

Industrial Pda Smartphone

Pda Scanner

Avita 11

ZEEKR X

ZEEKR 007

Handheld Pocket Pc

CS35 Plus

Changan Uni Series

Sonata

Wholesale Ct Xray Tube Supplier

X-RAY TUBE HOUSING

75KV HV Receptacle CA1

Changan HUNTER

Tube Head X Ray

Hyundai Elantra

X-RAY TUBE HOUSING

http://www.gazete1453.com.tr

3.5 Kva Solar System

Solar Motor Driver

http://www.smkn3cimahi.sch.id

Sodium metabisulfite Cas No. 7681-57-4

Inverter Without Solar Panel

Sodium metabisulphite Cas No. 7681-57-4

Metabisulfite Sodium

Latest Solar Inverter

Metabisulfite Sodium Cas No. 7681-57-4

Sodium Mercaptoacetate

Invt Vfd Drive

Air Bike

Tr 92 Titanium Dioxide

Weight Lifting Benches

Titanium Dioxide Mineral

Isopropyl sodium xanthate Cas No. 140-93-2

Sodium Isopropyl Xanthate Cas No. 140-93-2

Sodium metabisulphite

Sodium Isoproylxanthate Cas No. 140-93-2

Sodium Iso-propyl Xanthate

China ACR

cse-formations.com

Sodium O-isobutyl Dithiocarbonate Cas No. 25306-75-6

Car Electric Cooler

Led Mini Fridge

Car Camping Fridge Freezer

sodium O-propan-2-yl Carbonodithioate

Camping Air Conditioner

Isopropyl sodium xanthate

Proxan Sodium

http://www.mtcomplex.ru

DC Refrigerators

Sodium Isoproylxanthate

Steel Driveway Grating

Kia Seltos

Steel Driveway Drain

http://www.terapiasinfronteras.com

Steel Grating Platform

Black Steel Grating

Steel Grating Material

GWM POER

Kia EV5

Kia Sportage

Kia K3

Kia EV5

Single sided PERC modules

GWM POER

15kw Solar Inverter

cedmilano.com

Dc To Dc Ev Charger

Junction box (distribution box)

Digital Sine Wave Inverter

Kia Sportage

Kia K3

Kia Seltos

Fumed Silica

25g SFP+ to SFP+ Aoc Cable

Copper Chloride Dihydrate

36P SFF-8087 4i cable

Glutaraldehyde

10G Active Optical Cable

http://www.nighterbldg.com

Collagen Peptide

Formic Acid

Internal Mini SAS HD SFF-8643

10G SFP+ AOC cable

Hardware Stamping Die

http://www.trimolotka.ru

Precision Stamping Parts

High Quality Outdoor Chairs

Precision Moulds

Lithium Battery Mould

Best Outdoor Tables And Chairs

Indoor Hanging Egg Chair

Black Outdoor Dining Setting

Paper Bag Punching Mould

Inside Patio Furniture

Overhead Crane Wireless Remote Control for Industrial Remote Control Radio Remote Control for Crane

Pilates aluminum reformers

Fine Mesh Metals

Steel Wire Screen

Aluminum Half Trapeze Reformer

Aluminium Pilates Reformer

korchambiz.blueweb.co.kr

Woven Wire Fabric

Pilates Aluminum Reformer with Tower

Plain Steel Wire Mesh

Stainless Woven Wire Mesh

Citric Acid Monohydrate Cas No. 5949-29-1

Iphone 6 Mobile Phone Battery

Potassium hydroxide

Iphone 6 Mobile Phone Battery

Citric Acid Mono Cas No. 5949-29-1

commercefb.alwaysdata.net

6 Plus Battery

Building Integrated Solar Panels

Battery For Apple 6s

Caustic Potash Cas No. 1310-58-3

KOH

Outdoor Misty Fan with Humidifier

Rain Gauge With Ground Stake

Outdoor Portable Misty Fan with Humidifier

Mobile Weather Station

Outdoor DC Portable Misty Fan

http://www.sukhumbank.myjino.ru

Noise Tester

Outdoor Portable Misty Fan

Explosion-proof Ventilation Fans

Mini Sound Level Meter

Ultrasonic Rain Gauge

China Christmas Plush Dog Toys

Hollow Block Machine

Hollow Brick Making Machine

nighterbldg.com

Concrete Block Forming Machine

Brick Forming Machine

China Best Tough Plush Dog Toys

China Flat Plush Dog Toys

Cat Chew Toys

Solid Brick Making Machine

Luxury Dog Toys

odnowica.milaparila.pl

CS35 Plus

Prefabricated Steel Frame Houses

Outdoor Tent

Hyundai Elantra

Hyundai CUSTO

Door Jambs

Homes Prefab Houses Luxury Villa

Sonata

Container House Flat Pack

Nissan SYLPHY

Non Woven Packaging Bags

Drones Spraying

Non Woven Cooler Drinks Delivery Bags

Metal Rack Storage Systems

Heavy Duty Non Woven Tote Bag

Reusable Non Woven Packaging Bags

Drone Deploy Agriculture

Agriculture Drone Spray Machine

opylashy.website

Promotion Grocery Shopping Bag

Farm Sprayer Drone

45mm Awning Manual Radio Tubular Motor

Excavator Parts

kinnikubaka.xsrv.jp

Bus Railway 18mm Blinds Fast Motor

Dry Contact Curtain Motor Two Wires

Hydraulic Filter

Oil Line Filter

Five Wires Hotel Draper Curtain Motor

Multifunctional Five Wires RS485 Wifi Curtain Motor

Loader Machinery

Full Flow Oil Filter

http://www.thrang.kr

Large Bulk Bags

Polypropylene Feed Bags

EVA Ball

EVA Dice

Makeup Brushes

Large Bulk Bags

Fibc Bulk Bags For Sale

EVA Foam Pad

Makeup Sponges

Half Ton Bags For Sale

Led Display Fan

Microled Monitor

Automatic Hydraulic Concrete Block Making Machine

Automatic Hydraulic Block Making Machine

Led Pixel Display

Wall Panel Machine

Matrix Led Display

Automatic Hydraulic Concrete Brick Making Machine

Wall Panels Machine

Led Diffuser Panel

ncthp.dgweb.kr

Trapezium Aluminum Housed High Power Resistor Vertical type

Ballerina Flat Shoes

http://www.iprana.co.kr

RD Carbon Film Resistors

Trapezium Type Aluminum Housed High Power Resistor

Badminton Shoes

High Power Aluminum Heat Dissipating Housed Resistor

Backpacking Sandals

Ballet Flat Shoes

Bedroom Shoes Ladies

Boat Type Aluminum Housed High Power Resistor

Party Tent

FLQ50 Precision Sampling Resistors Shunt

shidai5d.com

FLQ50 Precision Sampling Shunt

RSU Metal Oxide Film Resistors Ultra Small Type

Goose Down Sleeping Bag

Teflon Coated Fabric

NRSS Anti-Pulse Non-Inductive Resistors Small Type

Camping Storage Cupboard

Baking Mat

FL13 Precision Sampling Shunt

packaging pouch

square bottom packaging pouches

Black-Edging Laptop Case

2nd Gen Carbon Fiber Laptop case for MacBook and HP G9

paper pouch

Functional Laptop Case With Stand

Starry Night Laptop Case

Biodegradable packaging pouches

Carbon Fibre Laptop Case

yumemiya.xsrv.jp

coffee packaging pouch with valve

Cement Sandstone Gravel Automatic Brick Machine

Vibrating Solid Concrete Brick Block Machine

Three Way Stopcock Valve

krakow.misiniec.pl

Threaded Barbed Fittings

Vacuum Rubber Pad

Cement Automatic Brick Making Machine

Red Clay Bricks Making Machine

Multifunctional Concrete Brick Making Machine

Tubing T Connector

Three Way Stopcock With Extension Tubing

Wax

Tropical Print Fabric

Eas Security Tags

Wax

Security Tag Types

Eas Label

Electronically Protected Stickers

Electronic Security Tags

http://www.borisevo.myjino.ru

Paisley Print Fabric

White Polyester Fabric

Smoked Paprika Powder

Purification Equipment

ptik.unima.ac.id

Ozone Generator

Chilli Powder Manufacturers

Chilli Red

Clean Sampling Car

China Chili Kashmiri Factory

Mechanism Panel

Air Filter

Red Spices Powder Manufacturer

Pull Rings

Deck Plate

Deck Filler

Turning Lock

Home Battery Wall

Power Solar Battery

24v 10ah Lithium Ion Battery

http://www.sukhumbank.myjino.ru

Rack Batteries

Tank Vent

Powerwall 15kw

Large Wicker Basket With Lid

316 Stainless Steel Handrail Rectangular Base

http://www.knf.kz

316 Stainless Steel Casting Hinge 50*50MM

Small Picnic Basket

316 Stainless Steel Casting Hinge 76*38MM

Large Wicker Laundry Basket

Empty Hampers

316 Stainless Steel Top Cap

Lined Wicker Basket

316 Stainless Steel 90 Degree Handrail Tee

China Dutch Kids Bicycle Suppliers

2+2 Seater Electric Golf Cart

20 Mountain Bike

6 Seater Electric Sightseeing Car

4+2 Seater Electric Golf Cart

menu.abilitytrainer.cloud

Element Folding Bike

Mountain Bike 26

6 Seater Electric Golf Cart

Child Riding Bike

6+2 Seater Electric Golf Cart

Decra Ceramic Roof Tile

Humidifier Perfume

Scent Diffuser Hotel

Glass Ceramic Roof Tile

http://www.sunflavour.co.jp

Aromatherapy Diffusers

Villa Ceramic Roof Tile

Car Oil Diffuser

Terracota Clay Roof Tile

Diffuser Fire

Colored Ceramic Roof Tile

http://www.xinpian.net

Forging Shaft

Kid Canvas For Colouring

5-Mode Rechargeable Zoomable 450lm Motion Sensor Headlamp

Forging Blank

Collapsible Portable LED Waterproof Tent Lantern for Outdoor

Dual Lighting Rechargeable Headlamp with Taillight

Parts For Automobile

Forging Roller

Crimping plier Tools

Collapsible Portable LED Tent Lantern for Outdoor

5kw Battery Storage

Home Solar Battery Storage

Solar Battery Storage System

Bonding Jumper

Solar Thin Film Panel Black Mid Clamp

radioklub.blansko.net

Battery Energy Storage

Solar Asphalt Roof Hook

Ess Flow Battery

Solar Mounting Panel Rail

Solar Panel Mounting Rails For Carports

DOB LED Power Chip

Heavy Duty Metal Storage Shelves

3 Tier Heavy Duty Shelf

Wire Rack Garage Storage

http://www.lovehere.club

KP10791WAP

Rectifier Bridge Integrated LED Power Chip

KP1079AWPA

18 Inch Deep Garage Shelving

Heavy Duty Corner Shelf

KP10790WAP

Cemented Carbide Nozzles

KP1071QWPA

Non-isolated LED Power Chip

http://www.hope.net.vn

KP1059AWPA

Cryolipolysis For Cellulite

High Efficiency Buck LED Power Switch

Friction Bearing

Lithium Battery Slitting Knife

KP1070QWPA

Cryolipolysis 2 Handles

KP1076AWPA

KP10752WPA

Automotive Impact Wrench

Impact Wrench Tool

http://www.thinkplus.tv

KP10750WPA

Air Impact Wrench 1 Inch

Impact Wrench Corded

KP10751WPA

Gambar Impact Wrench

KP1076BWPA

Universal Air Spring Kit

katowice.misiniec.pl

???????? ???? ????????? ?????? ????????? ???????? ?????????? 12000 ????

Heavy Duty Truck Airbags

???????? ???? ????????? ?????? ?? ??????????? ?????? ??????? ?? ??????? ????????, 12000 ????

Big Truck Air Bags

???????? ???? ????????? ?????? ????????? ???????? ?????????? 6000 ????

Shock Absorber Assembly

Air Bags For Semi Trailers

???????? ???? ????????? ?????? ?????????? ?? ??????? ????????? ???????? ?????????? 30000 ????

???????? ???? ????????? ?????? ?? ??????????? ?????? ??????? ?? ??????? ????????, 20000 ????

???????? ???? ????????? ?????? ?? ??????????? ??????????? ?????????? 30000 ????

China Car Charging Pile Supplier

???????? ???? ????????? ?????? ?? ??????????? ???? ??????? ??????? ?? ??????? ????????, 3000 ????

???????? ???? ????????? ?????? ?? ??????????? ??????????? ?????????? 20000 ????

China 100kw Inverter Manufacturer

Ev Charger Install

??????????? ???? ?????? ??????? ?? ??????? ????????, 6000 ????, ????????? ??????

Electric Vehicle Charging Station

???????? ???? ????????? ?????? ?? ??????????? ?????? ??????? ?? ??????? ???????? ?????????? 1500 ????

China Dc Coupled Inverter Factory

Usb C To Displayport Cable

KP1071QWPA

High Efficiency Buck LED Power Switch

KP1059AWPA

KP1070QWPA

Engine Wiring Harness Replacement

Waterproof Cable Assembly

Robot Cable Assembly

Non-isolated LED Power Chip

Usb Type C Cable Assembly

Sensory Dog Toys

Childrens Sensory Toys

Sensory Toys Target

Childrens Sensory Toys

Nine Layer PE Blown Film Machine

Surface Winder

Nine Layer EVOH Blown Film Machine

Gap Winder

Nine Layer PA Blown Film Machine

Sensory Toys For Teens

2.4inch tft lcd display

2.4inch lcd module

2.4 inch capacitive touch screen

Sunlight Readable Square TFT Color LCD Display

Blow Molds

Short Shot Molding

Pet Blow Molding

Cavity In Moulding

3.5 Inch Sunlight Readable 320×240 TFT LCD Display

Injection Molding Parts

Plastic Mold Components

Mold Maker

Injected Plastic Products

3.5 inch color display

Injection Moulder

TN TFT Module

1.5 Inch TN TFT Module

1.44 Inch TN TFT Module

Injection Mould Maker

Custom Tft Display

Storage Bags

Handbag

10.1 inch tft lcd high brightness display module

Solar Energy Bags

10.1 inch lcd with capacitive touch

10.1 inch 1280*800 lcd

10 inch lcd module

10.1 inch lcd screen display

Laptop Backpacks

Sport Bags

TFT LCM

Cable Gland Adaptor

Cable Gland Pg 16

Ccg Cable Gland

Small Size Lcd Modules

Cable Gland Pg 11

Cable Gland Jaycar

7.0 TN TFT Display

5.0 Inch TFT Display

640×480 lcd Module

Hard Sided Rooftop Camper

touchscreen

High Power Headlamp

Pop Up Car Tent

small tft screen

small lcd screen

small tft display

Small Roof Top Tent

4 Man Roof Top Tent

IPS displays

3.5 inch 320*480 TN TFT LCD module

Fennel Powder

1.77 inch 128*160 TN TFT LCD module

1.54 inch 320*320 IPS TFT LCD module

Boltless Rack

2.0 inch 240*320 IPS TFT LCD module

Heavy Duty Metal Shelving

3.5 inch 320*480 IPS TFT LCD module

Heavy Duty Wire Shelving

Echinacea Powder

Dog Chew

tft lcd manufacturer

Pets At Home Dry Dog Food

Training Treats For Puppies

hight brightness tft lcd

Steamed Chicken Breast

Cat Treat

10.1 inch color display

10.1 lcd 1024×600

10.1 tft display

Automatic industrial edge banding machine

Matching Christmas Onesies Manufacturers

Corset

Cabinet edge sealing machine

cnc router wood

Play Lingerie

open crotch stocking

Furniture edge banding machine

Office furniture edge banding machine

OEM Babydoll Chemise Supplier

Leopard Print Crystal Velvet

Mateer Filler

Vacuum Feeder

Super Matte Rabbit Fur

Leopard Print Flat Silk

Blue Jade Rabbit Velvet

Automatic De-Palletizer

Paint Can Filling Machine

Soft Drink Canning Machine

White and Purple Jade Rabbit Velvet

KMTYM Series Three Phase Motor Reversing Module

KGMB Series Three-phase Motor Reversing Module

Bohemian Style Decor

Home Office Decor

Room Decoration Items

Room Decoration Items

KMC Series Single Phase Motor Reversing Module

KSJD Series DC Motor Control

KSJR Series DC Output Motor Control

Modern Home Decor

4D 7D 2in1 HIFU Face Lifting Machine

Velashape III Cellulite Removal Machine

Plush Toy Bear

Endospheres Inner Ball Body Slimming Machine

Beer Bottle Cooler Bag

Baby Diaper Caddy Organizer

Plush Dog

Trusculpt 3D ID Cellulite Removal Machine

7D LIPOSONIX Vmax HIFU 3in1 Machine

Baby Shoulder Carrier

wood sander machine

edge banding trimming

Grinder Grinding Wheel

Norton Ceramic Sanding Belts

Diamond Impregnated Concrete Floor Pads

Drum Sander Machines

Irregular Abrasive

Norton Ceramic Sanding Belts

sheet metal laser cutting machine

wood edge bander machine

New Energy Garbage trucks

New energy Detachable Container Garbage Truck

Weather Balloon Manufacturers

Weather Balloons For Sale

Noaa Weather Balloon

Hwoyee 750g Meteorological Balloon

Weather Balloon Height

Garbage Trucks

Pure Electric Garbage Truck

New energy garbage truck

Pure electric Coaches

Micro Cmos Camera Module

internal combustion Coaches

ODM 2.4 Tft Spi 240×320

Motion Sensor Doorbell Camera

OEM Lcd 7 Inch

Pure electric coach auto

internal combustion coach auto

Visual Doorbell Camera Module

New energy coach auto

Cnc Metal Laser Cutter

Silicone Heat Transfer Printing

Heat Transfer Printing

Heat Transfer Printing for Toy

Good Price High Quality Custom Mens Muscle Slim Fit Organic Cotton Blank Gym T Shirt Mens Workout Fitness Tshirt

Oem Workout V Neck Women Cropped Hoodie And Jogger Women Heavyweight Custom Hoodies Embroidered

Cnc Laser For Sheet Metal Cutting

Kids Toys

Heat Transfer Printing for Plastic Tableware

Fiber Laser Cutting Machine 1000w

Customize Label Acceptable High Quality Crop Price Women Drawstring Cropped Winter Hoodies For Women's

automol.by

Cnc Laser Metal Cutting Machine

Metal Pipe Laser Cutting Machine

Wholesale 500gsm Heavy Plain Custom Heavyweight Distress Oversized Blank Stone Acid Vintage Wash Hoodie Essentials Hoodie

High Quality Manufacturer 100% Cotton New Style Dark Green Black Multi-color Simple Hoodie Men Hoodie

Customizaton Logo Oversized Street Wear Short Sleeve All-math Breathable Cotton Casual Women Tshirt

Car

Customization Vintage Y2k Streetwear Mineral T-shirts Quality Acid Wash Washed Print Women T Shirt

skylets.or.jp

Kitchen Rugs

cars

Women's Plus Size Unisex Women's Graphic T-shirt Street Apparel Harajuku Women's Top Y2k Vintage T-shirt

Artificial Grass

New energy MPV

Oriental Carpet

Vehicles

High Quality Custom Personality Letter T Shirt Summer Cotton Clothing Fashion Casual Streetwear T-shirts

Pvc Carpet Flooring

SUV

Artificial Turf

China Factory Streetwear Oversized Funny Print Women T Shirt Hip Hop Metal Rock Gothic Women T Shirt

Pipe Carbon Steel

Carbon Welded Steel Pipe

K Cup Coffee Maker CM-206

Pastel Hoodie – Soft Cotton Oversized Pullover For Women And Men

High Quality 2023 New Design Y2k Girls New Arrivals Letter Black Color T Shirts Tops For Women Crop Top

Quality Summer Fashion New Waterproof Over Size Sport Short-sleeved Basic Bodybuilding T Shirt For Men

Laminated Chipboard

Plywood Interior

Solar Lights

Men's Blue Pullover Hoodie – Oversized Cotton Sweatshirt For Street Style

Solar Wall Lights

Navy Blue Zip-up Hoodie – Men's Heavyweight Cotton Streetwear

Air Humidifier

orden.coulot.info

2 in 1 K Cup Coffee Maker CM-208RM

Chipboard Melamine

Floor Mat

China Factory Vanquish Tops Tees Male Casual Y2k O-neck Clothing Casual New Fashion Multi Color Men T Shirt

China New Design High Quality Cartoon Graphic Print Men T-shirt Summer Casual Multi Color Men Tshirt

Foldable Chair

Solar Outdoor Landscape Torch Light

Camping Table Adjustable Legs

Solar Garden Flame Light

Camping Cupboard

Sun Protection Beach Tent

Solar Crystal Ball String Lights

Air Humidifier

Solar Cork Light

Casual Y2k O-neck Clothing Custom Breathable Men's T-shirts Vintage Washed Cotton T Shirt Daily Wear Men Tshirt

Summer Men Fashion Cotton T-shirt Breathable Men's T-shirts Vintage Washed Cotton T Shirt Daily Wear Men Tshirt

abam.co.il

China Factory Customized Short Sleeve Main Striped Men T-shirts New Loose Contrast Summer Men Tshirt

200ml Oral Irrigator Portable Water Dental Flosser

szklarski.pl

ft lcd

custom lcd

Casual Daily Wear

Water Flosser Test

Funny Sloth Printed Cotton T-shirt For Men

Men's Collector's Graphic Tee

Designer Casual T Shirts Regular Fit High Quality Men Famous Brands Cotton Curved Hem T Shirts For Men

Designer Custom Vintage Cotton Polyester Sports Fitted T Shirt Gym Running Fitnessfamous Brands For Men

4.3 inch touch lcd

Low Pressure Water Irrigator

Cordless Toothbrush

4.3 inch ips tft lcd module

Oral Water Irrigators

2.4 inch lcd 240×320 st7789v tft display

wvga tft lcd display

Men's Black Hoodie With Dragon Print Oversized Streetwear Sweatshirt

http://www.profkom.timacad.ru

Self Loading Concrete Mixer Machine

Oversized Streetwear Essential

Heavyweight Men's Hoodie

Cropped Hoodie Men With Graphic Design Modern Streetwear Zip-up Sweatshirt

480*800 dot matrix lcd module

3.5 Color Lcd touch screen

Building Mixer Machine

Heavyweight Streetwear Style

custom lcd touch screen

Grout Injection Pump

4.3 inch color lcd module

Pump Concrete Truck

Mini Concrete Pump

Black Rubber Mat

Custom Clothing Manufacturers High-quality Cotton Oversized Hoodie

Coloured Gym Flooring

Vintage Inspired Distressed Graphic Hoodie Men's Streetwear Pullover

Natural Gum Rubber Sheet

http://www.licom.co.jp

Mini Coach Bus

New energy Mini Bus

Men's Casual Hoodie With Monster Print Streetwear Collection Heavyweight

Men's Tracksuit Cotton Hoodie With Zip Up Design

Rubber Matting For Shed Floor

Black Hoodie Men's Streetwear With White Graphic Print

Workbench Mat

New energy Mini Coach Bus

School Coach Auto

Electric Mini Bus

Foxboro FBM204 P0914SY

szklarski.pl

Mtz/Belarus Tractor Spare Parts Oem A61.04.000

Foxboro FBM218 P0922VW

Zetor Water Pump 49010651

Foxboro CP40

Gear Pump Nsh-10u-3 Right

Men's Light Grey Hooded Pullover Cozy Soft-touch High-quality Cotton Rich Fabric Modern Relaxed Fit Casual Streetwear Hoodie

Men's Color Block Zip-up Hoodie In Navy And Orange Athletic Street Style With Comfortable Cotton Blend Versatile Hoodie

Mtz Belarus Control 50-3502030-A

Russia Tractors Mtz Water Pump 245-1307010-A1-07

Men's Custom Logo Blank Drop Shoulder Hoodies Hooded Oversize Pullover Sweatshirt 100% Cotton Heavyweight Hoodie For Men

Foxboro FBM241c P0914WM

Foxboro FCM100ET P0926GS

Edgy Distressed Grey Hoodie For Men Soft Cotton Casual Pullover Durable Urban Streetwear Cozy Heavyweight Design

Light Grey Detailed Pullover Hoodie Men's Trendy Oversized Streetwear Comfortable Cotton High-quality Hooded

Double Bowl Sink

100% Cotton

http://www.oby.be

100% Cotton Streetwear

Concealed Kitchen Faucets

Cropped Hoodie Men With Graphic Design Modern Streetwear Zip-up Sweatshirt