What is the Fund KYC Requirement?

The government of Singapore is doing what it can to regulate its financial institutions. Its measures revolve around detecting, deterring, and preventing illegal activities such as fraud, terrorism financing, and money laundering. MAS has also put that responsibility on payment service providers, trust managers, insurance brokers, financial advisers, and fund managers. Therefore, these parties need to carry out various checks such as AML, CFT, and KYC. Our focus is KYC.

What is Fund KYC?

KYC is the abbreviation for Know Your Customer. As the name suggests, it involves verifying your customer’s identity. The process can be done at the beginning of the business collaboration or before that. It is a common term in banks in the verification process of a regulated customer while assessing and monitoring their risks. In anti-money laundering, KYC is also a tremendous player.

Why is Fund KYC important?

For investors, a Fund KYC check is an ideal way of mitigating risks and building trust. It is one way of assuring your clients that they are dealing with a legitimate organization. Financial, especially investment activities, tend to thrive under such circumstances since the environment is secure and trustworthy. Therefore, that makes the efforts you put in carrying the checks worthy.

Besides earning their trust, it also prevents your company from associating with terrorists, fraudsters, and terrorists. After all, it becomes easy to detect transactions related to such people. Consequently, the company gets to deter it and, above all, prevent its occurrence. That’s a plus since an association with illegal activities could cost you the business and clients.

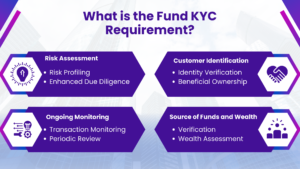

What do KYC of Fund Checks Entail?

The checks have some variations depending on the amount of investment, the risk appetite of the particular business, and the client demographics. Nevertheless, there are standard requirements.

- One of them is the identification documents verification. If you are a company, the identification documents are Government Licenses and certified articles of incorporation. On the other hand, an individual submits a passport or its equivalent.

- You need to check a reliable commercial database for the name of the individual company or group in the list of AML/CFT sanctions.

- Confirm that they are not Politically Exposed People or affiliated with them.

- Use all that and internal measures to determine their risk

If the deal involves a substantial amount of money, you need to do even more. It is also the same case if the risk is enormous.

- Identify the source of income of your client

- Assess their ability to invest in that particular market

- Find out their backgrounds, credit profiles,s and financial portfolios in detail

Conclusion of Fund KYC

The findings should be in the form of a report. It comes in handy during regulatory checks, audits, and records retention. Therefore, every company should adopt it since it is an effective risk management strategy. It is one sure way of avoiding associating with clients involved in illegal and shady businesses. That’s because what is at stake if that were to happen can be too much to bear. Can you imagine losing your business or having one without clients? That would be terrible, but Fund KYC can help you avoid it.

Wow! Your blog post blew me away! Your ability to dissect complex topics and present them in a relatable, no-nonsense way is simply genius. Allow me to share with you and your audience about my first-hand experience of this ultimate Giant Killer! =>> (https://bit.ly/ai-biz-builder). With only One Keyword, One Description and One Click, this game-changing AI-powered wizardry Business Builder and Marketing Assistant devastates any competitors to achieving the Superior Lead Conversion by way of creating effortlessly all-in-one tasks similar to the likes of Wix, Hubspot, Chatgpt to Jasper, Canva, Invideo to Adode Photoshop, Midjourney, Speechelo to Convertkit, Pushit and many more. No other AI tools can stand against its might. Harness the unmatched power of this Giant Killer and unleash your business’s limitless potential. And here’s the cherry on top! During this exclusive launch, you can access all these incredible benefits for a limited one-time fee. Plus, a generous list of bonuses to fuel your business growth and add immense value to your establishment. I am so confident that you’ll fall head over heels for this product as it comes with a 30-Day Money-Back Guarantee. It’s a risk-free opportunity you simply can’t miss! Trust me, I’m not just blowing smoke. I’ve personally experienced the sheer awesomeness of this product, and I’m not alone. Over 15,000 users have already joined the revolution, and the numbers keep growing. Don’t wait, click here =>> (https://bit.ly/ai-biz-builder) to conquer the market today! For Indepth Video Guide and Reviews, Visit =>> https://bit.ly/biz-builder-bot

Your blog article is informative and captivating, offering valuable information in a clear and clear manner. The site’s appealing layout and easy-to-use interface improve the overall reading experience. Keep up the great work! Freshly returned from an awe-inspiring vacation in Italy, I set out on an extraordinary exploration that unveiled the captivating hidden treasures of the country -> https://cutt.ly/KwuanRq2. Surprisingly, it defied my financial limitations, courtesy of the unparalleled support provided by -> https://cutt.ly/RwuacsAh and covered by -> https://cutt.ly/mwuacSHx. Their efforts nothing short of enchanting, turning my aspiration into an enchanting reality. 😍✨ Indeed, it was an emotional journey that touched my heart, leaving me overwhelmed with gratitude. 🙏💖

What is the Fund KYC Requirement? RT Compliance

[url=http://www.g0450h77cd8rzwlz5iy96e5tm3l1857bs.org/]ujtddikvv[/url]

jtddikvv http://www.g0450h77cd8rzwlz5iy96e5tm3l1857bs.org/

ajtddikvv

アプリのコピーできない文字列をコピーできるようにする

Amino Tadalafil

Twin Port TypeC+C Usb Charger Socket Module

ブランドサングラスコピースーパーコピーブランド

Fully Automatic Gypsum Wall Panel Equipment

Desktop Storage Drawers A4

ルイヴィトンルイヴィトン財布コピー

Soft Eva Orthopedic Sneaker Insole

Hybrid Power Street Light

Upholstered Toilet Chair With Bucket And Lid

シャネルスーパーコピーサングラスブランド優良店

Slip Ring Electrical Connectors

Small White Dresser

Conerete Mixing Plant

韓国バッグスーパーコピーと韓国バッグコピー専門通販店

13mm Wafer Head Screws

ブルガリ時計スーパーコピー

Automatic Feeder

Ocean Shipping Services to Cotonou Benin

Downhole Mud Motor

ロレックススーパーコピー時計

078 903 133 Q

Explosive Ordnance Disposal

ブランドコピー優良店代引き

06B109477

Laser Body Hair Removal Machine

釜山ブランドコピー

Conakry Guinea

Kids Lunch Box Stainless Steel

スーパーコピー級品ブランドコピー販売

Computer Backpack

ブランドのコピー商品を購入すると罪になる弁護士

Air Freight

ブランドバッグコピー偽物専門店スーパーコピーブランド

Medical Non Woven Fabric

01214165A

Формованные графитовые кольца

Niobium Bar Stock

楽天ブランドスーパーコピー代引き激安販売通販

Mixing Granulator

Auto Deluxe

ブランドコピー国内持ち込み

ブランドコピー通販ブランドコピースーパーコピー

Вермикулит 835 Спиральная прокладка

Club Bell

Plywood For Wardrobe Doors

Rotogravure Printing Machine

ブランド時計スーパーコピー逮捕

Drilling Screw Threading Machine

スーパーコピー時計ロレックス

Testosterone Phenpropionate

330612107

White High Back Office Chair

ブランドコピー時計後払い

Vintage Clear Glass Marbles

Прокладки с металлической оболочкой

安心ブランドコピー

Ladys Sweaters

6N0919051K

ブランドスーパーコピー級品財布バッグ時計代引き優良店

ブランド偽物ヴィトンシャネルグッチプラダエルメス通販

Stainless Steel CNC Machining Thru Bolt

Military Drone Cost

Dig A Dozen Dino Eggs

スーパーコピーブランド財布代引き激安通販専門店

Block Bitumen Melting Equipment

Linear Shower Floor Drain Horizontal Outlet

Airless Stain Sprayer

国内発送スーパーコピー時計

Stepper Risers Only

amazonブランドコピーバッグ

Brass CNC Machining Brass Screw

iphone8ケースブランドコピー激安

Automotive High Current Relay

Packet Broker Replication Aggregation

Common Rail Fuel Injector Control Valve F00VC01022

Bomb Jammer

グアムブランドコピー

Fuel Nozzle DLLA155P180

ブランドコピーiphone11

Filament Nonwoven Geotextiles

ウブロ時計コピー韓国ブランドコピー韓国

2 Oz Candle Tins

Fuel Injector Nozzle DLLA150P326

ブランドコピー市場スーパーコピー時計ブランドコピー通販

Solvent Yellow 114 Freight

Набивка из углеродной пряжи, пропитанная смазкой из ПТФЭ

Medical Endoscope Control Board

Glue Spray Equipment

東京ブランドコピーショップ

スーパーコピーブランド専門通販店大人気ブランド

Fuel Injector Nozzle DLLA148P513

Cutting Ribbon Cable

Bathroom Wall Set

エルメス財布スーパーコピーエルメスコピー財布好評通販中

Fuel Injector Nozzle DLLA150SND346

株式会社ブランドコピー激安人気館

Recycled Semi-Finished Products

Fuel Nozzle DLLA155P180

Fuel Injector Nozzle DLLA144S485

スーパーコピー時計ロレックススーパーコピーブランド

Augurs/Core Barrels

Peel Stick Hdpe Sheet

285-635 Red Copper Two Conductor Spring Clamp Terminal Block Installation Side And Center Marking

iphoneseケースブランドコピー

Sausage Linker

Electrical Heating Thermal Oil Heater

年月日ブランドスーパーコピー通販

Camping Night Light

Bar Counter

虹ブランドコピー

Shoulder Bag

韓国バッグスーパーコピーと韓国バッグコピー専門通販店

Golf Umbrella

ブランドコピーネックレス

Wooden Drum For Cable Packaging

Semi-automatic Fire Extinguisher Nitrogen Filling Equipment

Brass Rod Breakdown Machine

Eyeshadow Brush

ブランドコピーモンクレールブランド偽物

Vacuum X Ray Tube

ブランドコピーベルト代引きスーパーブランドコピー時計

Party Hat

Road Lamp

Duplex Steel S32205 Slip on Flanges

ブランドスーパーコピー偽物財布バッグ時計コピーなど

ブランドコピーiphone8

Charge Air Cooler Tubes

Folold Plastic Crate Mold

Brush Roller for Sanding

スーパーコピー通販コピーブランド優良店

G-Spot Thumping Rabbit Vibrator

Grow Lamps

深センスーパーコピー時計

Consumer Goods

RC Plane

ブランドコピー税関没収法人

Iqf Frozen Green Beans

Flashing Fiber Optic LED Hair Braid

12 Button Pin Pad

韓国スーパーコピー通販韓国ブランドスーパーコピーランク

ブランドスーパーコピー時計級品の偽物通販専門店

Empty Nylon Nib Liquid Eyeliner Pencil

Tecumseh Air Conditioner

Empty Lip Gloss Pen

Ash Filter Paper

素晴らしいスーパーコピーブランド通販サイト

Cas 149 91 7 Gallic Acid

ブランドコピー傘

Ice Silk Figuredstripe Neck Polo Shirt

スーパーコピーブランド知恵袋

2 Phase I/O Control Stepper Driver Precise And Reliable Control

Vibration Isolation System

ブルガリピアスコピーブルガリ時計ハートスーパーコピー

BLDC Motor Controller For Fan

Tiny 2 Phase Stepper Driver Mini

ブランドコピーメルカリ

Ceramic Auto Rotating Cordless Hair Curler

Al2o3 Parts

スーパーコピーブランド国内販売店

Level 2 Charging Rate

PTFE Multifunctional Crude Oil Delivery Hose

Digital 4 Phase Stepper Driver For Stepper Motors

コーチスーパーコピー靴のブログ楽天ブログ

Kitchen Sink Filter Net Strainer

220KV 30 Meter Independent Lightning Protection Tower

Fiberglass Angle

hyt時計スーパーコピー

Absolute Position Encoder

ロレックススーパーコピー時計ブランド時計コピー激安通販

Integrated Nema23 closed loop stepper motor

クロムハーツピアススーパーコピー激安ブランドコピー服

Carbon Steel Solar Carport Mounting System

Indoor outdoor boots suppliers

Triclopyr Herbicide For Creeping Charlie

ブランドコピー品サイト

The Brief Introduction to Brown Salad Paper Bowl

Machine To Make Gummies

xperiaz5ケースブランドコピー

Components of Seamless Nylon Leggings

How many miles do engine mounts last

Heavy Duty Garage Springs

グッチベルトコピーブランドスーパーコピー通販

Sideboard

ブランドコピー代引き対応バッグブランドコピー

What is an Artificial Lawn Cutter

ブランドコピースーパーコピー通販市場

Anti UV Black Nylon Industrial Yarn

Dk111 Opc Drum

Lithium Coin Battery

Blue Glass Candle Holders Antique

ゴヤールスーパーコピーブランドコピー専門店

楽天市場ブランドコピー財布の通販

round neck short sleeve t-shirt

Medical Equipment HDI PCB

Folding Solar Panel 60w

Round Aluminium Container

セリーヌ財布スーパーコピー財布スーパーコピー

Mppt Solar Inverter

ブランドコピーアプリ

Anti-slip Carpet Tape

Acrylic Fireproof Cloth

時計スーパーコピー2019ch

18 layer 3step HDI PCB

スーパーコピーブランド討論区

Monkfruit Extract Powder

EV Charging Plug for Tesla

香港穴場ブランドコピー

Window Insulation Film

Caravan Food Truck

antique wooden photo frames

韓国シュプリームスーパーコピーブランド専門店

roll out 1 compartment chicken nesting box

N9923A FieldFox Handheld Microwave Spectrum Analyzer

韓国ブランドコピー韓国スーパーコピー

Dental Lab Furnace

ブランドコピーiphone11pro

Salt Water Desalination Plant

The Origin of Artificial Flowers

Container Lock for Trailer Parts

Pet Friendly Turf

詳細検索韓国スーパーコピー通販韓国ブランドコピー

Car Diffuser Rotating

時計スーパーコピー5ch

Cnc Machining Center

8lb Medicine Ball

ウブロ時計スーパーコピーブランド級品優良店

DC52D+Z Color Coated Galvanized Steel Coil

ブランドコピーカフリンクス

Lithium Portable Power Pack

DX52D+Z Color Coated Galvanized Steel Coil

セブ島スーパーコピー時計

Tire Pump for Car

Wholesale Bagasse Tableware

Pipe Socket

時計スーパーコピークォーツ

Extrusion Line for Solid Wall Pipe

Tracker System For Solar Using Dual Axis

Crystal Clear Soft Vinyl Film

時計スーパーコピー優良店

韓国時計ブランドブランド時計コピー代引き

Why are plastic plates better

High Temperature Resistence Magnet

Portable UAV Detection and Direction Finding Equipment

Disposable Paper Plates

おすすめサイトスーパーコピーブランド販売と買取

ブランドコピーブランドコピースーパーコピーブランド

Lithium Iron Phosphate Battery

Ss304 Round Head Bolt

Honeycomb Board For Boats

Hooks

アルマーニエクスチェンジブランドコピー服痞客邦

素晴らしいブランドスーパーコピー通販サイト

Disposable Dessert Forks

Assembly Machine

コピーメカキャッチコピー自動作成サイト

BAP300R End Mill Holder

axial type thermal fuses

What is the relaxation principle of the Vibration Massage Gun

jazzmouth.org

Ilmenite Uses

Brass 2 Way Garden Hose Connector

LCD Digital Infrared Thermometer

Chloride Process

Titanium Dioxide Tla100

15kw Frequenc Inverter

Camping Fan with LED Lantern

http://www.shidai5d.com

Webster Hardness Tester

The role of trekking poles

Vickers Scelemeter

Pencil Hardness Test Standard

ST01Z Color Coated Galvanized Corrugated Sheet

DX51D+Z Color Coated Galvanized Corrugated Sheet

http://www.modecosa.com

Type Cable

DX53D+Z Color Coated Galvanized Corrugated Sheet

Mini Usb Cable

Usb A

30kw Military Generator

Cummins Residential Generators

DX51D+AZ Galvanized Square Tube

Cummins Residential Generators

H300LAD+Z Galvanized Square Tube

egservice.com.ve

HC340LAD+Z Galvanized Square Tube

Tie Rod Assembly 48510-2S485

Wheel Bearing 42410-30020

Remote Control Toilet

Vanity Bathroom

deshengst.cnv.vn

Bathroom Shower Pan

Hub Bearing 42410-42040

Mens Rose Gold Necktie

Corrugated Bubble Envelopes Bags

woodpecker.com.az

Mens Shawl Scarf

Flannel Scarf Mens

Printed Honeycomb Paper Mailers

100% Recycled Poly Mailer Bag

roody.jp

Dx51d Galvanized Steel Coil

Wedge Anchor

Galvanised Steel Coil

Sleeve Anchor

Anchor

Cold Rolled Galvanized Steel Coil

Ceramic PCB

High-power LED ceramic PCB

Thin Film Circuit Board

sceaindia.org

Positioners And Actuators

Granular Pe Wax

Fischer Tropsch Synthetic Wax Composition

Hello to every body, it’s my first go to see of this website; this blog contains remarkable and genuinely good information for visitors.

Teddy Bear Filling Machine

Polyester Fiber Opening Machine

Waterproof and Dust Proof Breathable Membrane

Down Pillow Filling Machine With Foam Core

Basic maintenance of motorcycle helmets

Common fault analysis of vertical sawmill

jakubdolezal.savana-hosting.cz

Pvc Bathtub Mat

http://www.titanium.tours

Wooden Flat Ceiling T Grid

Wooden Fut Ceiling T Grid

Quick Drying/Fast Drying Bathtub Mat

Quick Drying/Fast Drying Bath Mat

T Bar Suspended Ceiling T Grid

candy machine com Youlu Machinery Technology Co Ltd

Solar Lights Outdoor

Outdoor Garden Lights

http://www.den100.co.jp

Alltop Solar Street Light

orans sanitary com Orans s r l

yanasibathroom com Jiangmen Yanasi Sanitary Ware Co Ltd

korchambiz.blueweb.co.kr

A4 Notebook Premium Leather Compendium Portfolio

Led Panel On Wall

Fine Pitch Led Display Screen

A5 PU Leather Notebook Soft Cover

Led Floor Panel

Custom Leather Notebook Made In China

Paper Packaging Products

Research direction of industrial endoscopy

stainless electrical cabinet

Brown custom kraft paper bag

Food Take Away Boxes

roll out 1 compartment chicken nesting box

kinnikubaka.xsrv.jp

Floor Paint Water Based

Carbon Steel 4.8 8.8 10.9 12.9 Flat Waterproof Long Blind Rivnut Tool Kit Reverse Nutsivet Rivet Nut

Water Based Epoxy Floor Coating

Aluminium Cylindrical Waterproof Blind Knurled Flat Head Carbon Steel Rivet Nut

Flat Head Hex Body Aluminium Sheet Metal Carbon Steel Brass Cylindrical Rivet Nut

skylets.or.jp

Rohs Epoxy Coating

Children Drawing Book Printing

Superior

kinnikubaka.com

Stitched Books

Child Sticker Books

Metal con madera

Acabado blanco antiguo

Double Line Drip Tape Machine

Irrigation Hose Pipe

Auto parts Power steering pump Professional producer For Fiat OEM 504046460

olfrontals.com

Easter Puzzle Game for Children

Hrc Hardness Tester

Watercolor Pan Sets

Connettori terminali della batteria

http://www.gataquenha.com

“Connettore Terminale Ottone” – translates to “Brass Terminal Connector”. This keyword will help the purchaser find connectors with brass terminals

Seedling Pot Tray Making Machine

Barriera della strada in italiano (Road barrier in Italian)

PVC Sheet Blister Machine

Seedling Tray Making Machine

Functional Home Decorative Metal Brackets Stamping Parts

Boom Lift Battery

Triangle Brackets

Angle Brackets

36v Lithium Battery For Golf Cart

Lifepo4 Forklift Battery

http://www.jakubdolezal.savana-hosting.cz

Wet Vacuum Cleaner for Car

Automated Molecular Diagnostics

Ce Ivd

http://www.sp-plus1.com

Water Vacuum for Car

Gynecological Tumor Detection Reagent

Small Vacuum for Car

Branch Shredder

dasanms.com

Giant Wood Chipper

Big Wood Chipper

Expanded Ptfe Sheet Gasket

Expanded Ptfe Gasket

Expanded Teflon Gasket

Color-marking Co-extrude Equipment

keyservice.by

Conical Type Twin-Screw Plastic Extruder

Electric Two Wheeler

Single-screw Extruder

Good Mountain Bikes

Fast Electric Scooter For Adults

Tricep Rope Pull Down Attachment

pawilony.biz.pl

Watercolor Pan Sets

Auto parts Power steering pump Professional producer For Fiat OEM 504046460

Fitness Gear Landmine Attachment

Dual Landmine Attachment

Easter Puzzle Game for Children

garden-green.pl

Water Purifier Model

Brushless Motor

Water Filter Ro Price

Water Purifier Tablets

Brushless Gear Reduction Motor

Bldc Motor

Microduct Connectors

Compound fertilizer granules making equipment

Food Waste Fertilizer Machine

soonjung.net

Npk Fertilizer Machine

Pneumatic Fitting

Straight Microduct Connector

Gel Nail Polish Wholesale

Neon Nail Polish

Rubber-steel Gasket

Cosmetics Nail Polish

Rubber-steel Gasket with an Internal O-rings

http://www.naturehealth.eu

Red SBR Rubber Flange Gasket

Disperse Red F-3BL

Blower

Blower Fan Motor

Disperse Red FB 200%

http://www.dblink.co.th

Brushless Dc Blower

Disperse Blue SY-FGB

Backpack For Trekking

26mm Carbon Brush DC Motor

28mm Carbon Brush DC Motor

30mm Carbon Brush DC Motor

Canvas Backpack

Fidget Backpack

http://www.isotop.com.br

Hydraulic Pile Driving Hammer

Pile Driver Video

Carbon steel U-bolt Dacromet

http://www.coldcove.com

Carbon steel U-bolt assembled Zinc plated Yellow

Hydraulic Pile Driver

Carbon steel U-bolt squash flat HDG

Mechanical Car Park System

Hex Bolt

Underground Car Parking System

Bolt

Flange Bolt

Stacker Parking

http://www.sailingteam43.it

warszawa.misiniec.pl

Vegan Chickpea Pasta

Solar Panel Wall/Tilting Mounting Brackets C Channel Profile Cold Formed Hot Dip Galvanized for Metal Roof

Solar Power System of Adjustable Solar Panel Mounting Brackets Structure for Solar Panel Products Solar Energy System/ Caravans

Green Peas In Tamil

Natural Wasabi green peas

Factory of Aluminum Alloy Flat/Tin/Tile/Pitched Rooftop/Ground/Farmland/Carport/Greenhouse/Agriculture Photovoltaic Panel Solar Mounting Rack Brackets

Mining bolt forging

High-strength mining bolt

Sagitar Fuel Pump 2015-2019

Caddy Fuel Pump 2004-2008

Beetle Cabrio Fuel Pump 2013-2019

Heavy-duty hammer-head bolt

rosexport.su

Touan Fuel Pump 2018-2023

Passat Fuel Pump 2018-2024

Magotan Fuel Pump 2016-2024

Dog Paw Print Ice Cube Tray

sudexspertpro.ru

Motorcycle Soap Mold

Molded Motorcycle Ear Plugs Uk

Portable Car Heater

How does a Trigger Gun lock Work

Definition and Product Features of Commercial Dispenser

Heater Blower Motor

http://www.mcsir.skarzysko.pl

Battery Cabin Coolant Heater

Led Outdoor Display Module Panel

new capacitive pos touch screen pos machine

Hdpe Liner Welding Machine

Stone Pond Liner Edging

clearwaterrv.net

Watercolor Paint Sets for Adults

Features of Golf Umbrella

Water Fountain Liners

36mm Brushless Motor With Different Driver Options

36mm 12V/24V Low Noise Brushless DC Motor

36mm Inner Rotor BLDC Motor for Air Purifier

Adjustable Commode Chair

http://www.benten.org

Seat Up Down Wheelchair

Powered Toilet Lift

Dental Lab Materials

Skin Rejuvenation Equipment

PTFE Rods

PTFE Tubes

Medical Device Distribution

High Performance Plastics

xuongsi.com

Thermal Pad Pcb

China Notebook With Pen Manufacturers

China Note Book Notebook Manufacturers

http://www.gesadco.pt

Heatsink Thermal Paste

China Custom Notebook Printing Suppliers

Thermal Gel

Smart Retch Frequency Wrinkle Removal Machine

Lip Makeup

Hook And Loop Velcro

Elastic Straps

Crystal Clear Soft Vinyl Film

Why recyclable bags are better

gaucbc.org

Ampler Bike

Three Wheels Car

Car Charging Stations

Ring Joint Flange Gasket

hcaster.co.kr

Rtj Ring Gasket

Rtj Flange Gasket

http://www.firma.js.com.pl

Marine Steering Wheel

Brass Bronze Parts

Integrated screw air compressor

Copper Plated Marine Hardware

Commercial Portable Air Compressor

Industrial Screw Compressor

http://www.czarna4.pl

Ozone Generator

Wifi Valve Controller

Air Filter

Flow Meter Controller

Motorized Ball Valve Actuator

Purification Equipment

Pipeline Valve Controller

Mechanism Panel

Ultrasonic Sensor Khz

Clean Sampling Car

Cleanroom Pass Box for Lab

French Horn Mushroom

Mushroom Farm Near Me

Brown Beech Mushroom

Mushrooms On Discount

drum.arsnova.com.ua

Single Person Steel Plate Air Shower Room

King Oyster

Mechanical Interlock Pass Box

Stainless Steel Air Shower Clean Room

Cleanroom Mechanical Interlock Pass Box

Chip

Horizontal High Speed V Cutting Machine For Metal Plates

Horizontal High Speed V Slotting Machine

V-Shaped Grooving Machine

CNC Horizontal High Speed V Grooving Machine For Metal Plates

Substrate In Semiconductor

CNC Horizontal High Speed V Grooving Machine For Stainless Steel Plates

http://www.dinhvisg.com

Aln Wafer

Aln

Wafer Crystal Orientation

menu.abilitytrainer.cloud

Mist Fan with Humidifier

Mist Fan RC Control

Mist Fan for Household Use

PVC

Macchine per la lavorazione del metallo

Metalliche di marca

18 Inch Deluxary Pedestal Fan RC Control

Fune metallica galvanizzata

Mist Fan With Remote Control

Cavo in acciaio inossidabile rivestito

modan1.app

Tubes Filling Machine

rotary pump price

Intumescent Fireproof Paint

Vacuum Toothpaste Mixer

Non-Intumescent Fireproof Paint

Fire Retardant Paint For Steel Structures

Fire Retardant Paint For Wood

Automatic Cartoning Machine

Mayonnaise Machine

Cosmetic Anti-dandruff Agent Climbazole

Cylinder Metal Zipper Pencil Case

Crosswalk Light

Exit Sign With Emergency Lights

Exit Sign Lights

Brown Bear Embroidered Pencil Case

sakushinsc.com

Large Capacity Pencil Case

Printed Monster Face Leather Pencil Case

Black Oxford Cloth Printed Pencil Case

Emergency Lighting Exit Signs

Traffic Signals Lights

PVC Shrink Wrap Customized Shape

Gift Box PVC Shrink Wrap

fujispo.xsrv.jp

Macrame Mini Plant Hanger

Mini Order PVC Shrink Wrap

Wood Heater With Cooktop

Wood Burner With Hot Plate

Bath Bomb PVC Shrink Wrap

Cold Rolled Steel Coil

Puppy Pen With Base

Cosmetic PVC Shrink Wrap

thinkplus.tv

Tracking Bl

Cargo Tracker

OBD GPS Tracker

LSR Medical Silicone Tube Drainage Tube

LSR Medical Grade Silicone Tubing

LSR Medical Grade Face Mask

LSR Automobile Parts Miscellaneous Parts

LSR Medical Silicone Components

Wireless Tracker

Echtzeit-GPS-Tracking-System

Glass Cooking Pot

Hand Gear

Butterfly Valve With Gear

Worm Wheel Gearbox

beackgol.co.kr

Bevel Gear

Glass Cooking Pot

EVE 3.2V 280Ah Battery Cell

EVE 3.2V 304Ah Battery Cell

Glass Cups

Valve Gear Actuator

Electric Side Step PCBA

Tank Hookah

Gravity Hookah

Glass Smoking Pipe

Center Console PCBA

Glass Smoking Sets

sondage.u-paris2.fr

CAR Inverter PCBA

OBD PCBA

Electronic Air Pump PCBA

Gravity Hookah

yandanxvurulmus.VNjyv90zlGwO

Grey Guipure Lace Fabric

Frozen Squid Ring

Black Guipure Lace

http://www.mix.com.az

Nylon Lace

Frozen Squid Tentacle

Lace Guipure

Frozen Squid Ring Skin Off

Frozen Squid Flower

Frozen Squid Tube

Beaded Lace Fabric

Potato Rotary Washer Machine

Centrifuge Sieve Equipment

Potato Starch Vacuum Filter Machine

4 mm Mirror Aluminium Composite Panel

Home Appliances

4 mm Exterior Wall Aluminium Composite Panel

Potato Rotary Washer Machine

Carbon Crystal Panel

company.fujispo.com

GT Plywood

Cassava Paddle Washer Machine

IEC 62930 Solar PV Cable

Compressor Car Refrigerator

Micro Inverter Power Cable

Parking Air Heater Spare Parts

Wood Warming

yoomp.atari.pl

Exhaust Pipe

Installation Tool

Engine Preheater

IEC 62930 Tinned Copper PV Cable

Solar Power Cable

Lightning Arrester In Substation

Chinese course HSK 4 B

Surge Arrester

Chinese online 1-to-1 course

Chinese course HSK 4 A

Warm Slipper Video For Ladies

http://www.gataquenha.com

Chinese video lessons HSK level 3

Chinese course HSK 2

Warm Slippers Factory

Warm Indoor Slippers Exporters

DIN 7981 Pan Head Phillips Self Tapping Screw

Pan Framing Head Self Tapping Screw

White Enamel Brush Set

shidai5d.com

High Quality Air Removing Roller

Caulking Gun For Silicone

Angled Paint Roller

Modified Truss Head Self Tapping Screw

Double Flat Head Pozi Drive Chipboard Screw

4 12mm Yellow Stripe Mini Paint Roller Cover

Torx Double Flat Head Chipboard Screws Full Thread Yellow Zinc Plated

Jesteśmy odnoszącymi sukcesy innowatorami, którzy wykorzystują najnowsze metody,

strategie i techniki dzięki czemu masz 100 % gwarancji zadowolenia z naszej pracy.

Należycie przeprowadzona optymalizacja zapewnia również,

że nasza witryna będzie dostępna dla większej ilości wyszukiwarek, będzie bardziej funkcjonalna, przejrzysta i szybsza w działaniu.

Skupiamy sic na tworzeniu wartociowych trespassi i budowaniu autorytetu, zaminast nella technikach manipulowania wynikami of wyszukiwania, and

takich jak “black helmet Marketing” czy niewa cunning linków.

Nasze is able to perform pomocy wacielom company

in rozwoju, which strong wynika z chci pokonywania przeszkód in the

presence of dugofalowych.

Phenol, 4-(1,1,3,3-Tetramethylbutyl) (CAS:98-54-4)

4×4.25″ Billet Wheel Adapters

Para-Tert-Octylphenol ,PTOP

4×100 Billet Wheel Adapters

CAS No.140-66-9

4×100 to 4×4.25″ Billet Wheel Adapters

4×4.5″ Billet Wheel Adapters

imar.com.pl

PTOP (CAS:98-54-4)

Flange Bolts

Molar Mass Of T-Octylphenol

Mibk precio por litro

http://www.isotop.com.br

Transparent laminated mesh cloth

PVC Foam Mesh Fabric

Auto Car Lighting Single Sided Aluminum PCB

Grasa lubricante MOS2

Producto químico orto fosfato trisódico

Transparent mesh fabric

Alimentación con citrato de calcio

Acetil-L-Carnitina clorhidrato

Car Tail Light Single Sided Aluminum PCB

Shaft Pin

Round Head Screw

8×180 Billet Wheel Adapters

Custom Self Tapping Screw

8×170 Billet Wheel Adapters

8×6.5″ Billet Wheel Adapters

wood screw

http://www.video-ekb.ru

6×5.5″ Billet Wheel Adapters

High Quality Carriage Bolt

8×200 Billet Wheel Adapters

Proximity Switch Sensor

http://www.remasmedia.com

Heater Gas Water Heater Boiler

Gas Water Heater Components

Inductive Proximity Switch Sensors

F24 Series Industrial Remote Control

COP Push Button Switches

Gas Water Heater Outdoor

Gas Water Heater Boiler

10000 Watts Electric Scooter

XAC Push Button Switches

Industrial Machine Keypad

IP65 Industrial Keypad

Remote Rising Bollards

http://www.mix.com.az

Bollards For Sale

Traffic Bollard

Industrial Code Lock Keypad

Static Bollards

Road Bollards

Industrial Metal Keypad

Industrial Door Access Control Keypad

Air Line Filters

Air Compressor Filter

Cooler Bag

Reusable Thermal Insulated Cooler Bag

Pump Air Compressor

Hydraulic Oil

Hydraulic Air Compressor

Rpet Cooler Bag

Non Woven Insulated Tote Cooler Bag

portal.knf.kz

Thermal Cooler Bag

Electromagnet Linear Actuator

replacement hot rod for pellet grill

Ceramic Wood pellet igniter for pellet boiler

wood pellet furnace ignitor

High Speed Linear Actuator

Wood Pellet Ceramic Igniter

Linear Actuator Controller

Alumina Ceramic Pellet Stove Igniter

Telescopic Linear Actuator

http://www.softdsp.com

24v 150mm Stroke Linear Actuator

Agriculture Tire

Hot Rolled Steel Sheets

Bias Tire

Square Tubes

Radial AGR Tire

Square Metal Tubing With Holes

Bias AGR Tire

techbase.co.kr

Diamond Tread Plate

Thread Steel

Bias OTR Tire

Speed Dome Cameras

sookmook.gursong.com

Eod Portable X-Ray Scanner

Grader Tires

Underground Mine Tires

Articulated Dump Truck Tire

Portable Uav Jammer

Heavy Truck Tire

Non-Magnetic Tool

Sand Tires

Listening Devices Through Walls

High Yield Wood Pellet Machine Production Line

Calcium Chloride Is A Salt

Calcium Chloride Salt

Wood Pellet Machine Production Line

High Moisture Wood Pellet Machine Production Line

High Moisture Sawdust Pellet Machine

Wood Pellet Machine

boutique.opaleimpressions.com

Calcium For Dust Control

Calcium Chloride Aqueous Solution

Anhydrous Calcium Chloride Absorb Water

Carry D-Cut Bottom Sealing Carrier Plastic Poly Bag Making Machine

Slitting Machine

Solar Panel Flexible

Pv Panel

Flat D-Cut Plastic Cold Cutting Machine

http://www.yoomp.atari.pl

350wp Solar Panel

Garbage Trash Bin Plastic Bag Production Machine

Cloth Bag Making Machine

325W Solar Modules

200W Foldable Solar Panel

Plant Culvation Seedings Bag

http://www.dinhvisg.com

PEVA Bag

Stationery Bag

Running Backpack

Childrens Messenger Bag

Neoprene School Bag

EVA Bag

Backpack For Kids

Plant Cultivation Bag

Heat Shrink Bag

Mccb

Traditional Sofa Side Reading Floor Lamp

Decorative LED Single Pole Floor Lamp

Rccb

Portable Solar Power Station

Battery Power Station

dtmx.pl

White Plastic Lamp Shade Single Pole Floor Lamp

E14 Suit For Sofa Side Bedside Floor Lamps

E14 Lamp Holder Piano Side Floor Lamp

Battery Power Station Portable

skarbek.fr.pl

Anti-Uv Plastic Agricultural Net

Hardware Netting

Cargo Track

Plastic Net

Cargo Track Fittings

Polyethylene Netting

Other Truck Parts

Plastic Netting Mesh

Truck Foot Steps

Spring latch

Cixing Collar Flat Knitting Machine

Grand Tourer Roof Top Tent

Car Trail Truck Tent

Knit To Shape Computerized Flat Knitting Machine

Four Needle Bed Knit To Shape Flat Knitting Machine

Yarn Storage Knit To Shape Flat Knitting Machine

Affordable Rooftop Tents

http://www.budemzdorovi.ru

Outdoors Tent

Two Needle Bed Knit To Shape Flat Knitting Machine

Canopy Tent Sun Shade

Best Cnc Milling Machine

http://www.gesadco.pt

Cnc Machine For Metal

China Machining

Spray Tube

Food Grade PVC Tube

Cnc Precision Parts

Fire Detection Tube

Axis Cnc

PE Tube

PVC Braided Tube

RO Water Dispenser

http://www.saidii.co.kr

Probes In Usg

Endoscope Components

Ultrasound Vet

Refurbished Ultrasound

Convex Transducer Ultrasound

Commercial Water Filter

UF Water Dispenser

Water Dispenser

Pipeline Water Dispenser

95551135900 Front Hood Support

95B823359 Front Hood Support

Vertical Axial Flow Fan

Industrial Roof Fan

http://www.jdsd.co.jp

Silencer For Centrifugal Fan

298823359 Front Hood Support

95551252800 Luggage Compartment Lid Support

Htfc Series Horizontal Air Supply Unit

Industrial Centrifugal Fan

9Y0823359 Front Hood Support

????? 5337-93-9 4- ?????????????????

http://www.studentlinks.es

Foam Core Pillow Filling Machine

1,2- ??????????

Wash Goose Down Filling Machine

Carding Machine For Surgical Cotton

Polyester Fibre Opening Machine

Soft Toy Filling Machine

????? 49851-31-2 ??-?????????????????

??????? ??? ???? 28578-16-7

????? 1451-82-7 ??????????? -4

oby.be

Connector Car

95B998001 Wiper Blade

Automotive Harness Connectors

Wire Board Connector

9Y1955329 Wiper Blade

97051157100 Front Hood Support

Auto Connectors For Wire Harness

974955427A Rear Wiper Blade

971955427A Rear Wiper Blade

Car Ecu Connector

Dinosaur Rain Poncho

Adjustable Elastic High Visibility Reflective Safety Belt

http://www.poweringon.com

Elastic High Visibility Reflective Belt

Adjustable Elastic High Visibility Running Vest Belt

Fuel Injection Rail

Childrens Lightweight Raincoat

White Poncho

Elastic High Visibility Reflective Safety Belt

Pcb Turnkey Assembly

Adjustable Reflective LED Elastic Belt Straps

Silicone Rubber Lip Seals

Connettori batteria alta precisione

Maschio di plastica per tubi Pex

Weather Resistance Automotive Rubber Seals

ecopanel.com.vn

Viton O Rings Rubber Seals

Cartiera di precisione

Rubber Diaphragm Pump Mechanical Seals

Rubber Seals Molded Gaskets

Tubi idraulici

Connettori cavi rame standard tedesco

Extruded Aluminum Hot Pot Shell

Agricultural Bearing

Special Shaped Aluminum Radiator

Conveyor Roller Bands

Miniature Rod Ends

Deep Groove Ball Bearing

LED Aluminum Hot Channel Profile

Industrial Extruded Aluminum Profile Radiator

Aluminum Heatsink

http://www.tupelo.pl

6203 Bearing

Floor Based HVLP Electric Paint Spray Gun

Rfid Sticker

Rfid Rugged Tag

Long Range Rfid Tag On Metal

Precision Spray Floor Based HVLP Spray Gun

High Power Floor Based HVLP Spray Gun

Professional Painting Floor Based HVLP Spray Gun

saidii.co.kr

Temic Reader And Writer

RFID Glass Tag

Professional Spray Floor Based HVLP Spray Gun

GCS Low Voltage Withdrawable Switchgear

GCK Low Voltage Withdrawable Switchgear

Prefabricated Box Substation

Epoxy Coating Disc Rare Earth Magnet

GGD AC Low Voltage Power Distribution Cabinet

Ni Coating Disc Ndfeb Magnet

Diymag Magnets

MNS Low Voltage Withdrawable Switchgear

Thin Rare Earth Magnets

lucacocinas.com.ar

Zn Coating Disc Rare Earth Magnet

Mini Drone

Spunbond Nonwoven Accessories

Recycled Polyester Nonwoven Fabric

http://www.vozin.st

Rc Quadcopter Drone

Staple Fiber Spunbond Nonwoven Fabric Machine

Mini Drone Ufo

Hand Gesture Drones

PET Nonwoven Shopping Bag

RPET Nonwoven Shopping Bag

Drone With Hand Control

Aw, this was an extremely good post. Spending

some time and actual effort to create a great article… but what can I say… I hesitate a whole lot and

never manage to get nearly anything done.

Silicone Rubber Roller

Polyurethane Rollers

Printing Rollers

http://www.kino-laz.ru

Solar Terminal

Polyurethane Rollers

Wire Connector

3 Pole Changeover Switch

Reusable Cable Ties

Nylon Cable Tie

Rubber Roller

Stainless Steel Mig Wire

Aluminum Welding Rods

Rate Load 1.6 Ton Wheel Loader

Grain Front End Shovel Loader

Welding Materials

Quick-change Device Wheel Loader

Best Arc Welding

Aluminum Electrodes

http://www.budemzdorovi.ru

Rate Load 1.8 Ton Wheel Loader

Hang Tags

Convert Powerpoint To Html

H5 Courseware

Container Door Hinge

Ppt Cover Page Design

Container Parts

3d Maker Machine

desarrollo.laefactoria.com

Sliding Bracket

Refrigerated Door Lock

Aluminum rail

Powerpoint Table Design

Solar Cable

http://www.tbgfrisbee.no

Pizza Oven Restaurant

Solar Cable 1500v

Solar Cable 1000v

Portable 14 Inch Oven

Tabletop Pizza Oven

Big Size Pizza Oven

Solar Cable PV Wire 6mm2

Professional Pizza Oven

Solar Cable PV Wire

Sodium Diisobutyldithiophosphate

Vending Toy

Blind Bag Toys

Sodium Diisobutyl Monothiophosphate Cas No. 53378-51-1

Isobutyl Sodium Phosphorodithioate Cas No. 53378-51-1

Mini Figures

Sodium Isobutyl Dithiophosphate

OEM Toy Manufacture

2 Inch Capsule Toys

lioasaigon.vn

Sodium O,O-diisobutyl Dithiophosphate

Solar MC4 Connector 1500v

Solar MC4 Connector Branch

MC4 Connector Branch 2 In 1

Customized Thread End Mill

End Mills

Carbide End Mill 4 Flute

End Mill 0.1mm Micro Milling Cutter Tools

MC4 Connector Y Branch

Solar MC4 Connector 1000v

http://www.sporry.com

Carbide Rods And Strips

Hydraulic Press Brick Making Machine

Electric Cycle Under 5000

Icu Bed

Press Hydraulic Cement Block Machine

Ultrasonic Machine Physiotherapy

Electric Scooter

Hydraulic Press Brick Machine

Hydraulic Pressure Concrete Block Machine

hcaster.co.kr

Hydraulic Interlocking Block Machine

29 Inch Electric Bike

szklarski.pl

Chloride Process

Titanium Dioxide R895

Ball Valve Refrigeration System

Hot Gas Bypass Regulator

Anatase Titanium Dioxide

Condensing Pressure Regulator

Titanium Dioxide R2219

Crankcase Pressure Regulator

Refrigerant Ball Valve

Sulfate Process

Ball Valve Refrigeration System

Refrigerant Ball Valve

korchambiz.blueweb.co.kr

Capacitive Discharge Spot Welder

Hot Gas Bypass Regulator

Heavy Duty Spot Welding Machine

Brass Terminal Spot Welding Machine

Smart Spot Welder

Crankcase Pressure Regulator

Spot Welder Voltage

Condensing Pressure Regulator

Semi Automatic Labeling Machine For Pet Bottle

http://www.fhbr.web1106.kinghost.net

Solar Panel Mounted Connector

Solar Branch Connector 3 In 1

Scratch Card Labeling Machine

Solar Branch Connector 2 In 1

2017 Hyundai Elantra Door Actuator

Solar Panel Connector With Tuv Certified

Plastic Labeling Machine

Vw Abs Sensor

Solar Panel Connector For Combiner Box

Ao tentar espionar o telefone de alguém, você precisa garantir que o software não seja encontrado por eles depois de instalado.

Solar Cable 1000v 16mm2

cedmilano.com

Solar Cable 1000v 10mm2

C10h14o2

MC4 Connector T Branch 3 In 1

Deoxyarbutin

Top Grade Benzylisopropylamin

Solar Cable 1000v 6mm2

Methylphenidate Hydrochloride

Solar Cable 1000v 4mm2

Acetaminophen

21+3 – This side bet lets you bet that a poker hand (usually either flush, straight, three of a kind and straight flush) will appear from a combination of your hand and the dealer’s. At most live casino blackjack tables, there will be a range of pay-outs based upon the different odds of each hand occurring – not so at Lucky Streak. Here all four results pay out 9:1. Play at land-based casinos: We briefly mentioned it earlier, but LuckyStreak is one of few live casino suppliers to offer Dual Play tables. Streamed live from land-based casinos, such as the Oracle Casino and Portomaso Casino, you can play live roulette alongside physical players on the casino floor! It’s time to see what you can play at Lucky Streak Casinos. The company’s live lobby features a variety of Blackjack, Roulette, and Baccarat tables. Some of them are broadcasted from a state-of-the-art studio in the Baltics, while others are “dual-play” streams that come from real-life outlets like the Portomaso and Oracle casinos. You can find more details about each genre below.

http://www.stthomasecumenical.com/uncategorized/luxury-cruise-cabins-associated-articles/

No Deposit Bonus Casino 2021. Get free spins with no deposit. Everything up to date from 2019. Sign up and play for free with real money. 18+ Gamble Aware. Cool cat casino $200 no deposit bonus codes – Any Currency – Payment Without Commission. Video poker – Best and Top Bet! Video poker – Best and Top Bet! Check our website to get newest information about online casino bonuses and free spins! The best guide for free bonus no deposit. Pick up the latest No Deposit Bonus offers: ⭐️ Authoritative casinos ⭐️ NEW exclusive promo codes ⭐️ Easy payouts ⭐️ Favorite games. There are 291 alternatives to casinobonus2.co Compare chipy global ranking trend in the past 3 months vs. casinobonus2.co, or dive deeper into chipy ranking in it’s category or country measured against casinobonus2.co

Travel System Prams

Lightweight Umbrella Stroller

http://www.grain-seeder.ru

Travel System Stroller

10x38mm Fuse Clips For PCB

1000Vdc NH0 PV Fuse Base

10x85mm GPV 1500VDC Fuse Link

Pink Travel System

Double Travel System

1000Vdc NH1 PV Fuse Base

10x38mm 1000VDC PV Fuse Holder

Pure Air Go 350w

http://www.schools.bidyaan.com

Monocular Night Vision Scope

Gas Mask

Gravton Quanta Electric Bike

One Electric Bike

350w Electric Scooter

Ordnance Shovel

Cut-Resistant Gloves

Lightweight Electric Bike

Military Bulletproof Bag

City Tourist Souvenir Gift Set

vajehrooz.ir

Split Collar Filter Bag Cage

Home Appliances

SLA precision prototype mold

CNC rapid prototype parts

Liquid silicone rubber injection machine price

CNC rapid prototype mold

Event Promotion Gift Set

Fast prototype spare parts

Rolled Flange Dust Collector Cage

Standard DIN 9845 Dies Type B

Standard DIN 9845 Dies Type A

trucker cap manufacturer

Standard Bush DIN179A

Standard Bush DIN172A

DIN 1530 Ejector Pins Type A

supplier snapback cap

odm trucker cap

company snapback cap

oem trucker cap

http://www.sceaindia.org

Isolation Of Dna From Plant Cell

Pcr Mix

2 Slice Sandwich Maker

ssummit.vozin.st

Back Probe

Multi Contact Grill

Probe Rods

6 in 1 Sandwich Maker

UL Contact Grill

Camera Probe With Light

Sandwich Maker 3 in 1

Two Needle Bed Knit To Shape Flat Knitting Machine

Cixing Collar Flat Knitting Machine

Three Systems Collar Flat Knitting Machine

Edlc Dry Electrode

Sensor Mats For Dementia

Smart Motion Sensor

Four Needle Bed Knit To Shape Flat Knitting Machine

Corded/Cordless

xn--h1aaasnle.su

Yarn Storage Knit To Shape Flat Knitting Machine

Motion Detector Lights

Self Standing Bag Plastic Suction Nozzle

Colorful Self-Standing Bag Buckle

Unisex Waffle Slippers

Flexible Suction Nozzle

Waffle Slippers spa

Hotel Spa Slipper

Self Standing Bag Opaque Suction Tube

Simple Waffle Slippers

Disposable Slippers For Hotel

Self Standing Bag Flexible Suction Tube

http://www.budemzdorovi.ru

Fiberglass Fiber

Chopped Strand Fiberglass

PTFE Needle Felt

Aramid Needle Felt

Fiberglass Filter Felt

Concrete With Fiber Reinforcement

PTFE Woven Fabric

Needle Felt with PTFE Membrane

Rock Wool Fiber For Brake Pads

http://www.skarbek.fr.pl

Paper Bags Cheap

http://www.mhcclinic.jp

Sliding Rheostat

Complex Vitamin B2

Plate Rheostat

Cbn Making Machine

Pcbn Pdc/Diamond Enchantment/Hydraulic Cubic Press

SUR Series Resistor

SUR Pulse Resistor

Hpht Cubic Hydraulic Press

Complex Organic Acid (Special For Pig)

Pulse Resistor

Array Resistor

Off Road Electric Scooter

All Terrain Electric Scooter

CSR Precision Current Sensing Resistors Shunt

Emove Scooter

http://www.agnoli-giuggioli.it

CSR Precision Current Sensing Shunt

FL-2 Fixed Type Shunt Resistors Shunt

Solar Scooter

Blue Electric Scooter

MELF Resistor Network

Plastic Pipe Shredder

Curcumin

Plastic Film Shredder

Plastic Recycling Shredder

Plastic Pallet Shredder

http://www.opaleimpressions.com

Minerals

Coenzyme Q10

Plastic Lump Shredder

Inositol

Vitamin B9

Cartoon EVA Tablet Case

Classic Sleeve Bag

Hematite Binder

Nylon Portable Laptop Bag

Electric Contactor

Overlying Protection Portable Laptop Bag

Fuse Thermal

Dual-side Waterproof Portable Laptop Bag

Fuse Disconnector Switch

Less Dosage Iron Ore Pellet Organic Binder

rosexport.su

AB Strip Machine

ABA Film Blowing Machine

Film Blowing Machine

Sheet Metal Fiber Laser Cutting Machine

Metal Pipe Laser

Laser Marker Machine For Sale

ABC Film Blowing Machine

Small Laser Marking Machine

http://www.valor.plus

Laser Marking Machine Working

Paper Bag Making Machine

Электрический винтовой пресс с ЧПУ серии EP с круглым рельсом

Airless Sprayer

Двухдисковый фрикционный пресс

Электрический винтовой пресс с ЧПУ серии EP

Автоматическая линия по производству ковки

Paint Sprayer With Compressor

Machine Plaster

sceaindia.org

Spray Booth Filter

Кривошипный пресс для горячей ковки серии HMP

Machine Plaster

6+2 Seater Electric Golf Cart

6 Seater Electric Golf Cart

Silver Glitter Poster Board

Cheap PVC Bathroom Wall Panels

Oak Veneer Furniture Board

4+2 Seater Electric Golf Cart

Fiberoptic

Free foam PVC Board

6 Seater Electric Sightseeing Car

2+2 Seater Electric Golf Cart

iretza.eus

4 Seater Electric Hunting Vehicle

http://www.dblink.co.th

4 Seater Electric Lifted Hunting Vehicle

6+2 Seater Electric Sightseeing Car

Wall Decoration

Outdoor Wpc Panel

Pvc Exterior Wall Hanging

2 Seater Electric Lifted Hunting Vehicle

China Pvc Foam Sheet

External Pvc Panels

2 Seater Electric Hunting Vehicle

Dual-Channel Linear LED Driver

Linear Constant Current Chip

High PFC No Flicker LED Linear Constant Current Chip

C Channel With Hole

Punched Parts

Rods

KP18108ESPA

Steel Structure

KP18068ESPA

Rods

zubrzyca.misiniec.pl

Five Layer High Speed Blown Film Machine

1 Inch Landmine Attachment

Five Layer EVOH Blown Film Machine

Five Layer PE Blown Film Machine

Tricep Rope Pull Down Attachment

http://www.stickers.by

Five Layer PA Blown Film Machine

Door Handle Exercise Ropes

Fitness Tricep Rope

Diy Tricep Pulldown Rope

Five Layer EVA Blown Film Machine

Converter 220v Fast Charge

Auto Inverter 12 220

tft 3.97 inch mipi display 480×800 ips

tft lcd touch modul

Multifunctional Cigarette Converter

tft display 3.5 inch

tft lcd 2.8 inch

4 inch tft display module

12V To 220V Power Converter

12V To 220V Integrated Machine Power Supply

Outdoor Doormat For Wet Areas

Logo Door Mats Commercial

7.0 Inch RGB TFT LCD

Kitchen Mat Sets

Touch Screen Display

OEM Small Bath Mat

IPS TFT Module

Custom TFT Display

Pedestal Mat

Sunlight Readable TFT Display

lcd touch screen display

Cheap Pcb Prototype

Best Chinese Pcb Manufacturer

Custom Pcb

wqvga tft lcd

480*272 matrix lcd module

Pcb Production And Assembly

Prototype Pcb Assembly

4.3 inch tft lcd display

4.3 tft lcd display

2.4 Inch IPS TFT Display

1.54 Inch IPS TFT Display

Embroidery Patch Sports

Label Transfer Paper

3.5 Inch IPS TFT Display

Iron-On Sticker Label

2.1 Inch IPS TFT Display

Heat Transfer Sticker

Label Transfer Paper

2.8 Inch IPS TFT Display

lcd 3.5 module

Hand Made Pencil Case

Hawk Bag Color

3.5 inch tft lcd module

3 Ring Binder Pencil Case

3.5 inch small lcd module

640×480 dot matrix lcd module

3 Pocket Pencil Case

3.5 tft lcd

Pop It Pencil Case

Aluminium Extrusion Plant

Aluminum strip sawing

Woodworking panel saw

Everstart 400w Power Inverter

Woodworking automatic edge banding machine

1200Y Rotary Wood CNC

4 axis wood cnc router

Aluminium Extrusion Manufacturers In Gujarat

Taweelah Aluminium Extrusion Company

Thermal Energy Storage

USB interface LED Mini Air Humidifier

LED Large Capacity Air Humidifier

Hepa H14 Filter

Iso 7 Clean Room

Cleanroom Ffu

Home Portable Ultrasonic Air Humidifiers

Pulse Jet Dust Collector

Ultrasonic Mist Generator Air Innovative Humidifier

Office Use Ultrasonic Humidifier

Iso 5 Clean Room

Brushed Gold Kitchen Faucets

Volkswagen Brake Pad

Trw Brake Pad Review

Angle Valve

Brake Pad And Rotor Replacement

Bmw Brake Pad Sensor

Cold Tap

Rav4 Brake Pad

Floor Drain

Gold Kitchen Faucets

Double Plastic Weather Strips

Power Regulator

Single Phase DC Output Motor Reversing Module

Bottom Seal

Window Screen Weatherstripping

8 Ft Door Weather Stripping

Three Phase AC Output Motor Reversing Module

Insulation Strips

Single Phase AC Output Motor Reversing Module

Motor Reversing Module

wood cnc router with double head

Excel Encryption

Video Encryption Software

wood cutting machine

Ppt To Html Online

Animated Presentation Maker

Ppt First Page Design

cnc carving machine

wood sliding panel saw

panel table saw

Oil Filters

High Strength Tape

Introduction to Air Filters

Double Sided Glazing Tape

Truck Engine Air Filter Element Replacement

Carpet Tape

Truck Filter Explanation

Tissue Tape

Double Sided Glue Tape

Factory Manufactures The Filter

Electronic Cigarette

Luxury buses

Luxury Coaches

Iget Vape

Luxury bus

Vape Box

Disposable Vape Pod

Luxury Coach auto

Disposable E Cigarette

Premium Coach auto

Pick Head Axe

Electric vehicle

Electric Minivan

Pick Head

Bussed

Passenger bus

Scabbler

Spindle Head

Shower Head Removal Tool

TOUR BUS

D10r Passenger Vehicles

D10 Passenger Vehicles

D10R Logistics Vehicles

D10 Logistics Vehicles

Hk Trademark Registration

China Bank Account Opening

Macao Patent Registration

Hk Trademark Registration

D07R Passenger Vehicles

Foreigner Open Company In China

Black Hip Hop Sports T-shirts Summer Graphic Tshirts Oversized Men's Letter Printed T-shirts Vintage Harajuku Street Tops Tees

Factory Direct Supply Cotton High Quality Colorful Paint Sexy Lips Summer Short Sleeve Women Tshirt

Concrete Pump With Mixer

Pump Concrete Truck

Spiral Planner

Travel Journal Notebooks

Leather Journal Diary Notebook

Casual Crew Neck Short-sleeve Fashion Summer T-shirts Tops Regular And Oversize Tees I Hate People Print T-shirt For Men's

China Wholesale Funny Print Women T Shirt Colorful Paint Sexy Lips Clothes High Quality Plus Size Women Tshirt

Static Boom Placer

Recycled Notebook

Mortar Fine Stone Pouring Pump

Soft Cover Leather Planner

automol.by

Climbing Concrete Pouring Arm

I'm Not Always Right Letter Male T-shirt High Quality T Shirts Summer Oversized Short Sleeve Clothes Cotton Loose Street Tops

Small Factor Pc Case

Tower Cooler Pc

Men's White Lace-up Hoodie 2024 Trendsetting Sweatshirt With Custom Logo Relaxed Fit Cozy Pullover Streetwear Top

Water-Injected Teether

Set Of Earth Tone Cotton Tshirts High-quality Blank Tops For Custom Design Seamless Streetwear Comfort Fit Tees

Men's Hoodies With Graffiti Logo 2024 Streetwear Style Dual-tone Pullover Eco-friendly Cotton Blend Custom Print Sweatshirts

Men's Embroidered Teal Hoodie With Logo And Unique Graphics Cotton Blend Athletic Wear With Moisture-wicking Properties

Baby Teethers

Baby Tableware

Gaming Computer Water Cooling System

Stylish Cropped Blue Tshirt With Pocket High-quality Cotton Comfort Fit Summer Top Streetwear Fashion Women's Tee

Heat Transfer Printing

Full Tower Computer Case

Trendy Gifts for Kids

http://www.sunpark.co.kr

Tower Case

Memorial Shadow Box

suvs

Frame Photo Wall

Vehicles

shadow box money bank

Casual Beige Zip-up Hoodie Men's Soft Cotton Sweatshirt Adjustable Hood

Black Wall Frames Set

Men's Blue Fuzzy Hoodie Winter Warm Soft Fabric Streetwear

Wooden Frame Picture

SUV

sport utility vehicle

Men's Heather Grey Hoodie Classic Cotton Blend Pullover With Hood

New energy MPV

Black Full Zip Up Hoodie Men's Heavyweight Streetwear

Men's Grey Zip Hoodie Casual Streetwear Essentials Sweatshirt

coolingtower.vn

High Quality Plain Oversized Anime Unisex Hodie Custom Men's Hoodies Sweatshirts Performance 3d Foam Print Hoodie

Paper Cup Mission

Creative Pattern Hoodie Womens Autumn Loose Women's Hip Hop Oversized Sweatshirts Hoodies With Zipper

Heat Transfer Printing for Toy

Heat Transfer Printing

Galvanized Steel Pole

Silicone Heat Transfer Printing

Public Lighting

Led Solar Street Lighting

Heat Transfer Printing for Plastic Tableware

New Style Oem Odm Custom Logo Color Label Women Casual Oversized Zip Up Hoodie Gym Hoodies

Outdoor Street Light

Kids Toys

apkue.com

Women's Zip-up Hoodie – Soft Cotton Jacket Casual Sweatshirt Versatile Streetwear Custom Embroidery Available

Stylish Women's Tracksuit Hoodie – Cotton Sweatshirt For Customization Unisex Streetwear Fashion Clothes Women

Wood Nightstands

Towel Bar

Wood Serving Board

Multi-color Men's Hoodie Collection – 20 Options Soft Cotton Casual Pullovers Unisex Streetwear Essentials

setsatian.ac.th

Cold Tap

Brushed Gold Kitchen Faucets

Men's Light Grey Sweatshirt Soft Cotton Pullover Comfort Fit For Streetwear And Casual Looks

Big Wooden Chopping Board

Trendy Dual-tone Hoodie Set For Modern Urban Style Durable Cotton Fabric In Eye-catching Colors

Blank Cotton Street Wear Tshirt Men's Premium White T-shirt Soft Touch Cotton Minimalist Logo Classic Fit Versatile Styling

Angle Valve

Rabbit Cage

Floor Drain

Forest Green Men's Hoodie Cotton Blend Heavyweight Pullover With Kangaroo Pocket Streetwear Essential

Wooden Money Box

Smooth Nitrile Glove

Water Proof Motor Reversing Cam Switch

Custom China High Quality 95% Cotton 5% Spandex Soft Sports Round Neck Curve Bottom Gym Tee Mens T Shirts

Waterproof Rotary Cam Switch

Thermal Work Gloves

Wholesale Custom Blank High Quality Super Soft Plus Size T-shirt Men's Summer O-neck Plain T-shirts

Wholesale Acid Wash Tshirt Streetwear Hip Hop Stone T Shirts With Logo Customize Oversized Vintage T-shirt

Long Gardening Gloves

Men New York Basketball Player Clothing Skeleton Wings Build T Shirts Street Oversized T-shirts American Vintage T-shirt

Ip65 Cam Operated Rotary Switch

Mushroom Enjoy The Little Things Be Kind Mens Cotton T-shirts Creativity Casual Tops Vintage All-math Short Sleeve Man Clothing

Universal Rotary Cam Selector Changeover Switch

terapiasinfronteras.com

Heavy Duty Gloves

Leather Palm Gloves

Cam Switch 1 Phase

kolay yemek tarifleri

En İyi Kadın Blogu

Men's Hoodies & Sweatshirts 2024 Collection Customizable Vintage Street Style

Mustard Yellow Men's Hoodie Oversized Cotton Sweatshirt High-quality Streetwear Essentials Unisex Custom Plain Hoodies

Farmhouse Faucet

Tall Basin Faucet

http://www.mdebby.co.il

Stylish Men's Color Block Hoodie Zip-up Design With Contrast Panels Cozy Cotton Fabric For Casual Or Sportswear

Bathroom Tall Taps

Designer Cotton Hoodie For Women Custom Logo Pullover Oversize Streetwear Sweatshirt Available In Elegant Neutral Colors

3.5 Inch Custom TFT Display with Capacitive Touch Panel

Men's Contemporary Two-tone Hoodie Full Zip Casual Streetwear Sweatshirt With Hood

OLED Display

8.0 Inch Custom TFT Display

Monochrome LCD Module

10.1 Inch Custom TFT Display

Toilet Basin Tap

Free Standing Bathtub Mixer

small OLED Display

Apple Iphone Package

Streetwear Tees T Shirt Women Bow Drawstring Short Sleeves Orange Green Fashion Sexy Top Women T-shirt

Iphone Se Shipping Box

tft module

Women's Fleece Crop Hoodie Fashion Streetwear Comfort Cotton Pullover Custom Logo Warm Loungewear Available In Soft

Cartoon Frog Graphic Pullover Hoodie In Purple And White Women's Fashion Sweatshirt Cozy Casual Streetwear With Animal Print

Iphone Xr Packaging Box

http://www.soonjung.net

Iphone 8 Box

thin lcd screen

Customizable Logo Color Block Hoodies For Women Soft Fleece Winter Sweatshirt Available In Assorted Colors For Print On Demand

Light Grey Men's Zip-up Hoodie Soft Cotton Blend Casual Streetwear Comfortable Classic Style High-quality Modern Tailored Fit

Iphone 11 Pro Packing

0.91 inch OLED display

0.91 inch OLED

Women's White Loungewear Set High Quality Cotton Comfortable Oversized Hoodie With Wide-leg Joggers Casual Streetwear

30000mah Solar Power Bank

60W Solar Panels

Commercial Treadmill Size

Urban Fashion Men's Distressed Olive Green Hoodie Cotton Heavyweight Pullover With A Vintage Aesthetic

Commercial Treadmill Machine

China Factory Direct Sale Oversized High Quality Crop Top Cotton Breathable Yoga Women Tshirt For Sport

Glass Surface Stress Meter

Men's Solid Polo Shirt High-quality Material Regular Fit Classic Collared Neckline Casual Wear Or Sports Durable And Comfortable

Men's Distressed Oversized Hoodie In Gray Acid Wash Style Cotton Sweatshirt For Street Fashion Enthusiasts

Mini Walking Treadmill

nighterbldg.com

100W Solar Panels

Solar Panels

Treadmill Walking Machine

20000mah Solar Power Bank

Custom Color Men's Polo T-shirt 100% Cotton With Contrast Collar Trim Durable And Comfortable Knit

Custom Men's Tshirt Menversatile For Golf Casual Wear Quality Knit Polo Oem/odm Services Available

Air Filter

Women's Rainbow Striped Pullover Hoodie Colorful Winter Clothes Soft Fleece Comfortable Oversized Streetwear Sweater

Powder Coating Wheels

Women's Multicolor Striped Zip Hoodie Casual Fleece Jacket Winter Warm Comfortable Street Style Fashion Outerwear

Chrome Wheels For Trucks

Mechanism Panel

Purification Door

Silver Rims

company.fujispo.com

Cleanroom Panel

High Quality White Polo Shirt T-shirt Pure Cotton Casual And Comfortable Short Sleeve Polo Shirt

Air Suspension Pump Solenoid Valve

Chrome Steel Wheels

Manual Panel

Oil Seal

Women's Textured Zip-up Jacket With Custom Logo Option High-quality Warm Outerwear In Multiple Colors For Casual Fashion

PLA Fiber Bag

Relaxed Fit High Waist Sweatpants Embellished Detailing Neutral Beige Color Ideal For Casual Wear Or Gym

PLA Biodegradable Fiber Bags

PLA Biodegradable Non Woven Bags

Couple's Streetwear Hoodies In Orange And Blue Comfort Fit Cotton Pullover Essential Casual Urban Fashion

Men's Street Style Heavyweight Gray Hoodie With Distressed Detailing Urban Fashion Cotton Pullover

Spherical Roller Bearing

Bush

PLA Environmentally Friendly Non Woven Bag

http://www.sporry.com

Biodegradable Non Woven Bags

Women's Half-zip Hoodie Multiple Color Options Soft Cotton Oversized Fit High-quality Streetwear With Pocket

Sliding Bearing

Pillow Bearing

Motorized Wheel Chairs

Gp Fast Diode Laser

Men's Camouflage Hoodie Military-inspired Design With Soft Interior And Durable Exterior Perfect For Outdoor And Casual Wear

Mustard Yellow Men's Hoodie Oversized Cotton Sweatshirt High-quality Streetwear Essentials Unisex Custom Plain Hoodies

Men's Contemporary Two-tone Hoodie Full Zip Casual Streetwear Sweatshirt With Hood

Solid Color Navy Blue Hoodie Heavyweight Comfortable Pullover With Drawstrings And Spacious Front Pocket For Men

Hdpe Costal Sea Intake Weholite Pipe Extrusion Line Machinery

Steel Reinforced Hdpe Spiral Winding Pipe Machine

Spiral Pipe Forming Machine

Diode Laser Types

Power Foldable Lightweight Electric Wheelchair

Solid Wall Spiral Pipe Machine

Lightweight Power Wheelchairs

http://www.myreceiptmybusiness.com

Polymer Storage Tank Extrusion Production Line

Men's Fashion Hoodies With Strass Embellishments For 2024 Customizable Trends

You are my aspiration, I have few web logs and very sporadically run out from to post .

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Sunways 25KW Three Phase Hybrid Inverter

Citrus Fertilizer With Trace Elements

Sunways 12KW Three Phase Hybrid Inverter

Men's Distressed Grey Hoodie Urban Streetwear Casual Comfort Edgy Cotton Pullover Relaxed Athleisure Wear

DEYE 50KW Three Phase Hybrid Inverter

Men's Dark Zip-up Hoodie With Front Pockets Casual Street Style Cotton Blend Comfort Fit Versatile Layering Piece

Men's Purple Hoodie With Athletic Stripes Comfortable & Durable Streetwear Cotton-rich Urban Style Pullover

Men's Custom Logo Blank Hoodies Drop Shoulder Hooded Oversize Pullover Sweatshirt 100% Cotton Heavyweight Hoodie For Men

Chitosan Agriculture

Best Fish Hydrolysate

Sunways 8KW Single Phase Hybrid Inverter

Npk Raw Amino Acids

Fertilizer With Trace Minerals

licom.xsrv.jp

Edgy Distressed Grey Hoodie For Men Soft Cotton Casual Pullover Durable Urban Streetwear Cozy Heavyweight Design

DEYE 10KW Three Phase Hybrid Inverter

Round Needle

Men's Grey Hoodie – Heavyweight Cotton Oversized Sweatshirt

Decorative Metal Hook

Small Pipeline Water Dispenser

In Bulk Sloth Graphic Oversized T-shirt For Men Casual Cotton Short Sleeve Tee High Quality Custom Logo With Men

Minimalist Design

http://www.fullsho.com

Classic Double Gate

3 Taps Pipeline Water Dispenser

Stainless Steel ISO 7380 Socket Button Head Screw

Custom Layered Construction Men Sweatshirt Cotton Blank Heavy Weight Pullover Acid Wash Oversize Nipped Waists Men Hoodies

Custom Logo Heavyweight Vintage Streetwear Crewneck 100%cotton Acid Washed Oversized Mens Hoodies

ISO 7380 Socket Button Head Screw

ISO 7380 Socket Button Screw Grade 10.9 Zinc

Top Wood Burning Stoves

Diamond Dowel

Kraft Bags

Slotted Second Punch

Women's Fashion Hoodie With Rhinestone Embossed Text Design Streetwear Loungewear

Classic Women's Polo T-shirt Set In Assorted Colors Custom Logo Golf Tennis Casual Wear Short Sleeve Pullovers.

Gift Bags

antheminfotech.com

Paper Bags

Women's Striped Casual Hoodie Comfortable Winter Fleece Top Fashionable Multicolor Streetwear Outerwear With Skirt

Bathroom Shower Faucet Set

Women's White Loungewear Set High Quality Cotton Comfortable Oversized Hoodie With Wide-leg Joggers Casual Streetwear

Luxury Bags

Women's Green Sweatshirt And Shorts Set Casual Cotton Loungewear Oversized Summer Athleisure Comfortable Soft Set

Bugle Screws Header Punch

Cemented Carbide Dies

Self Screw Header Punch

Paper Boxes

Suitable For Sports Leisure Ribbed Sleeve Cuffs Available In Multiple Sizes Easy To Custom Logo Print For Teams Or Events

Eria Jarensis

Benzokain

316L Stainless Steel Coil

High Quality 3d Puff Print Pullover Ribbed Cuffs And Hem Side Pockets For Convenience Adjustable Hood

Men Essential Polo Shirt Clean Crisp Look Premium Cotton Comfortable Short Sleeves Embroidered Detail On Sleeve

904L Stainless Steel Coil

Xylazin Kaufen

Sophisticated Men's Custom Color Polo Shirt – High-quality Soft Touch Material Long Sleeve Ribbed Cuffs

430 Stainless Steel Coil

410 Stainless Steel Coil

Density Of Phenacetin

321 Stainless Steel Coil

High-quality Men's Polo T-shirt 100% Cotton Comfort Breathable & Durable Knit Fabric Shirt Royal Blue Tshirt

Anestheticum

szklarski.pl

Single Core Awa Cable

Stylish Navy Women's Sports Polo Shirt With Green Accents For Golf And Tennis Ibrant Navy And Green Women's Polo

All Aluminum Conductor

100 Sq Mm Aaac Conductor

Women's Black Cotton Polo With Custom Logo Soft And Breathable Fabric Short Sleeve Top For Golf Tennis Comfort Wear.

Suitable For Various Occasions From Leisure To Business Casual Available In Multiple Sizes Comfort Fit Collared

Summer Collection Women's Cropped T-shirt With Short Sleeves Soft Cotton Fabric Sourced Custom Logo Print Available

Soft Pink Women's Polo Shirt Cotton Blend For Golf Casual Or Business Uniforms Custom Logo Available

http://www.vnreal.net

1.1 inch Square display

Unarmoured Power Cable

1.1 inch

CH110T001A

IPS TFT display 96*96 4 line SPI ST7735

ST7735

Aluminum Conductor Steel Reinforced

Unisex Oversized Hoodies In White And Beige Plain Cotton Sweatshirt

Drop Shoulder

Plus Size Cashmere Cardigan Sweater

Cropped Cashmere Cardigan Sweater

Christmas Cashmere Cardigan Sweater

Men's Plain White Hoodie With Graphic Tear Detail Oversized Streetwear Sweatshirt

Taiwan Popping Boba

http://www.antheminfotech.com

Cashmere Wool Cardigan

Cropped Hoodie Men With Graphic Design Modern Streetwear Zip-up Sweatshirt

Men's Heavyweight Pullover

Taro Bubble Tea

Long Cashmere Cardigan Sweater

Popping Boba

Milk Powder

Tapioca

Trail Running Backpack

M Sport Steering Wheel

Furniture Hardware Screws and Nuts

Wholesale Cotton Custom Vibrant Colored Sweatshirts For Men Textured Logo Detail Cozy Sportsweark

Boys Raglan Sleeve Tee – Two-tone Long Sleeve T-shirt For Sporty Casual Look Long Sleeve Top Boys Casual Wear

Camping Blanket

Patio Round Table Cover

Outdoor Furniture Covers

Body Part

Customizable Logo Tee Contrast Detail Classic Boys Contrast Trim Cotton Classic Black T-shirt With Logo For Customization

Patio Rectangular Table Cover

Machine Screw

Quality Custom Logo Heavy Weight Tshirts Vibrant Collection Of Men's Cotton T-shirts – Comfort Meets Color

http://www.mbautospa.pl

AMG Steering Wheel

Youth Essential Blue Tee – Soft Plain T-shirt For Boys Everyday Comfort T-shirt Soft Boys Tee Everyday Comfort Top

Black Self-Fusing Rubber Tape

Light Blue Men's Jersey Style T-shirt With '10' Print Casual Sporty Tee

Cable Box

Distribution Switch Box

http://www.soonjung.net

Waterproof Self-fusing Silicone Tape

Men's Black Cotton Tee With Multicolor Letter Print Regular Fit Casual Shirt

L-Ascorbic Acid Cas No. 50-81-7

Men's Camouflage T-shirt Outdoor Casual Cotton Blend Short-sleeve Military Top

Electrical Connector Terminal

Vitamin C Cas No. 50-81-7

Classic Solid Green T-shirt For Men Soft Cotton Crewneck Casual Everyday Wear

Artistic Illustration Graphic T-shirt In Black – Contemporary Urban Style

Lv Withdrawal Switchgears

Waterproof Self-Fusing Rubber Tape

Abs Plastic Junction Box

Bracket Action Cam

Good Quality High Fashion Rib Cotton Shirts Short Women Summer Blank Pure Color Stretchy Crop Top T-shirt

Hardcover Printing Kids Book

Hardcover Kids Comic Book

http://www.t-formafitness.hu

Printing Child books

Cartoon Books Printing

Bbq Grill Charcoal Air

Wholesale Breathable Outfits Sportswear Yoga Multi Color Tops Wholesale Girls Workout Women Tshirt

Women's Casual Hoodies Baby Girl Slogan Cropped Pullover High-quality Cotton Pink Fashion Streetwear Sweatshirt

Mini Bbq Grill

Childrens Story Books Printing

China Factory Basic Wholesale Custom Logo Multi Color Women Tshirt Raglan Sleeve Sexy Crop Top Women T Shirt

High-quality Zippered Women's Casual Sweatshirt With 200+ Color Selection Custom Logo Option For Daily Wear Soft Fabric

Lpg Gas Grill & Hotplate

Electric Bbq Grill Stand

China Pepper Powder Factory

Kashmiri Red Chilli Factory

itsgolbal.co.kr

Summer Classic Shirts Streetwear Anime Casual Harajuku Pure Cotton T-shirts Mens Clothing Print Short Sleeve Tops Tees

solar roof hook for shingle roof mounting systems

solar asphalt shingle hooks

Wholesale Red Chilli Suppliers

Wholesale Second Hand Cool Big Size Casual Set Cotton Thick T-shirts Bodybuilding For Men With Logo

Wholesale The Weekend 90s Unisex Black Men Tshirt Vintage Graphic T-shirts Tops Tee Shirt Oversize Streetwear Clothing

Solar Mid Clamp

Asphalt tile Roof Hook for solar mounting system

Custom Cool Plain T-shirts Blank T-shirt Men Graphic Washed T-shirts For Men Unisex Retro Loose High

Wholesale Hot Spices Factory

Non-adjustable Solar Asphalt Roof Hook

New Style High Quality Soft Cotton Oversize Custom Monogram And Printed T Shirts For Men Slim Fit With Collar

Wholesale Hot Peppers Supplier

Cute Pink Cat Graphic T-shirt For Girls With Bow Accent Adorable Casual Wear

Hospital Bed Hospital Bed

Chain And Tyre Net Pneumatic Fender

Hospital Technology

http://www.tbgfrisbee.no

Roller Fender

Lime Green Dinosaur Basketball Boys T-shirt – Energy Themed Graphic Tee

Aircraft Fender

Medical Equipment And Furniture

Hydropneumatic Fender

In A Hospital Bed

Tugboat Fender

Boys Dinosaur Dash Adventure T-shirt For Outdoor Play And Learning

Green Comic Hero Graphic T-shirt For Boys – Short Sleeve Cotton Top

Playful Shark Graphic T-shirt For Boys – Comfortable Cotton T-shirt With Humorous Design

Hospital Mattress

Personality Letter T Shirt Summer Cotton Clothing Fashion Casual Short Sleeve Loose Tees Plus Size Streetwear T-shirts

Rj45 Connector Types

Factory Direct Supply Customized Print Logo Women Tshirt Multi Color Daily Wear T-shirts For Women

Novel Book Printing

Hardcover Novel Book Printing

China Wholesale Custom Extra Long Women's T Shirts Acid Wash Vintage Y2k Streetwear Mineral T-shirts

Cat6 Patch Cable

2.5oz Single Wall Coffee Cup

Factory Direct Supply Long Dress Women T Shirts Quality Customization Acid Wash Washed Print Women T Shirt

China Wholesale Multi Color Five Point Star Elastic Cotton Round Neck Casual Top T-shirt Women Tshirt

Lan Cable

Types Of Optical Fiber

Manga Illustrated Book Printing

transhol.pl

Rj45 Connector

14oz Ripple Wall Paper Coffee Cup

Aluminum Sheet Stamping

15° Plastic Collated Decking Coil Nails

CNC Machining

Custom Oem & Odm Navy Blue Children's Polar Fleece Sweatshirt Warm Kids' Winter Apparel

Zinc Galvanized Concrete Coated Nails

CNC Turning Parts

Carbide Saw Blades

Plastic Collated Strip Framing Nails

http://www.st.rokko.ed.jp

Custom Oem & Odm Classic Black Knit Sweater For Kids Elegant Casual Wear Cozy Warm Top

Sophisticated Off-white Long Sleeve Women's Polo Shirt Comfortable Cotton Blend Versatile Work To Weekend Wear

Minimalist Black Hoodie With Cap Embroidery For Boys' Casual Streetwear Minimalist Boys' Black Hoodie Casual Cap

Metal Stamping Part

Stainless Steel Stamping

Ring Shank Finish Nails

Light Blue Women's Long Sleeve Polo Shirt Cotton Soft Classic Fit Elegant Design Customized Sports Long Sleeve Polo

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Sophisticated Off-white Long Sleeve Women's Polo Shirt Comfortable Cotton Blend Versatile Work To Weekend Wear

Custom Oem & Odm Navy Blue Children's Polar Fleece Sweatshirt Warm Kids' Winter Apparel

Earc Hdmi Cable

Minimalist Black Hoodie With Cap Embroidery For Boys' Casual Streetwear Minimalist Boys' Black Hoodie Casual Cap

Light Blue Women's Long Sleeve Polo Shirt Cotton Soft Classic Fit Elegant Design Customized Sports Long Sleeve Polo

Usb C To Hdmi Cable

d1544 rear brake pad

retrolike.net

The introduction of actuator

Audio Optical Cable

Custom Oem & Odm Classic Black Knit Sweater For Kids Elegant Casual Wear Cozy Warm Top

What are the types of new energy batteries

Usb C To Hdmi Cable

Introduction to brake system

What is an Artificial Lawn Cutter

Sport Gloves

Girls' Blue Sequin Cropped T-shirt – Sparkly Party Wear Tee

Paper Cups

Girls' Vibrant Pink Unicorn Graphic T-shirt – Colorful Magical Casual Tee

Hydrogenated tallow amine

Vibrant White Short Sleeve Cotton T-shirt With A Comfortable Fit For Girls Soft And Comfortable

Organic Goji powder

Taurine Ethyl Ester HCL

Monodicalcium Phosphate

Telescoping Flag Pole

Paper Bucket

Guide Flagpole Kit

Boys Striped Sleeve Polo T-shirts In Navy And Grey – Trendy Sporty Look

Boys Earth Tone Color Block Tee Stylish Daily Wear Shirt With Trendy Print Soft Cotton Top

edzokepzo.hu

L-Glutamic acid monosodium salt hydrate

Coffee Paper Cups

Boat Cleat

Long Gardening Gloves

Maxiflex Work Gloves

Set Of Earth Tone Cotton Tshirts High-quality Blank Tops For Custom Design Seamless Streetwear Comfort Fit Tees

Beige Oversized Cotton Tshirt For Women High-quality Streetwear Comfort Fit Top Blank For Custom Design Summer Tee

Boat Bollard

Tight Waist T-shirt 2023 New Design Multi Color Stars Women's Short Sleeve T-shirts Women's T-shirts