FinTech Regulatory Sandbox License Singapore: Guide for Startups and Innovators

What is the MAS FinTech Sandbox and Its Purpose?

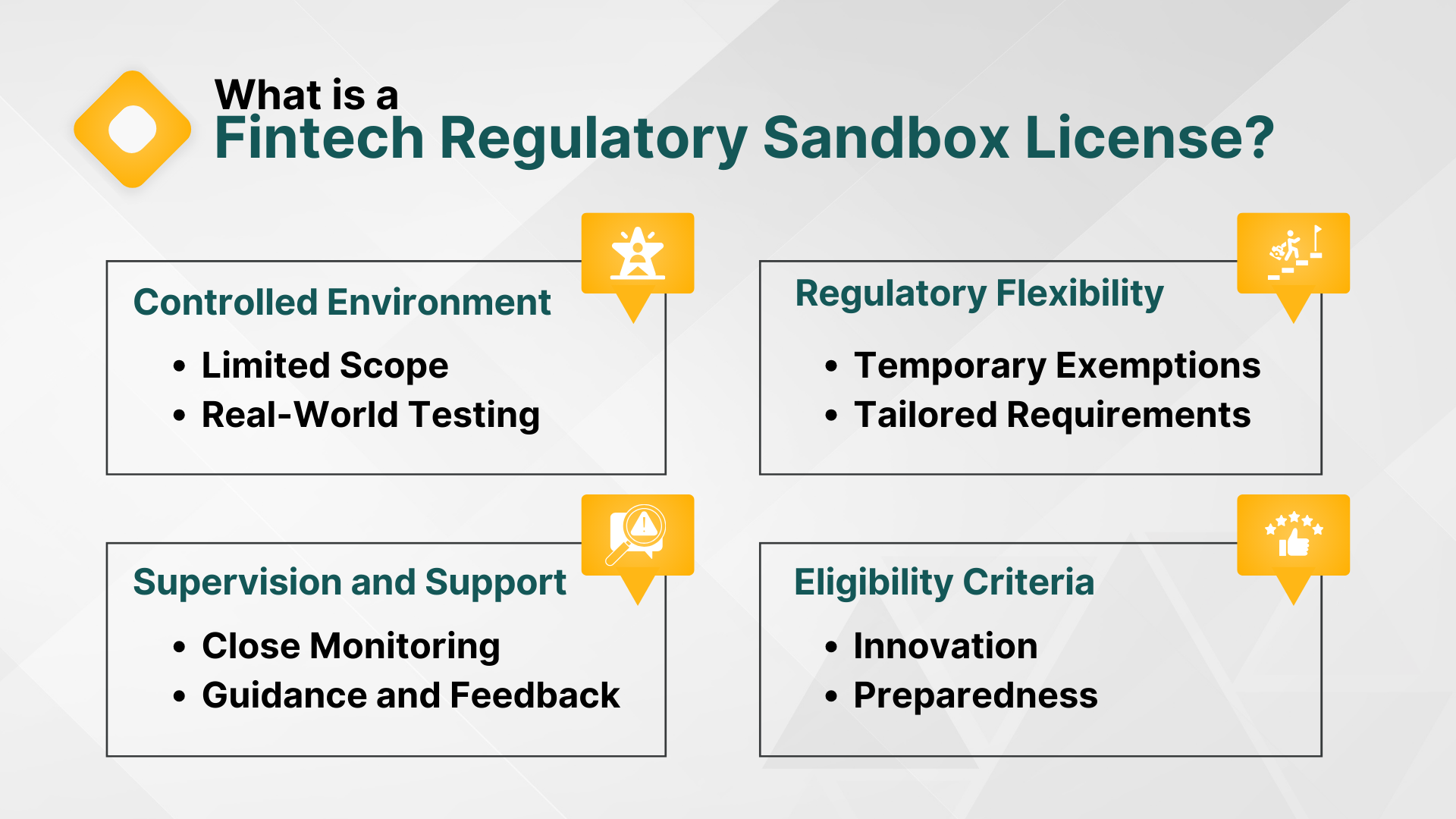

The MAS FinTech Regulatory Sandbox License in Singapore is an initiative by the Money Authority of Singapore to foster innovation in the financial sector. It allows startups and firms to test innovative financial products and services in a controlled environment without needing full regulatory compliance upfront.

This Regulatory Sandbox FinTech framework provides exemptions under specific conditions, helping early-stage FinTech startups in Singapore validate their offerings while minimizing risks. It supports the launch of new financial technologies like blockchain, digital wallets, robo-advisors, and other fintech solutions.

Why the FinTech Regulatory Sandbox is Crucial for Innovation in Singapore’s Financial Sector

The FinTech Regulatory Sandbox of Singapore, which was initiated by the Monetary Authority of Singapore (MAS), significantly contributes to the promotion of innovation and competitiveness in financial ecosphere. As one of the leading financial centers of the world, Singapore understands that there is a need to strike a balance between oversight and experimentation – this is exactly where the MAS FinTech Sandbox is critical.

Meetings of innovative financial products, services or business models by startups /financial institutions in a test environment, sandbox allows regulatory flexibility. Under the management of the MAS, firms can be run while allowing certain exemptions from the traditional rules. This lessens the initial compliance malaise and expedites the go-to-market approach for a lot of tech-led financial solutions.

Further, the sandbox creates an environment of innovation, with early-stage ventures brought on board to address complex financial problems, including financial inclusion, digital banking, robo-advisory services, blockchain, and payment system. It also bolsters consumer protection, because firms are required to disclose risk openly and work in transparent manner during the testing phase.

Such as Sandbox Plus and Sandbox Express are programs that make the application process even smoother for the firms that are eligible and quicker and easier to implement cutting-edge services. Such regulatory pathways indicate Singapore’s aggressive stance towards the rapid rate of evolution of financial technologies.

In other words, the MAS FinTech Regulatory Sandbox is not a laboratory for experimentation but a geostrategicw backdrop helping the responsible innovation, monitoring compliance, and substantiating Singapore as the FinTech innovation capital.

Key Considerations and Safeguards within the MAS FinTech Regulatory Sandbox

The MAS FinTech Regulatory Sandbox in Singapore provides firms with an environment where they can test newly developed products or services in Financial Technology without the fear of running into serious problems in case anything happens. Although the sandbox offers regulatory leeway, this is no free pass; there are specific safeguards and the conditions that are very important in protecting consumers, while maintaining financial stability and maintaining market integrity.

The most important of the considerations is eligibility. Technological innovation and targeting the financial sector is a must for the product or service. It should belong to the MAS regulatory ambit or have a chance of belonging to it when it is implemented. When it comes to sandbox entry of firms, they need to prove the need for such entry and their readiness for live testing, such as having proper risk mitigation measures.

Safeguards are customized to every applicant based on the nature and threat of the solution. These usually involve caps placed on the number of customers; limits on transactions that can be made; and limits on the duration of open operation (typically 6–12 months). Firms also need to have consumer protection facilities – dis closure of product threats and explanation of terms of use.

In addition to this, MAS requires firms to provide an elaborate exit strategy. This provides a description on how the company will manage customer obligations and data in the event that the solution does not make it past the sandbox phase. Firms may also be obliged to take a professional indemnity insurance or keep minimum financial buffers.

Holes-in-the-wall have kept the regulators at bay, who can continue to ensure that they do not breach safety walls while carrying out their business. Overall, the sandbox establishes a balance between penetration of regulations and attraction of innovations, reflecting the government’s commitment to safe, trusted, and future-oriented FinTech environment of Singapore.

Who Can Apply? Sandbox Eligibility Criteria in Singapore

Eligibility for the MAS Sandbox or Sandbox Plus requires that your company introduces a technological innovation within the regulated scope of financial services. The solution must be either regulated by MAS or is likely to be regulated once fully developed…

Applicants must also consider both regulatory and legal compliance frameworks. This ensures the sandbox is not used as a loophole but as a tool for responsible innovation.

How to Apply for MAS FinTech Sandbox or Sandbox Plus

First of all, there is no specific duration within which you should apply for this license. That said, once you decide to apply, the process is relatively easy. If MAS already regulates your firm, all that’s necessary is to submit the application to the MAS Review Officer. Use the template available in the guidelines. On the other hand, if it is not MAS regulated, you should apply FinTech_Sandbox@mas.gov.sg. Feel free to use the email also to seek clarification or answers to questions abound regulatory sandbox licenses.

What to Do After Receiving the FinTech Regulatory Sandbox License

The responsibility of the firm continues after acquiring the MAS approval. You owe your customer several things.

- Make your customers aware that you are operating in the sandbox

- Disclosure of any critical risks involved with the service or product

- Ensure that your customer understands all the risks before buying it

As a customer, if the firm does all that and you buy the product in the end, related dispute resolution may be complicated. After all, you can go to neither the Singapore Deposit Insurance Corporation (SDIC) nor the Financial Industry Disputes Resolution Centre (FIDReC).

What Happens After the Sandbox Period Ends?

Fintech regulatory sandbox licenses are bound to expire after a stipulated period. When the time lapses, the company has two options. It can choose to graduate to a standard business and apply for the necessary license with MAS. Another option is terminating the provision of the service or product altogether.

Conclusion: Accelerating FinTech Innovation with the MAS Regulatory Sandbox

A Fintech regulatory sandbox license is something worth appreciating. It supports a bright future driven by technology and innovations. If you want to participate, this article explains how you should go about it. It highlights what to do before, during, and after the application for the license.